| Updated:

Technology research firm Novum Insights looks at mainstream adoption of cryptocurrency and examines which areas might win this race.

Cryptocurrency markets had a great run in April and a period of relative stability in May, which could draw enough attention to propel some into the mainstream. This kind of price action has resulted in heavy activity in crypto but we do remember the last big increase in 2017 which pulled in actors, rappers and celebrities into promoting projects before the market crashing. It is worth assessing what crypto achieving mainstream adoption might look like and if it is possible to establish or measure where we are in this transition?

Trading market adoption of bitcoin

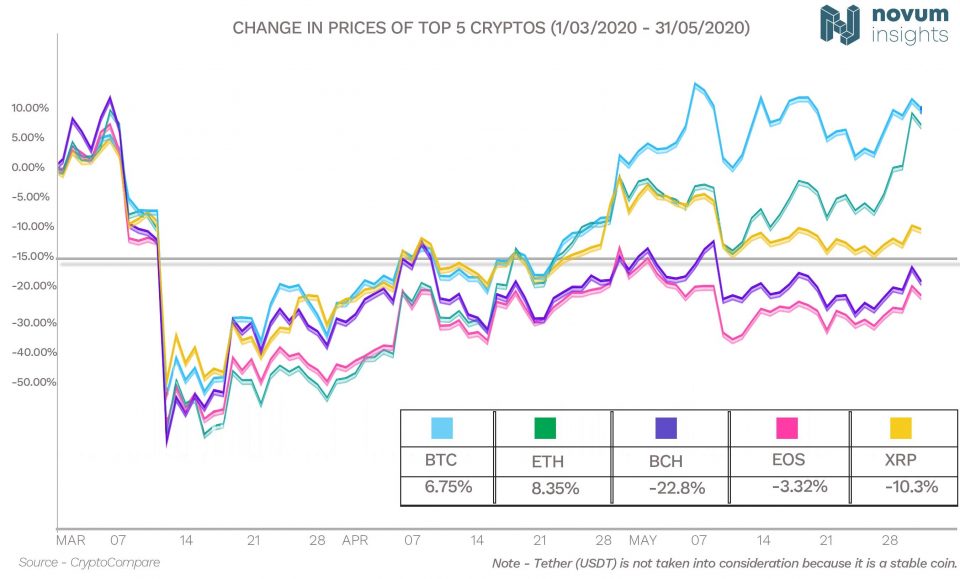

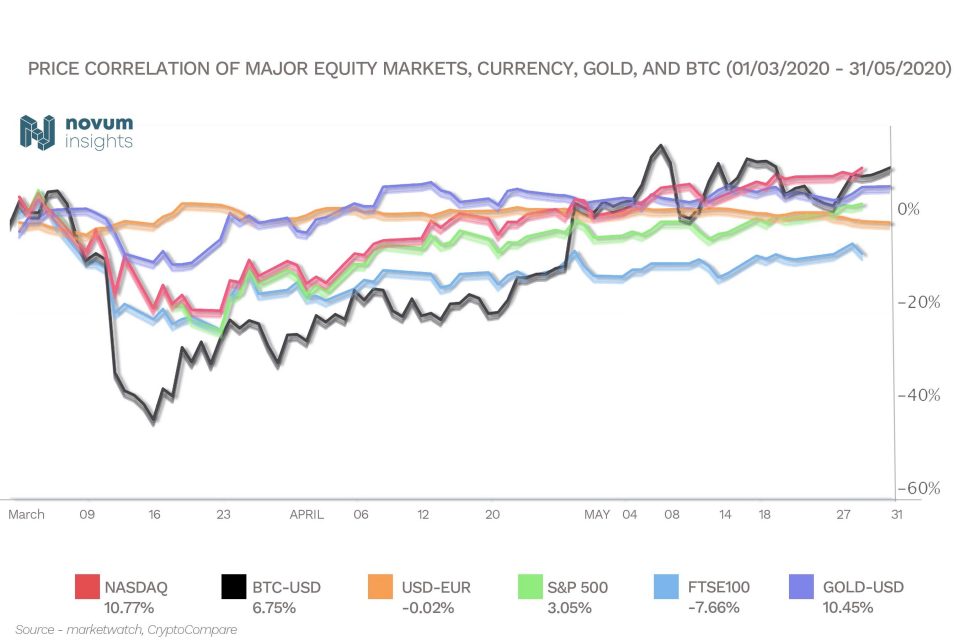

Top hedge funds Tudor Investment Management and Renaissance Capital are among some of the latest new entrants into bitcoin trading, and although some financial market insiders like Goldman Sachs continue to be publicly sceptical about bitcoin, institutional enthusiasm is certainly growing. A resounding rally by bitcoin in the last two and a half months has likely fuelled this interest, after crypto prices initially crashed extremely hard in the market rout (insert Crypto AM chart 1) triggered by the realisation of the seriousness of Covid-19 for the global economy.

