On Donald Trump’s return to the White House, he issued an executive order banning a US “digital dollar”. A compelling new book, framed as a wake-up call to Western policy-makers, reveals the global significance of this move.

It warns the West’s slow embrace of digital currency frameworks could erode its long-term financial influence – and diminish its ability to shape global monetary rules.

Smart Money positions central bank digital currencies (or, CBDCs) as the latest battleground in a new Cold War. CBDCs are digital money issued by a central bank, backed (just like cash) by the government of the nation issuing it. While the US dollar, the United Kingdom’s pound and the euro currently have no digital equivalent, China has made rapid advancements in its digital yuan (e-CNY).

Review: Smart Money: How Digital Currencies will Win the New Cold War – and Why the West Needs to Act Now – Brunello Rosa with Casey Larsen (publisher)

Governments regulate their CBDCs in the form of secure digital code. In this way, they differ from (private) cryptocurrencies – which Trump favours instead.

Smart Money’s authors, financial economist Brunello Rosa and strategic communications consultant Casey Larsen, compare the rise of CBDCs to that of the internet 30 years ago.

Until last month’s ban on a US digital dollar, 130 countries, or 98% of the global economy, had been exploring a CBDC to complement cash.

The US faces partisan resistance, with bills like the CBDC Anti-Surveillance State Act seeking to ban digital dollars over privacy fears. Meanwhile, the European Union and UK are prioritising safeguards such as pseudonymous transactions, to balance innovation with civil liberties.

Australia has no current plans to issue its own CBDC. But should it?

Richard Wainwright/AAP

‘A wake-up call’

For Australia, the stakes are particularly high. As a resource-exporting nation with deep trade ties to China, it must navigate the growing divide between US-led financial systems and China’s expanding CBDC networks.

The global monetary order has been anchored by the US dollar since World War II. Rosa and Larsen argue it faces an existential threat from China-led trade networks among Global South nations: including nations like Russia and Nigeria, which are increasingly aligned with China-centred multi-CBDC networks.

They warn if the West remains preoccupied with dystopian fears of digital currencies, it risks ceding global financial leadership to China.

Trump’s executive order may deepen the divide in digital currency adoption between the US and its allies. If China continues to advance CBDC-based trade settlements, Australian exporters could face pressure to adopt Beijing’s financial infrastructure. This would raise concerns about Australia’s economic sovereignty and geopolitical leverage.

The growing influence of China’s financial infrastructure, particularly through CBDC-driven networks, creates complex choices for Australia in balancing economic interests with its strategic ties to the US.

The race for digital money is already underway – and Australia cannot afford to be left behind.

Shutterstock

CBDCs are different from cryptocurrencies

Cryptocurrencies like Bitcoin are decentralised, meaning they’re not issued or controlled by a central authority. But CBDCs are state-issued and backed. This ensures their stability and makes them easier to trust.

CBDCs are designed to function alongside or replace physical cash. They are the only digital liability of a central bank, and symbolise a claim on its reserves. This makes them equivalent to cash.

Smart Money focuses on “money as information”. CBDCs can be programmed with certain rules or conditions and integrate smoothly with existing financial systems. More critically, they can be transmitted and processed over the internet, enabling real-time, automated transactions. The pre-programmed payments and transactions these CBDCs allow can meet the specific needs of their issuing governments.

At its core, Smart Money argues CBDCs are not merely financial innovations. They are powerful geopolitical instruments, capable of reshaping global trade, economic sovereignty and the monetary order. Their rise is accelerating de-dollarisation, or the reduced influence of the US dollar in global trade and financing.

Making financial sanctions less effective?

Nations vulnerable to US sanctions, including China, are particularly attracted to these CBDC-based settlement networks – as the US continues to weaponise its dollar.

Just one way is through sanctions that exclude certain countries from the SWIFT system: they’ve been described as “the nuclear option” of financial sanctions.

The SWIFT network is used by banks to send and receive information, such as money transfer instructions – including cross-border payments.

