With digitization and artificial intelligence (AI) on the rise, the growth of fintech companies has skyrocketed. Fintech (finance + technology) stocks are shares in companies that use technology to provide better financial services, frequently disrupting traditional banking and financial systems. They provide products and services in payments, lending, banking, insurance, cryptocurrency, and asset management.

Here are two fintech stocks that Wall Street considers “strong buys,” and expects to thrive in the long run.

1. Block

Founded in 2009, Block SQ started as a simple solution for small businesses to accept card payments through mobile devices. It has expanded its offerings in recent years to include a wide range of financial services.

Block accounts for a 5.23% stake in renowned investor Cathie Wood’s ARK Innovation ETF ARKK. Wood is known for selecting emerging companies that focus on disruptive innovation.

Valued at $35.3 billion, Block stock has gained 25.1% year-to-date, compared to the S&P 500 Index’s SPX gain of 10.6%.

The company operates through two platforms: Square, which is its original payment processing platform that offers point-of-sale (POS) systems, hardware, and software solutions for businesses; while Cash App is the popular mobile payment service that allows users to send money, pay bills, and invest in stocks and Bitcoin BTCUSD.

In the second quarter, Block’s net income increased by 91.1% to $195 million, while total revenue increased by 11%, supported by growth in all of its segments. Square’s revenue and gross profit increased by 9% and 15% year on year, respectively, while Cash App’s revenue and gross profit increased by 12% and 23%, respectively, over the year-ago period. Cash App inflows rose 15% to $71 billion during the quarter.

In addition to its flagship offerings, Block operates TIDAL, a global music streaming service platform, and Spiral, which focuses on Bitcoin development and adoption. In addition, its Bitcoin ecosystem includes TBD, an open developer platform for decentralized finance (DeFi) applications.

The company’s balance sheet remains strong, with sufficient liquidity and manageable debt levels. This financial stability will allow Block to move forward with its growth initiatives and future acquisitions. The company ended the quarter with $9.5 billion in cash, cash equivalents, restricted cash, and investments in marketable debt securities. It also had an adjusted free cash flow balance of $1.43 billion.

In 2024, management expects a 17% increase in gross profit and a 31% increase in adjusted EBITDA over 2023. Analysts predict that Block’s revenue and earnings will grow by 13.0% and 96.2%, respectively. Furthermore, revenue and earnings are projected to rise by 11.6% and 26.7%, respectively, in 2025.

Valued at 17 times forward 2024 adjusted earnings, Block seems like a reasonable buy for a growth stock. The ongoing shift towards digital payments provides a strong tailwind for Block. Furthermore, Block’s involvement in the cryptocurrency space, while risky, has great long-term potential.

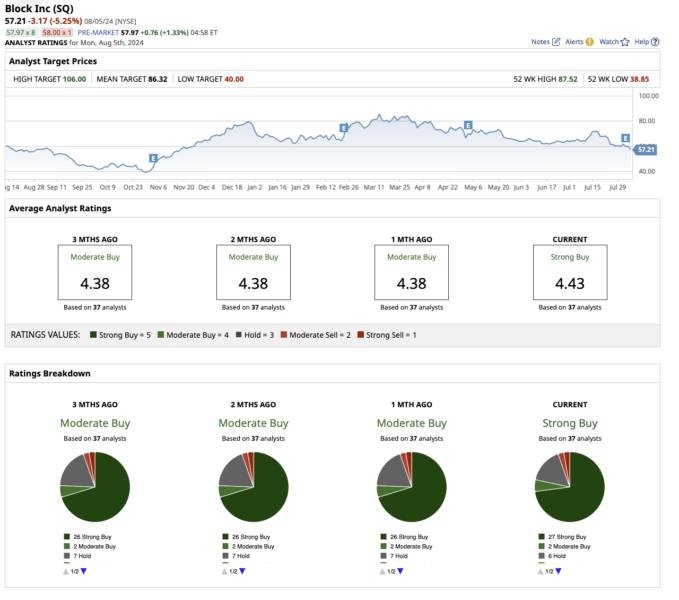

Overall, on Wall Street, Block stock is a “strong buy.” Out of the 37 analysts covering SQ, 27 have a “strong buy” recommendation, two say it’s a “moderate buy,” six rate it a “hold,” one recommends a “moderate sell,” and one says it’s a “strong sell.”

The analysts’ average price target of $86.32 implies a potential upside of about 48%. Its Street-high estimate of $106 suggests the stock could potentially rally by 81.8% in the next 12 months.

2. Intuit

Intuit INTU, a financial software giant known for products such as QuickBooks, TurboTax, and Mint, has long been a prominent player in the financial technology industry.

Valued at $168.5 billion, Intuit stock is slightly negative YTD, compared to the broader market’s gain.

Integrating AI into its offerings has increased the efficiency of Intuit’s products, resulting in strong performance over the last few quarters. In the most recent third quarter of fiscal 2024, total revenue increased 12% to $6.7 billion, while adjusted earnings increased 11% year over year.

This performance was driven by particular strength in one of its four operating segments, Small Business and Self-Employed, which increased 18% year on year. Additionally, its three other segments, Consumer Group, Credit Karma, and Pro Tax, saw revenue increases of 9%, 8%, and 3%, respectively.

Consistent earnings growth has enabled Intuit to return value to shareholders through dividends. It has a forward dividend yield of 0.58%, which is lower than the technology sector’s average yield of 1.37%. However, its aggressive dividend hikes and a low payout ratio of 18.8% indicate that future dividend growth is likely. In Q3, the company increased its dividend by 15% to $0.90 per share.

At the end of the quarter, Intuit had $4.7 billion in cash and investments, but also $6 billion in debt. Management expects a 13% increase in revenue and a 17% increase in earnings for the fiscal year ending in 2024. Similarly, analysts covering the stock expect a 12.6% increase in revenue and a 16.9% increase in earnings.

Furthermore, revenue and earnings are projected to increase by 12.2% and 13.8%, respectively, in fiscal 2025. The stock is trading at 32 times forward earnings estimates for 2025 and 9 times projected sales. While Intuit appears to be trading at a premium, its AI-driven, diverse portfolio of successful products could continue to boost earnings, resulting in long-term gains.

Out of the 27 analysts who cover INTU stock, 22 have given it a “strong buy,” one rates it a “moderate buy,” and four have a “hold” rating. Based on the mean target price of $709.29, INTU stock has an upside potential of 14.3% from current levels.

Plus, the high target price of $770 suggests that the stock could rise 24% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.