One Virginia woman who claims she got scammed through investing her savings into cryptocurrency hopes to help other investors by sharing her story.

This article is part of WTOP’s monthlong series, “Money Matters,” where we explore tips for saving, budgeting and making your money work for you. Check for new articles all month, right here on WTOP.com.

A Virginia woman nearing retirement said she connected with an influencer on TikTok who advised her to try out cryptocurrency trading.

He connected her with a “trade coach” who recommended a website for the investments.

“I asked a million questions. He was able to answer them,” said the woman, who asked to be identified under the alias of Phoenix.

“The biggest thing was, you have to get in on it, now. You have to invest now.”

WTOP is using aliases to refer to the women who have lost money through investing in cryptocurrency to protect their identities.

The 63-year-old woman said she thought trying out crypto could help her pay off her loan when she retires this spring. She invested tens of thousands of dollars and eventually reached a profit margin of $400,000.

But when she went to pull out her earnings, she lost access to the funds.

“How did you get suckered? I saw a financial opportunity, as I said, I vested before,” Phoenix said, referencing investments she made in penny stocks.

Phoenix hasn’t been able to recover most of her money — a loss of at least $60,000.

She believes the same influencer who advised her to invest may have carried out a similar scam involving another older woman who lives outside the D.C. region.

That woman is a retired widow who invested thousands of dollars before she lost access to her account and funds. Counting all the fees she paid trying to regain access to her money, 71-year-old Alice lost close to $40,000.

“I believe that there are other women out there,” Phoenix said.

They aren’t alone. About $1.42 billion was lost to cryptocurrency fraud in the U.S. last year, according to a report from the Federal Trade Commission.

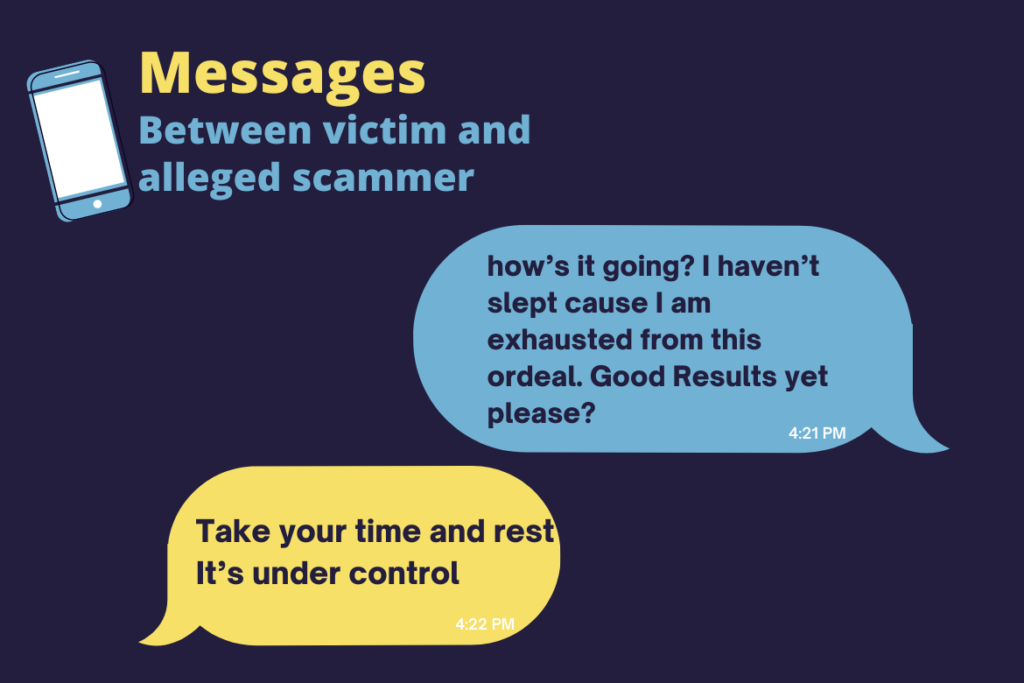

Both women provided WTOP with documentation, some of which shows their investments and communication with people who they believe worked together to scam them out of tens of thousands of dollars.

