July 28, 2025

The U.S. dollar has long been the undisputed heavyweight champion of global finance.

Could America lose the global currency race?

Understand the historical dominance of the U.S. dollar, the emerging threats from geopolitical shifts and digital currencies, and the profound implications if America’s global monetary influence wanes.

The U.S. dollar has long been the undisputed heavyweight champion of global finance, serving as the world’s primary reserve currency and the bedrock for international trade and investment. Its enduring dominance is deeply rooted in a rich history, the sheer size and stability of the American economy, and the robust infrastructure of its financial markets. Yet, as the 21st century unfolds, this formidable position faces unprecedented challenges from geopolitical shifts, the rise of economic rivals, and transformative technological advancements, such as digital currencies. OANDA explores the foundations of the dollar’s power, the forces testing its supremacy, and the potential implications should its global monetary influence wane.

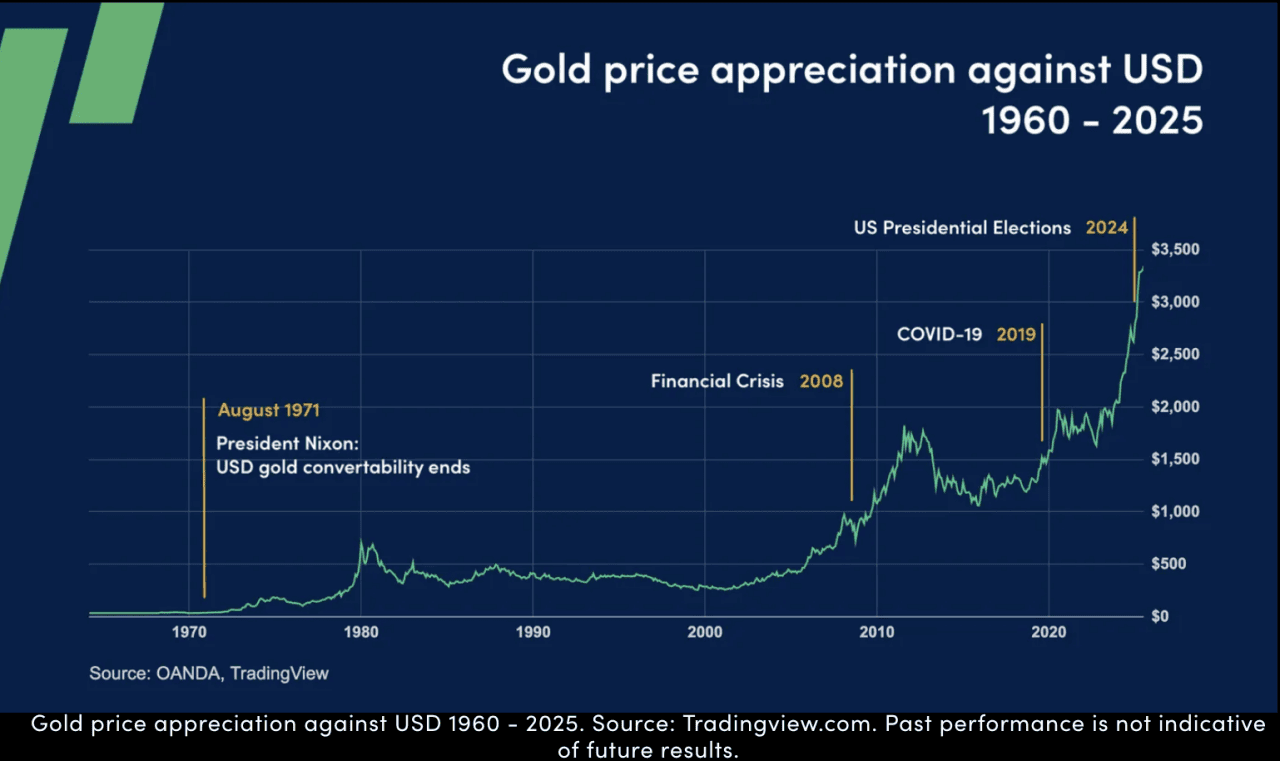

The U.S. dollar’s history is deeply connected to the economic and political development of the United States. Initially, various currencies circulated within the colonies. The Coinage Act of 1792 officially established the dollar as the standard unit of currency in the United States. The Federal Reserve, created in 1913, further solidified the dollar’s role in the nation’s monetary system. A key turning point was the Bretton Woods Agreement in 1944, which made the dollar the world’s primary reserve currency. Under this system, other currencies were pegged to the dollar, which was in turn linked to gold. When the Bretton Woods system collapsed in 1971, the era of floating exchange rates began, in which market forces determined the value of the dollar. Despite facing challenges and fluctuations over time, the dollar has maintained its dominant position in global finance as a key reserve and transaction currency.

