- Grayscale seeks to convert its Digital Large Cap (GDLC) fund into an ETF after filing an S-3 form with the US SEC.

-

NYSE Arca filed 19b-4 to list and trade GDLC in October 2024.

-

Crypto investors anticipate sweeping volatility ahead of US President Donald Trump’s ‘Liberation Day’ tariffs.

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF. The application could see Grayscale’s Digital Large Cap Fund (GDLC), with a diversified portfolio holding Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA) convert from a private fund to a public investment vehicle.

The SEC’s final decision on GDLC 19b-4 in July

The NYSE Arca filed the 19b-4 form with the SEC in October, seeking to list and trade the GDLC fund. According to ETF Store President Nate Geraci, this filing proposes a rule change under NYSE Arca Rule 8.800-E to allow the listing and trading of multi-asset index funds.

Bloomberg analyst, James Seyffart, is positive that Grayscale’s filing aligns with the SEC deadline on the 19b-4 form in July with the possibility of index-based crypto ETFs before the end of the year. The SEC commenced its 240-day review on November 4, 2024.

Grayscale has filed S-3 for Digital Large Cap ETF…

Holds btc, eth, xrp, sol, & ada.

NYSE had previously filed 19b-4 to list & trade this.

Sticking w/ prediction that index-based crypto ETFs will be approved by year-end (if not before then). pic.twitter.com/sBoKScthBx

— Nate Geraci (@NateGeraci) April 2, 2025

GDLC boasts over $530 million in assets spread across major cryptocurrencies, including BTC, ETH, XRP, SOL and ADA. If approved, the conversion to an ETF tradable on a traditional stock exchange would directly increase accessibility to retail and institutional investors.

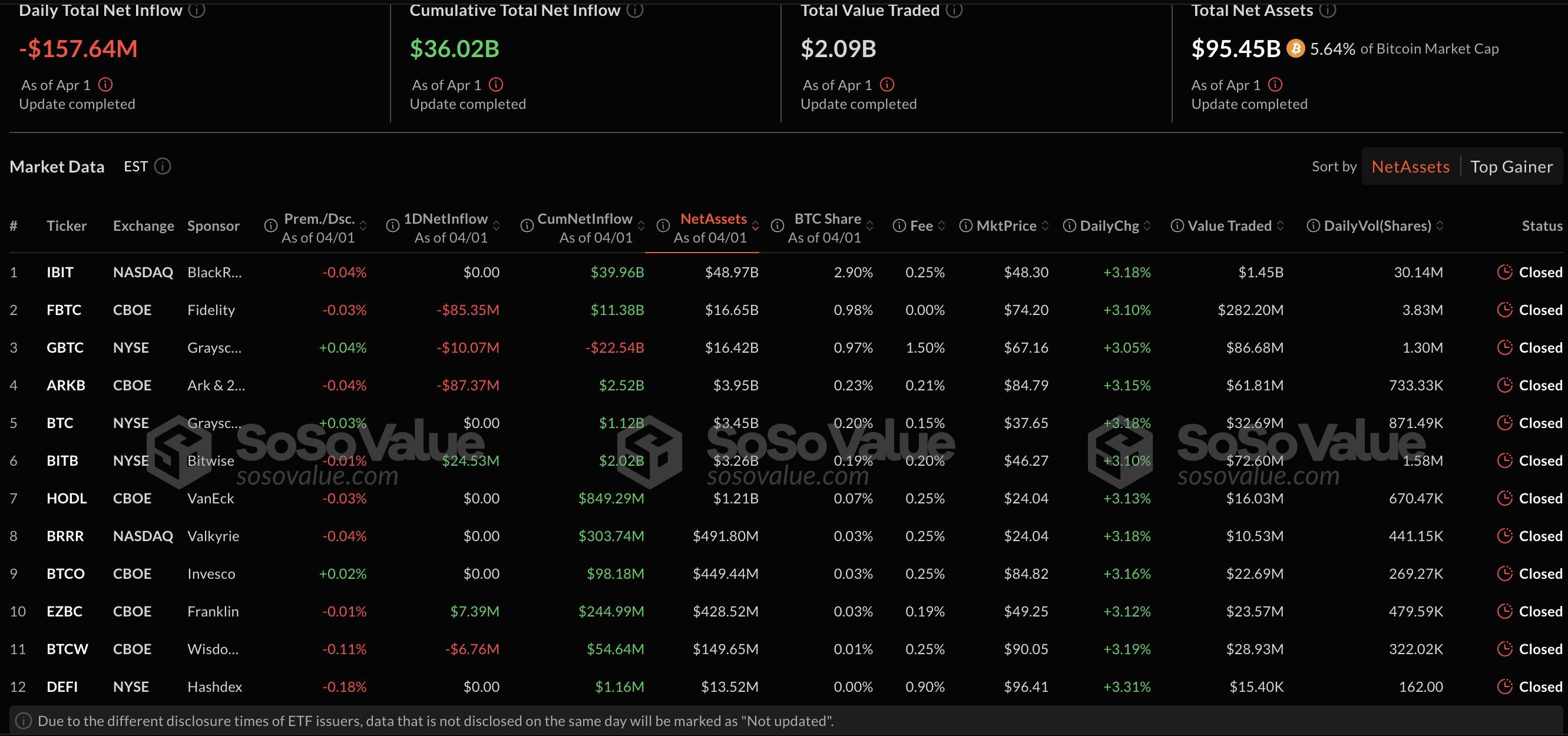

Exchange-traded funds have become a conduit for enhanced liquidity into the crypto market, with SoSoValue data highlighting a total net inflow of $36 billion since their launch in January 2024.

Bitcoin reacts ahead of ‘Liberation Day’

Following the announcement, the leading cryptocurrency, Bitcoin sustained a relatively positive outlook, increasing 2% in 24 hours to $84,584 as per CoinGecko price data. Ethereum maintained a slight edge over BTC, rising 2.3% to trade at $1,876 during the late Asian session on Wednesday.

XRP, Solana and Cardano hardly reacted to the news, suggesting caution among investors ahead of Donald Trump’s ‘Liberation Day.’ The White House has promised to impose sweeping reciprocal tariffs likely to affect all its trading partners.

Global markets are in panic mode as consumer confidence plunges to a 12-year low. According to the weekly QCP report, these tariffs could mean more bleeding, especially in equity markets, currently facing a 4-5% weekly decline.

“Crypto vols have defied the sell-off, drifting lower despite a similar drawdown and Friday’s mega washout,” analysts at QCP added. “On our desk, activity was skewed bullish into Asia open. Buyers were seen taking topside exposure ($85k-$90k strikes) and selling downside risk ($75k-$80k strikes), a potential bet on a firmer start to Q2.”

Investors will likely remain cautious despite April being historically a strong month for crypto. Markets could take time to adjust and digest oodles of macro risks while waiting for direction.