Central Bank Digital Currencies (CBDCs) have moved from being merely theoretical concepts to a stage when dozens of countries throughout the world are actively testing them in various pilot schemes. Designed as a government-backed digital version of fiat money, CBDCs combine the trust of centralised monetary systems with the flexibility of digital payments. Unlike cryptocurrencies, which fluctuate based on market sentiment and are often decentralised, CBDCs are state-issued, pegged to national currencies, and intended to offer price stability and legal certainty—features that make them particularly relevant in a time of growing demand for secure digital payment systems.

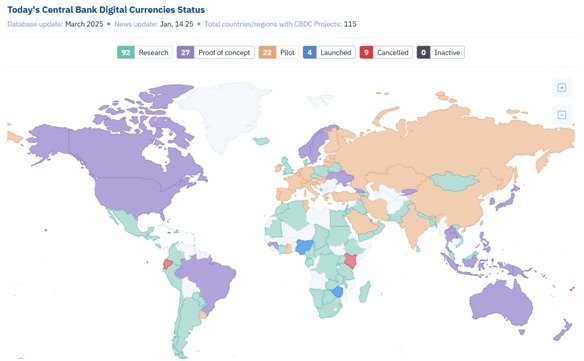

According to recent data, over 130 countries representing 98% of global GDP are now exploring CBDCs in some form, including pilots, development, or research (albeit few have fully adopted them). This rise reflects both technological momentum and regulatory intent to reclaim control over digital currency ecosystems, especially as private stablecoins and decentralised crypto assets have proliferated.

Source: https://cbdctracker.org/

What sets CBDCs apart from cryptocurrencies

Stability and trust

While cryptocurrencies like Bitcoin or Ethereum operate in highly volatile and speculative environments, CBDCs are anchored to fiat currencies and issued by central banks. This offers higher value stability and institutional backing, reducing the risk profile for users.

Design and oversight

CBDCs are programmable but centrally managed. Governments can impose compliance measures and offer consumer protection in ways decentralised crypto systems cannot. Moreover, unlike crypto assets, CBDCs are not mined or privately issued, ensuring state control over monetary supply and transaction oversight.

Kar Yong Ang, financial market analyst at Octa, notes: ‘CBDCs offer a new model of digital liquidity—blending state trust and legal tender with tech efficiency. For traders, this opens doors to a more secure and transparent digital finance ecosystem.’

Why are central banks racing to develop CBDCs?

Here are three key reasons why central banks invest resources in CBDSs:

- The decline of cash and rise of digital payments. As societies increasingly favour digital over physical money, central banks face pressure to modernise public currency formats. In Sweden, for example, cash transactions make up less than 10% of payments. CBDCs are seen as a public alternative to private payment apps and platforms, ensuring monetary sovereignty in the digital realm.

- Controlling private stablecoin risks. Private stablecoins like USDT and USDC have raised concerns over systemic risk and shadow banking practices. A CBDC can serve as a stable counterbalance to these instruments, offering liquidity and legal clarity in fast-evolving financial markets.

- Financial inclusion and transparency. CBDCs can increase financial inclusion by offering digital wallets to unbanked populations, especially in developing economies. They also offer governments more visibility into money flows, enhancing tax collection and curbing illicit finance—though this has sparked debate around surveillance and privacy.

Pros and cons of CBDCs

CBDCs offer notable advantages: their value is typically pegged to fiat currencies, ensuring greater price stability than most cryptocurrencies. With full state backing, they function as legal tender and may include programmable features like conditional payments. For underbanked populations, they also present a path toward improved financial access.

However, concerns remain. Privacy is a major issue, as CBDCs could give governments visibility into personal transactions. They also pose cybersecurity risks, potentially becoming targets for large-scale attacks. Moreover, they could interfere with traditional monetary policy and financial market dynamics if not carefully designed. For instance, commercial banks could experience deposit runs if individuals perceive CBDCs as a safer alternative to traditional money for savings.

Real-world cases

Although the majority of countries still research CBDC and their application in the economy, some have already implemented them.

- Bahamas. The Sand Dollar became the first nationwide CBDC in 2020. It now serves all islands through a network of mobile-based wallets.

- Nigeria. The eNaira, launched in 2021, has seen a slow adoption of less than 0.5% as of 2025. The government continues to offer incentives to boost usage.

- China. The e-CNY has been piloted in over 25 cities and integrated into public transit and e-commerce platforms. Its scale makes it the most advanced major-economy CBDC.

Looking ahead: the road to adoption

While CBDCs promise greater efficiency and offer more tools for governments to implement social objectives, they also pose new governance challenges. To thrive, states willhave to balance innovation with civil liberties, infrastructure resilience, and global interoperability. As the world of digital currenciescontinuesto develop, CBDCs areincreasinglyimportant for progressive traders to grasp. Keepingupwithdevelopments can give a vitaladvantage in understanding the future of money.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision.

Octais an international broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

Since its foundation, Octa has won more than 100 awards, including the ‘Most Reliable Broker Global 2024’ award from Global Forex Awards and the ‘Best Mobile Trading Platform 2024’ award from Global Brand Magazine.