A reserve currency is one held in significant quantities by central banks and financial institutions as part of their foreign exchange reserves. It is used for international transactions and investments, as well as a benchmark for global trade. The most desirable reserve currencies are those perceived as stable, liquid, and backed by large, trusted economies.

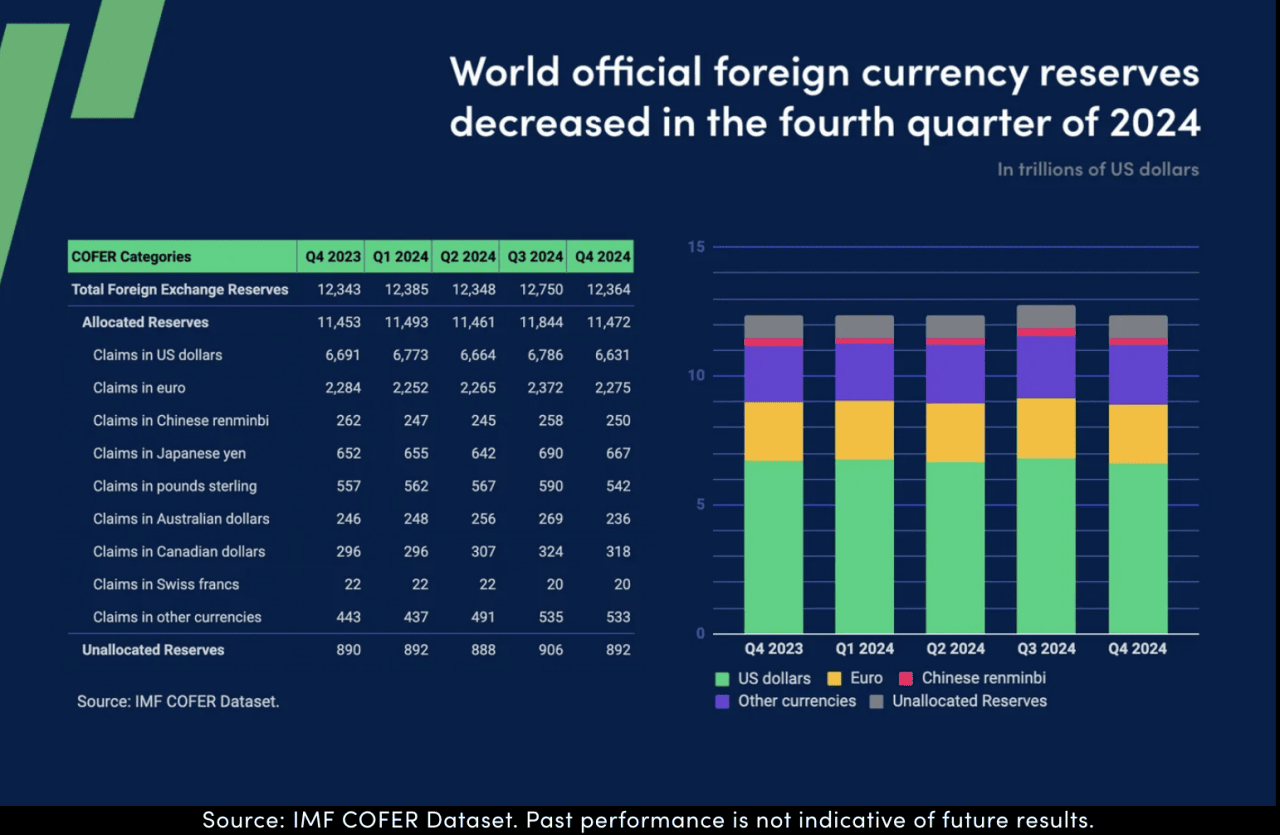

The U.S. dollar fits these criteria almost perfectly. As of 2024, the U.S. dollar accounts for approximately 57.8% of global foreign exchange reserves, according to the International Monetary Fund (IMF). The euro is second at 19.8%, followed by the Japanese yen at 5.82%, the British pound at 4.73%, and, increasingly, the Chinese yuan at 2.18%.

