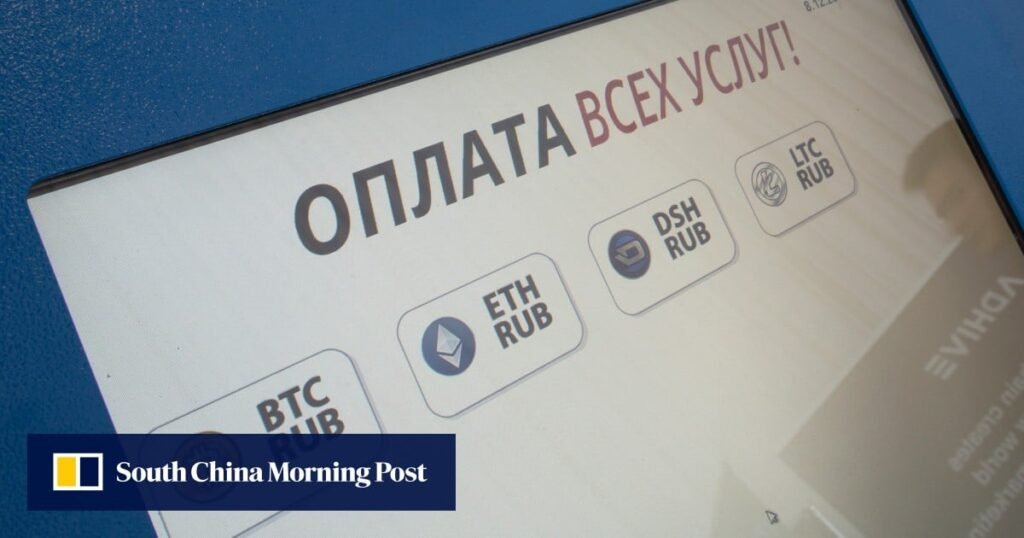

Russia is moving to regulate the use of cryptocurrencies, as companies wrestle with increasing difficulties in foreign payments under the threat of US sanctions over the war in Ukraine.

Lawmakers in the lower house of parliament, the State Duma, will consider a cryptocurrency bill in the second and third readings on Tuesday, as well as separate legislation regulating crypto mining.

The draft laws are also expected to gain quick approval from senators in the Federation Council before being signed into law by President Vladimir Putin to take effect on September 1, according to Anatoly Aksakov, head of the Duma’s financial market committee.

“Previously, there were fears that the legalisation of cryptocurrency could create problems for the development of the domestic market,” Aksakov said in a phone interview. While cryptocurrencies may help Russia to bypass Western sanctions, their use is “an objective phenomenon and cannot be ignored” by regulation, he said.

The move marks a rapid shift in attitude toward digital instruments, and comes as Russian businesses confront growing payment pressures triggered by US threats of secondary sanctions on foreign banks. While the use of digital currency for payments is currently prohibited in Russia, Putin this month called on the government “not to miss the moment” in regulating the method inside the country and in foreign deals.

Cryptocurrencies “are increasingly used in the world as a means of payment in international settlements,” Putin told officials.

As recently as January 2022, just weeks before Russia’s full-scale invasion of Ukraine began, the central bank proposed a blanket ban on the use and creation of cryptocurrencies, arguing that they posed major risks to financial stability and economic security.

The bank softened its position at the end of last year, supporting the experimental use of cryptocurrency and mining in cross-border settlements. Still, it urged financial organizations in Russia not to publicise services related to digital currencies.

The Bank of Russia didn’t respond to a request to comment on the change in its position. First Deputy Governor Vladimir Chistyukhin said last month that the country should consider all possibilities for overcoming difficulties in international payments, including those “that seemed unpopular to us yesterday.”

Under the legislation, crypto will be regulated in the same way as foreign currency in Russia, according to Aksakov. Businesses involved in crypto and mining lobbied hard for the law to ensure “they can work within normal legal frameworks” and not fear official investigation, he said.

The authorities are rushing through the law because they hope that cryptocurrencies will improve cross-border transfers, said Ani Aslanyan, an analyst who runs a Telegram channel devoted to cryptocurrencies. However, the US is likely to monitor services and companies used by Russia to try to block them, setting off a race to stay ahead of sanctions.

Only large exporters will be likely to meet conditions set out in the regulations, making crypto payment like a “closed club” that excludes small and medium-sized businesses, according to Aslanyan. For example, transactions will be restricted to those who have mined crypto themselves, something only big companies in Russia currently do, she said.

The Bank of Russia will be the regulator on cryptocurrency issues, according to the law, while the Federal Financial Monitoring Service, the Federal Tax Service, the Federal Security Service and the Federal Property Management Agency will have roles in controlling the turnover of crypto.