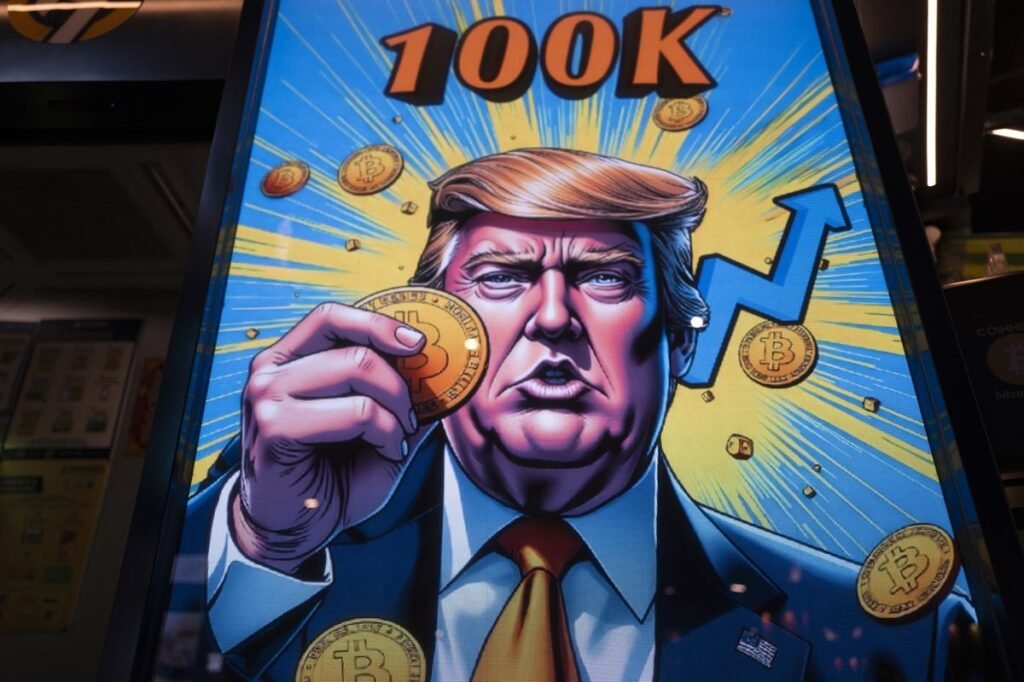

Donald Trump’s plans to establish a government stockpile of cryptocurrencies took a notable step forward this past weekend, as the president unveiled the five assets he plans to include in his federal crypto reserve. The U.S. will be the “Crypto Capital of the World,” Trump said in a Truth Social post touting relatively low-profile assets like XRP, solana and cardano as the first currencies to join better-known brands bitcoin and ether in a stockpile designed to “elevate this critical industry after years of corrupt attacks by the Biden Administration.” Perhaps unsurprisingly, the value of the currencies named has skyrocketed in the wake of Trump’s announcement.

At the same time, Trump’s crypto-forward plans for the American economy have begun alarming financial experts who warn that crypto’s extreme market volatility and susceptibility to manipulation could spell trouble for the country. As Trump continues pushing for a national cryptocurrency stockpile, why are economists raising their red flags, and what — if anything — can they do about it?

Trump’s crypto plan has produced a backlash from “conservatives and even ardent crypto backers” who cited concerns over “giveaways to an already wealthy community” and “delegitimizing the digital currency industry,” The New York Times said. Some Republicans criticized the plan to use tax dollars to purchase crypto’s “risky assets” rather than simply using the money for “paying down the national debt.” Other critics pointed out that both Trump and his crypto czar, David Sacks, stand to personally benefit from the boost to the crypto industry.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

SUBSCRIBE & SAVE

Sign up for The Week’s Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Trump’s announcement was met with an “unusual amount of skepticism among crypto and tech bigwigs,” Forbes said, as insiders questioned the decision to “include assets other than ‘digital gold’ bitcoin in the fund.” Those lesser assets differ from bitcoin by being “more akin to tech investments,” James Butterfill, the head of research at asset manager CoinShares, said to Reuters. As currently understood, Butterfill said, Trump’s plan “suggests a more patriotic stance toward the broader crypto technology space,” rather than utilizing the “fundamental qualities” of each individual asset. With bitcoin as the “most battle tested and decentralized” of the cryptocurrencies, CNBC said, some observers worry that Trump’s inclusion of non-bitcoin crypto “invites the government to pick winners and losers in the crypto market.”

“People should be calling this what it is, which is a crypto bailout,” said journalist Adam Serwer on Bluesky. Referencing members of the Trump family who have launched their own crypto businesses in recent months, he added: “They’re cutting cancer research so they can bailout rich, degenerate gamblers.”

“Borrowing more to ‘invest’ in bitcoin is about the worst idea I’ve heard,” said Hoover Institute economist John Cochrane in a panel survey organized by the University of Chicago Booth’s Kent A. Clark Center for Global Markets. “It will end up in Trump coin or similar.” Andrew Lo, an economist at MIT Sloan, was similarly blunt in his survey response: “This can’t possibly be a serious question.” Of the more than three dozen economists surveyed by the Clark Center, none endorsed the proposal.

What next?

Crypto analysts from Bernstein Wealth Management — “arguably the most mainstream group covering digital asset industry,” said Forbes — have cited “material unresolved questions” with Trump’s proposal, including how the funds will be distributed across the various named assets, how the government will fund the project and whether such a reserve can be “created merely by [the] president’s executive order,” Business Insider said. Trump’s proposal “lacks details on size, timing and whether it will be managed by the Federal Reserve or another new or existing entity,” said Andrew O’Neill, the digital assets managing director for S&P Global Ratings, to Forbes.

Analysts now look ahead to this coming Friday’s “first-of-its-kind” White House cryptocurrency summit, which will include “founders, CEOs and investors from the industry,” The Hill said.