Arkham Intelligence shows that a wallet tied to the U.S. government is sitting on a hefty stash of cryptocurrency. A massive fortune can heavily influence the markets, and we have previously seen how the German Government’s Bitcoin sell-off affected the markets. Amid the political drama and crypto confusion, let’s find out how much the U.S. Government holds.

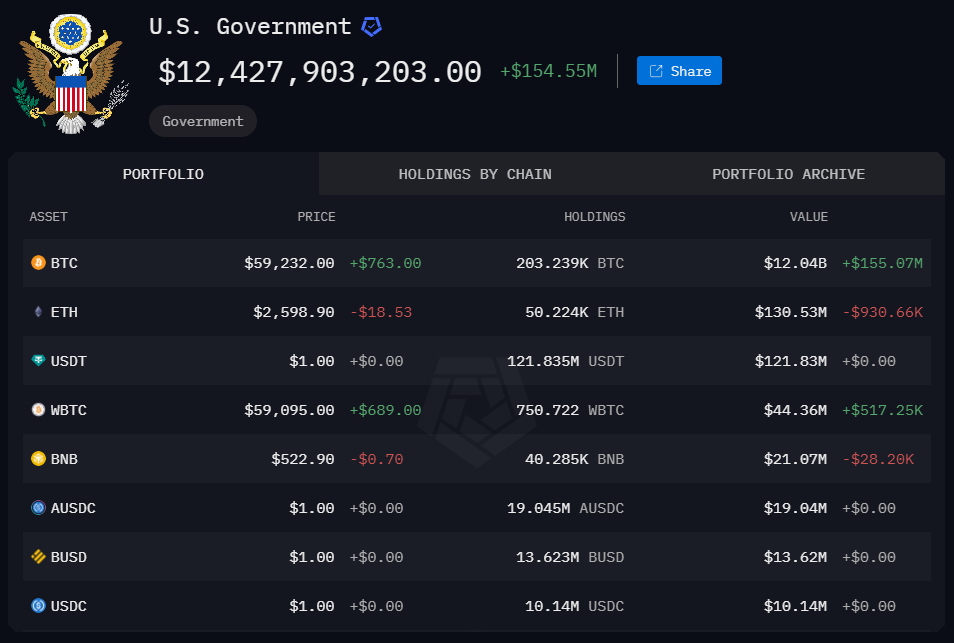

When we say hefty, think 203,200 BTC, which clocks in at roughly $12 billion, along with 50,200 ETH, worth around $130 million. On top of that, the address holds 750.7 wBTC, valued at about $44.41 million, plus a variety of other tokens. Altogether, the total value of the assets is estimated to be around $12.4 billion.

Crypto Market Jitters Amid Political Drama

This discovery comes at a rather tense time, with the U.S. political landscape adding more fuel to the already unpredictable crypto market. Vice President Kamala Harris has thrown her support behind the digital currencies, echoing the vision of the Democratic President-Elect. But here’s the kicker: the current administration doesn’t seem to be on the same page. The government’s recent $2 billion crypto sell-off has stirred the pot, contradicting the pro-crypto stance many expected.

Meanwhile, former President Donald Trump has jumped into the fray, championing blockchain-based currencies as the future. He’s pushing for the U.S. to become the biggest holder of Bitcoin and other digital assets, arguing against further sales and urging the government to hold onto its digital asset reserves.

The political tug-of-war is only deepening the uncertainty surrounding U.S. cryptocurrency policy.

U.S. Marshals Eye Bitcoin Sell-Off

Adding another layer of complexity, there’s chatter that the U.S. Marshals Service (USMS) might be liquidating Bitcoin seized from the notorious Silk Road case. Finance lawyer Scott Johnsson has linked recent blockchain movements to a service agreement with Coinbase, signed back in June. The USMS has been transferring the Bitcoin to a custodial address in line with the agreement’s asset segregation requirements.

The sale of these assets was originally expected to wrap up last year, but delays in finalizing the deal with Coinbase seem to have stretched the timeline. If these Bitcoin sales go through, it could put additional pressure on an already shaky crypto market.

The Uncertain Road Ahead

As the U.S. government continues to wrestle with its role in the cryptocurrency world, the future of digital assets remains anything but clear. The massive holdings revealed by Arkham, coupled with the ongoing political and legal maneuvers, underline the fierce debate over cryptocurrencies’ place in the nation’s financial future. Will the U.S. become a major player in the digital assets market, or will it keep offloading its holdings? Investors and analysts are on high alert, waiting to see which way the wind blows.

Also Read: Vitalik Buterin Donates all His Animal Memecoins to Charity