When contacted by WTOP, the influencer who the women believe was involved in the scam denied any involvement with crypto investing and pointed to numerous accounts on TikTok that he said are impersonating him. The influencer’s profile isn’t verified on the app, which he claims has opened the door for fake accounts.

The local sheriff’s office in Phoenix’s county confirmed to WTOP they are investigating her case.

No charges have been filed in either case at this time.

Like the ‘Wild West’: Unregulated crypto presents risks and opportunities

Social media is a breeding ground for advertising and serves as an avenue to recruit potential investors.

But those opportunities — with promises of bountiful riches — often don’t pan out. Some might be schemes to steal funds or rip off investors.

“The typical investor doesn’t have a high sophistication level when it comes to crypto, and so it’s easy for people to get taken advantage of,” said Christina Lynn, a certified financial planner who works as director of wealth strategy at Mariner.

Lynn said there are a couple of things behind the boom in crypto scams: it’s new, complicated and isn’t yet adequately regulated.

“The regulators are catching up with some of them eventually, but there’s a lag there that happens, and so it’s just it does feel a little bit like the ‘Wild West’ still,” she said.

What’s the appeal of crypto?

While many investors are interested in crypto, Lynn said traditional institutions, such as financial advisers, have been slower to jump in.

“We are wired, and we’re required to be really cautious with new stuff,” Lynn said.

Regulatory concerns are one reason for their caution.

“Unlike regular assets that are backed by something, like $1 is backed by the U.S. government, for example, the thing that’s unique about crypto currencies is that they’re decentralized. There’s no middleman.”

Crypto uses something called blockchain technology.

“It’s like a digital ledger or a notebook that records every transaction across a network of computers all around the world, and that ledger keeps everything transparent and trustworthy.”

Though the uncertainty of a cryptocurrency makes some financial professionals wary, some potential investors are intrigued by how cryptocurrency differs from other forms of investing.

“It’s kind of like what the internet represented back in the day. It’s that type of huge shift in technology that we’re looking at,” Lynn said. “We’re just kind of seeing it in its infancy stage right now.”

Lynn said investors should ask themselves about where they’re getting advice before moving any funds.

“Who are you getting your advice from? Is it from someone on YouTube? I would really be careful with following advice from any influencer,” Lynn said.

In Phoenix’s case, she felt the person she was talking with was trustworthy.

“I believe in the good of people, period. He seemed honest enough,” Phoenix said. There was nothing that was done that seemed to be deceptive. My questions were able to be answered.”

For Alice, she said the same influencer who she believes scammed her made promises that went beyond finances.

“I even got a proposal. I am 71 years old. I’m not looking for no husband,” Alice said. “He sends me a picture of these rings. Well, OK, fine and dandy. Anybody can walk in Tiffany’s and take a freaking picture of a ring.”

Alice met him several times in person, along with his family members, she told WTOP.

A person with the trading website asked Alice to withdraw $10,000 from a Bitcoin machine and then redeposit it before her funds would be released, she said. But she refused that request.

A request to deposit or take money out of a Bitcoin ATM should raise alarm bells, Lynn said.

In an attempt to get her money back, Alice said she paid a crypto lawyer that was recommended to her and shared with him her bank account information under the promise her funds would be sent there.

“I beat up on my kids about doing stuff like that,” she said of sharing the sensitive banking information. “I have grown grandkids. I beat up on them about it. I said, ‘Lo and behold, look at grandma. She’s done got herself in the jam.’”

She hasn’t seen any of her money returned.

Phoenix has recovered about $8,000 with the help of law enforcement.

‘Real risks in the crypto world’: Ways to safeguard investments

Decide on where to safely store crypto

For starters, Lynn said investors need to think about where they will store funds.

Investors can buy crypto on an exchange platform, through an exchange traded fund or a financial adviser. Those funds can be kept on the exchange platform or moved into a hot wallet or cold wallet.

She said sometimes people might run into trouble by trying to save money on how they invest.

“Well, does that ‘cheaper way’ mean that you’re putting yourself more at risk for the exchange or the platform to go belly up or to get hacked, right?” she said. “Those are all things that we don’t really need to think about with traditional financial assets, but all of a sudden become real risks in the crypto world.”

