Arbitrum (ARB), one of Ethereum’s (ETH) most popular second layers, will unlock over $65 million in tokens on July 16. This will increase Arbitrum’s native token circulating supply by nearly 3% and could impact its price, creating a selling pressure.

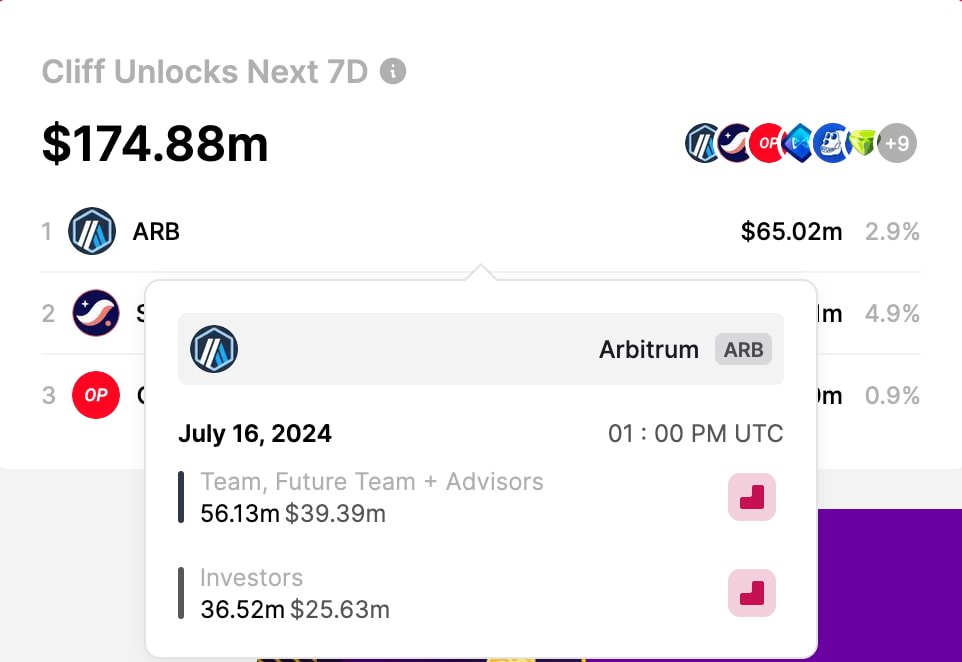

Finbold retrieved this data from TokenUnlocksApp on July 13, highlighting cryptocurrency cliff unlocks for the next seven days. In particular, Arbitrum stands out as the largest unlock in US dollar nominal value, representing 37% of the $174.88 million.

Notably, the team will end vesting contracts with 56.13 million ARB, worth $39.39 million. Meanwhile, private investors will have $25.63 million in 36.52 million ARB to sell, realizing profit on retail buyers. As of this writing, Arbitrum trades at $0.69 per token in a worrying year-to-date downtrend.

Arbitrum historical unlocks and selling activity

Arbitrum vesting contracts unlock new tokens every month as part of ARB’s release schedule and inflation model. Finbold has reported these unlocks, and it is notable to observe how the nominal value has fallen over time.

Interestingly, the single largest inflation occurred in March, with a massive unlock of 1.11 billion ARB, worth $2.06 billion at that time for an average of $1.85 per token.

In April, the recurrent monthly unlocks started, releasing the 92.65 million ARB from each month’s schedule. At that time, the unlock had a nominal value of $105.62 million at $1.14 per token. This represented a drop of 38% in Arbitrum’s price month-over-month (MoM).

Later on, the next month was marked by another sell-off of 92.65 million ARB worth $92.44 million. Arbitrum registered around 12% losses from April and 46% from March to May. Finally, Abritrum’s unlock was worth $85.37 million in June, losing 7.6% MoM and accumulating even larger losses from the previous months.

These token unlocks are a cautionary tale on the economic effects of supply inflation and sell-offs for cryptocurrencies. They highlight the importance of crypto investors and traders studying the underlying fundamentals of a cryptocurrency before deploying capital.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.