- Economic size and stability: The United States has the world’s largest economy, underpinned by deep financial markets and relatively strong institutions.

- Petrodollar system: Since the 1970s, most global oil transactions have been priced and conducted in US dollars, reinforcing demand across energy-importing nations.

- Treasury markets: U.S. government bonds (treasuries) are considered a haven, and their massive and liquid markets offer global investors a reliable place to park their reserves.

- Global trade and finance infrastructure: Many global contracts, loans, and commodities are denominated in dollars. U.S.-based financial institutions and systems (like SWIFT and CHIPS) are foundational to international banking.

- China’s rise: The Chinese yuan (renminbi) is being gradually internationalized. Initiatives such as the Belt and Road Initiative and the creation of the Cross-Border Interbank Payment System (CIPS) are part of a long-term strategy to reduce dependence on the dollar.

- De-dollarization efforts: Countries such as Russia, Iran, and, more recently, Brazil and India have taken steps to reduce their use of the dollar in trade, often motivated by geopolitical concerns or a fear of US sanctions. Known as the BRICS nations, the group is actively pursuing de-dollarization, aiming to reduce its reliance on the US dollar.

- Central Bank Digital Currencies (CBDCs): Digital versions of sovereign currencies could, in the future, streamline cross-border transactions and diminish the dollar’s payment infrastructure advantages.

- U.S. fiscal concerns: High national debt, persistent budget deficits, and political dysfunction in Washington raise concerns about the long-term stability of the dollar.

- Lower borrowing costs: High global demand for dollar-denominated assets allows the US government to borrow at relatively low interest rates.

- Global influence: Sanctions and financial restrictions enforced in dollars have a disproportionate impact on foreign governments and institutions.

- Trade flexibility: The U.S. can run persistent trade deficits without facing the currency crises that developing countries typically encounter.

With all that said, the financial landscape is constantly evolving, and new contenders are emerging that could reshape the future of global currency. Among these, the rise of cryptocurrencies presents a unique challenge to the established order, prompting questions about their potential to disrupt the dollar’s long-standing dominance.

Central banks globally are approaching cryptocurrencies with a mix of caution and strategic interest. Many are exploring or developing their own Central Bank Digital Currencies (CBDCs) to maintain monetary sovereignty, improve payment systems, and counter the potential disruption from private stablecoins. For instance, the European Central Bank (ECB) has urged the European Union to expedite legislation for a digital euro, highlighting concerns that large-scale private stablecoins could pose a threat to monetary stability. While recognizing the innovative potential of blockchain technology, central banks generally aim to integrate digital assets into a regulated financial framework rather than allowing them to operate entirely outside of their oversight.

The rising tension between government-backed digital currencies (Central Bank Digital Currencies – CBDCs) and decentralized cryptocurrencies stems from fundamental differences in their design, control, and implications for financial systems and individual freedoms.

- Centralized control: CBDCs are issued and controlled by a nation’s central bank. This gives the government complete oversight and control over the currency’s supply, transactions, and user data.

- Monetary policy tool: Governments view CBDCs as a means to enhance the effectiveness of economic policy, facilitate faster and cheaper payments, and potentially reduce reliance on cash.

- Financial stability: Proponents argue that CBDCs can enhance financial stability by providing a secure, state-backed digital asset and facilitating the tracking of illicit economic activities.

- Privacy concerns: A significant point of tension is the potential for reduced privacy, as transactions could be fully traceable by the government, raising concerns about surveillance and financial censorship.

- Disruption of commercial banks: The introduction of CBDCs could bypass traditional commercial banks, impacting their role in the financial system and potentially leading to disintermediation.

- Decentralized control: Cryptocurrencies operate on a distributed ledger technology (blockchain) and are not controlled by any central authority, government, or financial institution.