In 2022, several Russian banks (including its central bank) were excluded from SWIFT over the war on Ukraine. From 2012 to 2016, almost all Iranian banks were delisted, over Iran’s nuclear program.

SWIFT exclusion has meant effective isolation from much of the global financial system.

CBDC networks allow nations to bypass traditional financial infrastructure and reduce reliance on the US dollar in cross-border trade.

Mikhail Klimentyev/AAP

Digital money and the trade war

China’s e-CNY is designed to reshape the global monetary order. China’s dependence on the dollar-based financial system makes it vulnerable to US financial sanctions.

By developing a state-backed digital currency, China seeks to reduce its reliance on Western-controlled financial infrastructure, such as SWIFT – and mitigate risks that could destabilise its trade and economy.

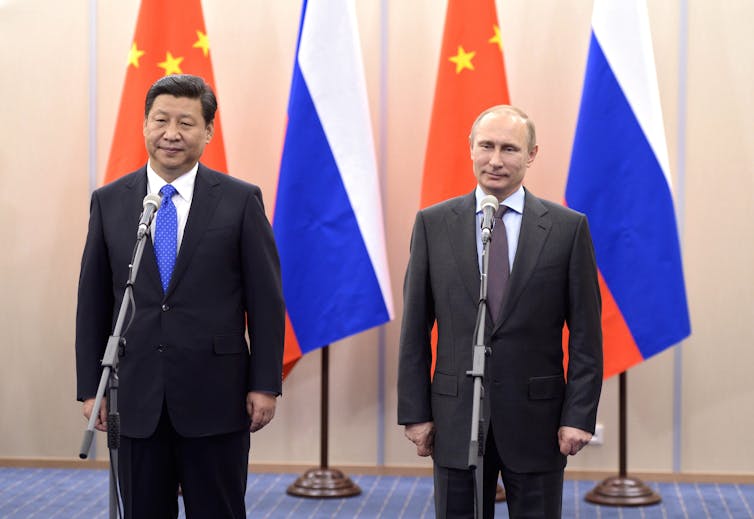

Rosa and Larsen highlight a pivotal moment in the e-CNY’s evolution. On February 4, 2022, during the Beijing Winter Olympics, Chinese president Xi Jinping and Russian president Vladimir Putin declared a “partnership of unlimited friendship”.

Soon after, China’s yuan overtook the US dollar as the most widely used currency for cross-border transactions in Russia. This marked the digital yuan’s first major alignment with an alternative global financial system – and signalled a direct challenge to the Western-led monetary order.

Alexei Nikolsky/Ria Novosti/Kremlin Pool/AAP

“The race for digital money,” the authors note, “is intertwined with the race to exploit natural resources”. China aims to integrate the e-CNY into trade involving strategic resources: particularly energy, food and critical minerals.

By offering an alternative to dollar-based financial systems, China challenges US monetary dominance, while tightening control over trade routes and critical commodities.

A recent report from the Asia Society supports the authors’ arguments. It suggests a potential move from a (petrodollar system – where US dollars are paid to oil-producing countries for their exports – to a digital framework for critical resources dominated by the Chinese yuan. China dominates most of these supply chains, which are essential for advanced technologies and defence.

Digital currency as strategic weapon

Rosa and Larsen argue Beijing aims to become “the chief architect of all trade conducted in state-issued digital currencies”. First, by establishing the necessary physical and digital infrastructure. Then, by setting the technological standards and rules.

Their book examines how Beijing is integrating the digital yuan into the Belt and Road Initiative (BRI), a vast network of development and investment initiatives around the world, linking China to other nations through physical and digital infrastructure. This is expanding China’s financial influence over strategic trade routes and markets, such as the China–Pakistan Economic Corridor and the Silk Road Economic Belt in Kazakhstan.

KHALED ELFIQI/AAP

The global shift away from the US dollar (“De-Dollarization 2.0”) has accelerated since 2022. The authors compare its significance to the post-1944 rise of the Bretton Woods system, which used the gold standard to create a fixed currency exchange rate – and to the 1970s establishment of the petrodollar.