A Virginia woman says she lost thousands of dollars in an alleged crypto scam. WTOP’s Jessica Kronzer reports.

Investors should be honest with themselves about their understanding of crypto trading. If they aren’t confident, Lynn said to consider investing in an exchange traded fund, or through a financial adviser.

“Those types of things can be worth the little extra fee that you might pay for those services, the peace of mind that it gives you that, ‘Hey, I know that my crypto is going to be there next time I look and I don’t need to worry about it,’” she said.

Pick a ‘tried and true’ crypto

Then people need to think about which cryptocurrency to invest in.

“Not all cryptocurrencies are created alike,” Lynn said. “They are vastly different, and there’s tens of thousands of options out there, so it can be pretty overwhelming to pick which ones make sense for you.”

Lynn recommended researching a list of top 10 cryptocurrencies.

She recommended investing in coins that have a track record.

“I would suggest staying away from meme coins, away from coins that you think are just up and coming,” she said.

Don’t expect to get rich overnight

For one, she said to “avoid trying to get rich quick.”

“That is such a trap,” Lynn said. “I think that investors fall into thinking like, ‘Oh, I heard about some particular coin that somebody smart is saying is going to go to the moon.’ Those types of ideas, I think backfire a lot on people.”

Then there’s day trading.

“There’s a real allure to day trading, because volatility is so extreme in the crypto world,” she said.

And while day trading has paid off for a lucky few, she said it’s a red flag for most.

“Most likely you’re not going to do well with day trading, and I have just seen it so many times with day trading, that people really get harmed financially with attempting to do that,” Lynn said.

“Not only that, but they churn up a bunch of taxable events that take them by surprise come tax season.”

What else to consider about crypto

Lynn said the investor’s will or trust should dictate what to do with crypto assets should the person die.

“Whether you have $100 invested or $100 million invested in crypto, it does not pass to your loved ones the same as traditional assets do,” Lynn said. “So depending on how you have those crypto assets stored, there’s a huge risk that it wouldn’t go to your family or to your loved ones.”

It can be tempting to invest big, she said.

“Be sensible, invest what you can afford to lose. Even a small allocation is known or is projected to have outsized returns,” Lynn said.

Lynn also recommended diversifying your crypto assets.

‘I don’t have another home to go to’: What to do after you’ve been scammed

Phoenix for her part is still going to retire as planned, but she won’t be paying off her home loan. Coming to that conclusion was a difficult process.

“After crying for four days and honestly wishing I was dead because I couldn’t tell anybody. I’m a single woman. I don’t have any sisters or brothers or any family, and if I fail, I fail. I don’t have another home to go to,” she said.

Phoenix screenshotted conversations with a staffer from the trading platform’s website, the influencer who recommended them and others she believes may be involved. She also saved information about her investments.

Lynn said that’s exactly what investors should do if they suspect they’re getting scammed.

WTOP’s Jessica Kronzer has cryptocurrency tips from a certified financial planner.

“Make sure that you document everything possible, emails, messages, phone calls, texts, take screenshots, just get it all. Document as much as you can, and then report it to law enforcement and regulators,” Lynn said.

Phoenix said the scammers have deleted the chat history. Both women were pushed to talk with the scammers off TikTok, instead using encrypted services where messages can be removed.

Scams can be reported to local law enforcement as well as the Federal Trade Commission and the FBI.

Lynn also recommended that investors contact the platform or institution where the crypto was stored to alert them about what happened.

That’s just what Alice and Phoenix have done.

The women described the scammer as intelligent, pleasant and nonchalant.

“I have not told anyone in my family what I have done because they’d take me apart,” Alice said. “He was just so convincing with it.”

After contacting the trading website they used, both Phoenix and Alice were asked to pay thousands of dollars to recover their funds. Lynn cautioned against such recovery scams.

One advantage to crypto that Lynn pointed out is it’s traceable. Lynn recommended talking to a financial professional with experience with crypto about scams.

“You can actually trace the funds, which should give us some hope for recovery,” Lynn said.

Get breaking news and daily headlines delivered to your email inbox by signing up here.

© 2025 WTOP. All Rights Reserved. This website is not intended for users located within the European Economic Area.