- Anonymity/pseudonymity: While not truly anonymous, many cryptocurrencies offer a degree of pseudonymity, allowing users to transact without revealing their real-world identities, which privacy advocates highly value.

- Freedom from government interference: A core appeal of decentralized crypto is its resistance to government censorship, seizure, or inflation, as its supply is often algorithmically determined and transactions are peer-to-peer.

- Volatility and regulation: Decentralized cryptocurrencies are often highly volatile and largely unregulated, posing risks to investors and making it challenging for governments to integrate them into existing financial frameworks.

- Challenge to monetary sovereignty: The existence and growing adoption of decentralized cryptocurrencies can be seen as a challenge to a nation’s economic sovereignty and control over its financial system.

In essence, the conflict is a modern manifestation of the struggle between state control and individual liberty in the digital age, played out in the realm of finance. As both CBDCs and decentralized cryptocurrencies continue to develop, this tension is likely to intensify, shaping the future of global finance.

- Economic stability and prosperity: The U.S. dollar’s role as the primary reserve currency means that global trade, finance, and investment primarily revolve around it. A diminished role for the dollar could lead to increased volatility in exchange rates, higher transaction costs for U.S. businesses and consumers, and a less predictable global economic environment, potentially impacting US economic growth and employment.

- Borrowing costs and fiscal health: The US benefits from its ability to borrow at relatively low interest rates due to the dollar’s status as a haven and the deep liquidity of U.S. treasury markets. A decline in monetary influence could lead to higher borrowing costs for the U.S. government and corporations, exacerbating national debt and potentially limiting fiscal flexibility to respond to economic downturns or invest in critical areas.

- Geopolitical leverage: Monetary influence translates directly into geopolitical power. The U.S. has historically used its financial leverage (e.g., through sanctions and control over global financial institutions like SWIFT) to advance its foreign policy objectives. Losing this influence would diminish its ability to exert pressure on other nations and could alter the global balance of power.

- Control over the global financial system: The U.S. has played a leading role in shaping global financial regulations and institutions. A loss of monetary influence could mean that other nations or blocs, potentially with different values and interests, take the lead in setting the rules for the international financial system, which might not align with US interests.

- Impact on U.S. consumers and businesses: Americans could experience direct impacts, such as higher prices for imported goods if the dollar weakens significantly, and increased uncertainty for businesses engaged in international trade. U.S. companies operating globally might face more complex and costly currency conversions.

- Role in innovation and financial technology: If other countries or decentralized systems become the primary drivers of financial innovation, the U.S. risks falling behind in crucial areas, such as digital payments, cross-border transactions, and new financial instruments. This could hinder its competitive edge in the global economy.

- Trust and confidence: A loss of leadership would signify a decline in global trust and confidence in the U.S. financial system and its governance. This erosion of confidence could have long-term repercussions extending beyond monetary influence, affecting diplomatic relations and international cooperation on multiple fronts.

In essence, a decline in the U.S.’s global monetary influence would not just be an economic shift but a fundamental reordering of power, with significant implications for the U.S. economy, its foreign policy, and its standing in the world.

The U.S. dollar has undeniably remained the bedrock of the global financial system for decades, bolstered by a strong economy, vast treasury markets, and its pivotal role in international trade. However, the emergence of rival currencies and, more significantly, the disruptive potential of digital assets, such as cryptocurrencies and central bank digital currencies, signals a shifting landscape. While central banks and regulators grapple with integrating these innovations into established frameworks, the tension between centralized control and decentralized freedom persists. The future of global monetary influence is not a foregone conclusion; how the U.S. adapts to these challenges will determine whether the dollar maintains its formidable position or if a new era of multipolar financial power begins. The stakes are high, impacting not just economies but also geopolitical leverage and the daily lives of citizens worldwide.

This article is for general information purposes only, not to be considered a recommendation or financial advice. Past performance is not indicative of future results. This is not investment advice or a recommendation to buy or sell financial instruments.

Opinions are the authors’; not necessarily those of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors.

This story was produced by OANDA and reviewed and distributed by Stacker.

RELATED CONTENT: TikTok-Fueled Boycott Exposes Deep Divide Between Black Americans and Africans; It’s Time To Knock It Off