How do multi-CBDC platforms provide emerging economies with an alternative to Western-dominated financial systems? They streamline trade and reduce reliance on traditional financial infrastructure and reserve currencies (like the US dollar, euro, and British pound).

As more nations explore digital alternatives, the potential to bypass Western-led regulatory regimes increases.

OHAIL SHAHZAD/AAP

Two world economic blocs

This shift is dividing the world into two economic blocs. One is the G7, which consists of the US, Canada, France, Germany, Italy, Japan and the United Kingdom (UK). The other is the Global South: countries in Africa, Latin America, Asia and Oceania that are typically characterised by lower income levels and emerging economies. These nations often face challenges related to development and global inequality.

Ciro Fusco/AAP

BRICS – generally considered a significant part of the Global South – originally consisted of Brazil, Russia, India, China, and South Africa. In recent years, the bloc has expanded to include countries like Egypt, Ethiopia, Iran, the United Arab Emirates (UAE), and most recently, Indonesia – strengthening its geopolitical and economic influence.

While the G7’s share of global GDP declines, BRICS+ nations are leveraging their demographic, economic and resource power to counterbalance the West.

Maxim Shemetov/Pool Photo/AAP

At the same time, Iran and other states aligned to China’s Belt and Road Initiative are deepening their financial ties with China, to reduce dependence on Western-controlled monetary systems.

Rosa and Larsen argue Trump’s protectionist policies – rather than curbing China’s rise – have inadvertently pushed more nations toward economic alignment with Beijing and away from the US dollar.

Is the West losing the smart money race?

In regions with underdeveloped banking infrastructure, like Nigeria (which has the eNaira) and The Bahamas (with its Sand Dollar), CBDCs offer a chance to bypass traditional banking. They provide fast, affordable financial inclusion and international transactions.

On the other hand, Western scepticism of CBDCs is growing. It’s driven by fears of government overreach and the potential misuse of programmable money: for geopolitical control, or transaction restrictions based on location or time.

shutterstock

These concerns stem from the two-tiered structure of smart money. CBDCs leverage decentralised technologies, like blockchain, for transactions. But their governance, development and policies remain firmly under state control.

Rosa and Larsen argue this centralised oversight grants governments who use CBDCs unprecedented authority over financial activity, including real-time purchase monitoring, transaction limits and spending restrictions.

China exemplifies this model. Its CBDC infrastructure prioritises programmability and state control.

The digital yuan is integrated into China’s social credit system, reinforcing state oversight through surveillance networks like Skynet. Skynet is a highly sophisticated system that tracks individuals’ actions, assigning social credit scores based on their activities. (Financial behavior, adherence to laws, and even social and moral conduct are included.)

The e-CNY enhances its effectiveness by providing real-time data on financial transactions, making it easier for the government to monitor and evaluate citizens’ financial behaviours.

An urgent warning Australia should heed

Smart Money argues CBDC development is a strategic necessity, not just financial innovation. It’s an urgent warning.

The book’s greatest strength lies in its ability to synthesise complex geopolitical and financial trends into a cohesive narrative. The authors’ parallels between the rise of CBDCs and the internet bolster their argument that “digital currencies are not just upgrades, but foundational shifts in how value and power circulate globally”. It’s convincing.

However, Smart Money’s alarmist tone sometimes overshadows a more nuanced discussion. The authors downplay challenges to China’s ambitions, including global scepticism about the yuan’s convertibility, and the entrenched inertia of dollar-based trade.

Their critique of US complacency sometimes paints non-Western initiatives as monolithic threats, overlooking regional nuances like the independent ambitions of the United Arab Emirates’ in financial technology.

Despite these caveats, the book offers a sharp and insightful examination of the geopolitical and financial stakes of CBDCs.

Even a modest global shift towards digital currencies could erode demand for the US dollar, weakening its borrowing power. This would make Western markets, including Australia, more volatile.

As a resource-driven economy deeply intertwined with China, Australia must urgently reassess its financial and economic strategies in response to these shifting dynamics.