Massive monetary intervention from the world’s central banks, at the same time as the reduction this month in the bitcoin mining reward in the so-called ‘halving’ are two of the major reasons why crypto-enthusiasts anticipated stronger adoption. Bitcoin has a fixed maximum supply of 21 million coins, and this built-in scarcity was designed in the aftermath of the last financial crisis deliberately in contrast to the massive central bank interventions which increased the money supply back then. Although recent movement in a wallet created by one of the earliest adopters of bitcoin, and attributed by some to the mysterious creator of bitcoin, Satoshi Nakamoto, also demonstrates a market flaw with the predominance of so-called “whales” owning large chunks of the market. The wallet in question was created in February 2009, more than 12 months before the first transaction was carried out, buying two pizzas for 5,000 BTC each giving some indication of the abundance of bitcoins at that time.

At the same time, retail adoption of wider crypto trading is increasing, even though financial institutions are typically most interested in bitcoin. The most widely used wallet Coinbase has more than 30 million users, while popular exchange Binance has more than 15 million. Given hot fintech Revolut only has 7 million users, and many of those also use that app to trade the bitcoin price, retail tinkering and enthusiasm for crypto is arguably surprising for a market that can still seem obscure to many. Yet in an age where there is growing interest in the supply of money and how we can exist online in a cryptographically secure way, this is doubtless an exciting time for crypto.

Will central bank-issued digital currencies or stable coins take over?

Public enthusiasm for cryptocurrency is arguably driven by its exotic nature. Yet at the same time digital money will inevitably become an increasing part of our lives. Covid-19 has surely hastened the demise of printed money, and it poses a problem for the world’s central banks on how to control the money supply. For this reason there are efforts in China, the US, the UK, Sweden and elsewhere to bring in central bank-issued digital currencies where there is a known supply of digital money approved by the central banks in circulation. Given the detailed opinion papers being put out by the likes of the Bank of England this area of innovation is certainly being signaled as a major change which will catapult digital money into the mainstream.

Yet there is also innovation in the creation of stable-coins which follow established currencies or markets. Adopters of cryptocurrency are now accustomed to using the synthetic dollar USDT, Tether, or other stable coins, to park their funds pegged to traditional fiat currencies as they trade in and out of more volatile cryptos. While last year Facebook controversially made plans as part of a consortium to launch cryptocurrency Libra, which initially was conceived as a basket of major currencies and even drew the criticism of US president Donald Trump among politicians and officials around the world. Yet given Facebook is the world’s most popular social network it seems likely its experiment will turn heads when it goes live. Yet in a concession, Libra agreed to create different currencies for each different country which some argue has totally weakened the concept as a global currency.

Digital securities

There have been multiple projects launched to trade and create digital regulated securities. Given that financial institutions are likely to welcome these markets, Novum Insights has been tracking developments in this sector, yet to date it has largely been at experimental scale. Many of the seemingly well-funded businesses attempting to create securities exchanges have struggled to gain widespread adoption, but it is likely new ways to trade real world assets in a regulated manner will grow in popularity.

Protocols and smart money

Innovators are excited by the way different cryptocurrencies can be used as smart money. The most popular smart currency among programmers is Ethereum by a significant margin, but at the same time there is widespread experimentation in tradable protocols such as ADA Cardano and EOS. Logic being built into currency should allow for increasingly complex financial experimentation in real life. As these protocols are built into more widely adopted products cryptocurrency will arguably imbed itself more into people’s lives, but at the moment it is still an experimental area. Some of the most active innovation going on in the creation of programmable money is happening in decentralised finance, where the likes of MakerDAO and Compound are used by programmers for peer to peer lending of cryptocurrencies.

Non-fungible tokens

A surging use case is also the creation of digital collectibles known as non-fungible tokens. The trading back and forth of unique digital items is a clear use case which is leading to adoption of the technology in video games and virtual worlds. The space drew widespread attention with the viral popularity of Crypto Kitties in 2017 and games like Gods Unchained and virtual worlds like Decentraland have been experimented with by enthusiasts.

Crypto and digital currency future will be weird and wonderful

The array of innovation and experimentation detailed in this article certainly suggests that the future of crypto and digital currencies is going to be bright, although much of the current usage beyond trading is largely experimental. As can be seen there are many contenders worthy of watching. The next iteration in crypto will arguably see the realm move from speculation to significant innovation, and we look forward to seeing how some of the experiments become second nature for global citizens like the internet is today. There is still huge pushback from banking institutions, and this is a major hurdle for adoption, but the array of possibilities should see mainstream adoption come soon.

Toby Lewis, Novum Insights