Join Our Telegram channel to stay up to date on breaking news coverage

Today’s Avalanche Chain focus highlights three innovative tokens: Pulsar, Frax, and Pharaoh. Let’s examine what propels these top trending cryptocurrency tokens on Avalanche Chain as they contribute unique elements to the ecosystem, such as innovative incentive schemes, incredibly stable on-chain currency, or a metaverse driven by play-and-earn mechanisms.

Animoca Brands and Immutable, two blockchain companies, are extending game layers. Immutable’s zkEVM onboarding games, Treeverse and Capsule Heroes, demonstrate how next-generation gaming ecosystems are being constructed for scale.

Trending Cryptocurrency Tokens on Avalanche Chain Today

Pharaoh is attracting attention due to its comprehensive DeFi integration and vote-escrowed mechanisms, which offer strong incentives for liquidity suppliers and long-term holders. With its fractional-algorithmic architecture, Frax provides unparalleled stability and power to DeFi systems throughout Avalanche, anchoring on-chain value. In contrast, Pulsar is causing a stir with its daring combination of immersive metaverse gameplay and savings usefulness, which gives token use a purpose beyond price speculation.

1. Pharaoh (PHAR)

Pharaoh addresses a significant issue in the Avalanche ecosystem: traders’ and LPs’ ineffective incentives and fragmented liquidity. PHAR links token-holder commitment with yield production and protocol health by combining a vote-escrow 3,3 incentive model with concentrated liquidity in Uniswap v3. Users lock PHAR to increase yields and voting power, encouraging sustained engagement.

Launched through Pharaoh DEX, the PLYR/GAMR pool caused a stir with its lightning-fast swaps and cheap gas prices on Avalanche’s C-Chain. Since Pharaoh already ranks in the top 10 for holder revenue throughout DeFi, a hot alliance with Avant was hinted at. However, this week focuses on platform development, particularly in light of the growing popularity of themed pools like PLYR/GAMR.

PHAR surged beyond $771 on June 16th, setting new all-time highs for the month. A token that enjoys quick acceptance, active governance participation, and yield-chasing behavior among vePHAR stakeholders is typified by the 40–60% rollercoaster within a few days. The daily volume surges, which peaked on June 16 at $1 million, imply that whales and LPs are cycling funds according to incentive schedules. In contrast, PHAR increased by +42% in USD during the course of 30 days, which is unmistakable evidence of robust medium-term positive emotions.

vePHAR votes have been cast and your new APRs and $PHAR distribution has been decided.

The flywheel has been strong on Pharaoh recently, take a look at our blue chip pairs below and then see a few community favorite APRs in the post below this one ⤵️ pic.twitter.com/r2jmUap3XY

— Pharaoh on AVAX (@PharaohExchange) June 26, 2025

The Pharaoh Exchange verified that the vePHAR voting process was completed and that the new APR structures and PHAR distribution dates had been finalized. This may sound technical, but it serves as a focal point. These governance votes determine the direction of emissions, whether toward new partnerships, pools, or even co-incentives with other tokens.

2. Frax (FRAX)

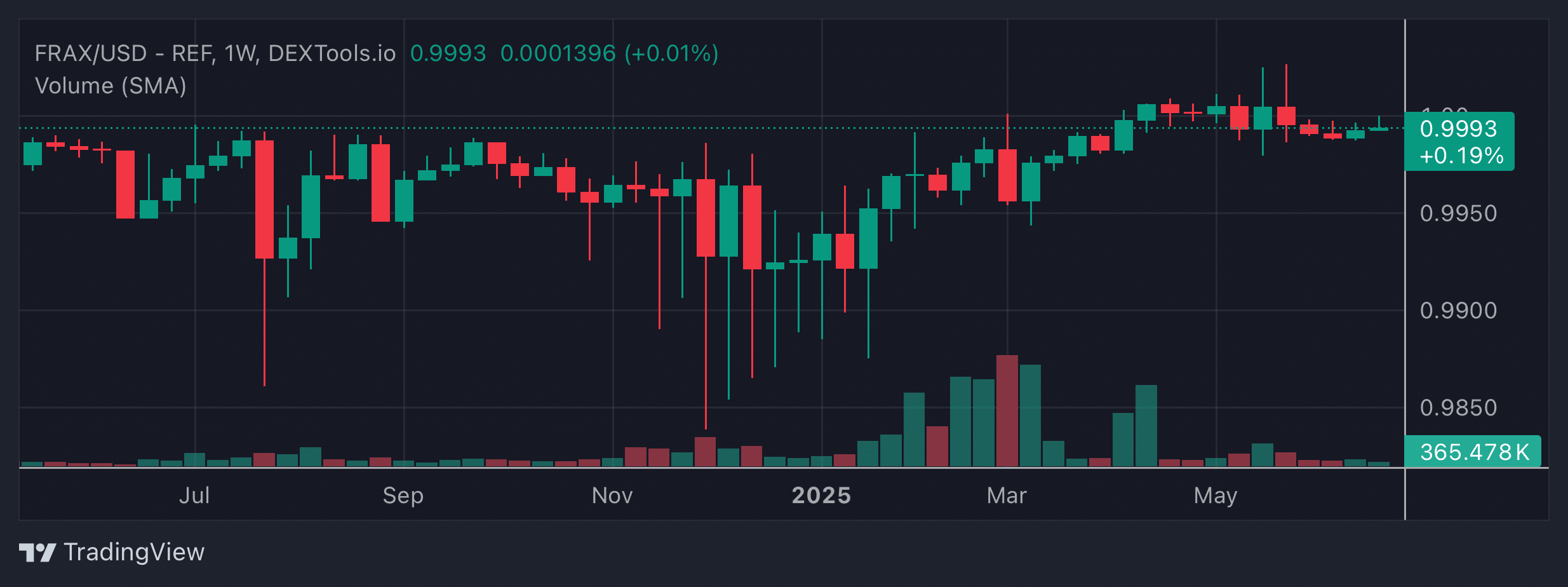

The distinctive feature of Frax is its fractional-algorithmic design, which is partially stabilized by code and partially backed by actual collateral, usually USDC. The protocol contracts supply when FRAX falls below $1 because it mints less FRAX or redeems collateral more heavily. More FRAX is created when it rises above $1, increasing the supply. This push-pull system keeps things stable without requiring too much collateral, while active treasury management and governance improve scalability and value capture.

Developer interest in cross-chain AMO upgrades has increased again; these intelligent modules enable FRAX to automatically rebalance liquidity on new chains. One developer on X (Twitter) alluded to experimental integrations with zk-layer2s that could soon bring FRAX liquidity to ecosystems with zero knowledge. During a recent local DeFi event, hacker-house attendees purportedly demonstrated proof-of-concepts that would enable FRAX to be used not just in smart contract stacks but also in real-time payments using wallet-to-wallet channel networks.

With a strictly regulated 621,130 tokens in circulation and an all-in market valuation of just $621,240, FRAX is cruising at exactly $1,000, suggesting that every FRAX created is now in use. A nearly undetectable 0.00057% decline and a 24-hour trading volume of just $1,420 reveal a slow trading scene and an extremely steady peg. However, the blockchain’s confidence and utility engine lie beneath that serene exterior.

In other news, rumors from a recent DeFi hackathon indicated that FRAX is being tested in on-chain micropayment channels, a new frontier: FRAX is being prepared for small, immediate payments over peer-to-peer wallet networks, not simply for Ethereum megaloans. Furthermore, tool financing for improved governance dashboards was covertly approved by the Grants DAO, which promised more transparent control panels for monitoring treasury transfers, AMO activities, and collateral ratios.

3. Pulsar (PLSR)

PLSR is more than just a token; it powers “Pulsar Tech,” a bold AAA-caliber Web3 game that combines RTS-style combat, MMO persistence, 4X strategy, and roguelike dungeons. Every coin has in-game uses, transforming savings into engaging gaming elements as players mine, stake, and spend PLSR. A coin controlled by masternodes that you can earn, stake, and spend on land, upgrades, and competitive events offers a unique crossover.

Over the past week, rumors of the impending Genesis Land Sale have caused a price spike of around 11%, sending shockwaves across the PLSR community. Ahead of the block-height 1,400,000 fork that starts the PoW/PoS halving, the team revealed that they will launch Pulsar V2.0 and V2.1 on June 30, 2025, bringing dark-mode wallets, block caching, and the first masternode layer to life. This will include the necessary update to V1.1.5. Because of the intense excitement, the community’s catchphrase is “You don’t build Genesis lands, you earn them.”

The current market capitalization of PLSR is close to $3.01 million, with 256.57 million tokens in circulation out of a hard maximum of 1 billion. The live price of PLSR hovers around $0.0117. About $14 was traded in the last day, and the token lost roughly 0.065% of its value during that period. Only around 25.7% of the total float is in circulation, which indicates that substantial reserves are locked up for network and staking functions.

Genesis Units return June 30.

Forged in the first war. Upgradable. Scarce. They don’t just win battles. They define them.

Will you command one or face one? pic.twitter.com/8fdyHxSQMD

— Pulsar 🕹🪐 (@PulsarGame) June 26, 2025

In addition to being a technical fix, the V2.1 release adds master node architecture and dark-mode wallets, establishing PLSR as one of the top trending cryptocurrency tokens on Avalanche Chain. It is the center of a strategy-gaming metaverse where coins aren’t just idle; they are the armies, the territories, and the keys. Small TVL in the community’s ecosystem could generate enormous enthusiasm and have long-term potential that goes well beyond the news.

What Might Be The Next Top Trending Crypto?

Redefining Bitcoin’s promise, Bitcoin Hyper is preparing to transform the flagship cryptocurrency by providing a fast Layer-2 built on Solana’s SVM that combines low-fee, sub-second transactions with the rock-solid security of Bitcoin. A unique early-stage opportunity that falls exactly where demand meets benefit, participants may lock in access to innovation and earn eye-catching APYs north of 400% for just over $0.012 per token.

The core of HYPER is its Canonical Bridge, which allows users to deposit Bitcoin, mint wrapped tokens on Layer 2, and transact at lightning speed. All of these features are supported by zero-knowledge proof finality and anchored to the robust base layer of Bitcoin. This legitimate infrastructure bridge opens DeFi, NFTs, DAOs, and meme coins within the Bitcoin ecosystem; it is not vaporware. Launched with certified smart contracts from Coinsult and SpyWolf, the focus is on security and transparency, which are crucial in the current environment.

Now is the time for investors to get involved because this is more than just buzz; it’s a revolution in how Bitcoin works. With its high APY staking, Layer 2 build-out, audited smart contracts, and booming presale popularity, HYPER emerges as a unique combination of speed, security, and strategic potential. While the groundwork is being established, stake the bridge because once this network goes online, it can potentially reinvent Bitcoin for the DeFi generation.

Read More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage