As a response to the latest anti-Bitcoin paper by the European Central Bank (ECB), a new academic paper titled “Challenging Bias in the ECB’s Bitcoin Analysis” has been published. Authored by Murray A. Rudd, along with co-authors Allen Farrington, Freddie New, and Dennis Porter, the paper offers a comprehensive critique of a recent working paper by ECB officials Ulrich Bindseil and Jürgen Schaaf.

Dennis Porter, CEO and founder of Satoshi Action Fund, who initiated the paper with a few days announced the publication on X, stating, “₿REAKING: Full Academic Rebuttal to the anti-Bitcoin ECB paper officially published.”

The original ECB paper by Bindseil and Schaaf portrays BTC as a speculative asset with limited intrinsic value and significant risks. It criticized BTC’s volatility, lack of productive contribution, and wealth concentration, while advocating for Central Bank Digital Currencies (CBDCs) as a superior solution for modern financial systems, as Bitcoinist reported.

The rebuttal systematically addresses and refutes the key assertions made by Bindseil and Schaaf:

#1 Bitcoin’s Political Lobbying Influence

Bindseil and Schaaf argue that the industry’s lobbying exerts disproportionate influence, skewing regulatory policy in its favor. The rebuttal counters this by highlighting the decentralized nature of Bitcoin. “not have a CEO, legal or marketing departments, or lobbyists: it is a neutral, global, leaderless protocol. Bitcoin advocates typically operate without the institutional backing enjoyed by the corporations that dominate the crypto industry,” the authors write.

They point out that traditional financial institutions spend far more on lobbying than the nascent industry noting that in 2023, crypto-related lobbying expenditures in the US constituted less than 1% of financial sector lobbying expenditures.

#2 Wealth Concentration

Addressing the claim that ownership is highly concentrated among a small number of large players, the rebuttal emphasizes that this view overlooks the widespread dispersion of BTC holdings. “Institutional and exchange wallets represent the holdings of diverse investors rather than single entities,” the authors explain. They note that many of the largest wallets belong to exchanges like Coinbase and Binance, as well as ETF issuers like BlackRock and Fidelity, who hold BTC on behalf of millions of users.

The authors also challenge the notion that wealth concentration in coins is inherently unfair. “They imply that any form of inequality is unjust, yet fail to explain why this applies—a free market for Bitcoin has been available to all since its inception,” they write. “Unlike the vast majority of cryptocurrency tokens (‘altcoins’), Bitcoin had a fair and public launch. There was no pre-launch distribution of Bitcoin, no ‘founder shares,’ and no venture capital backers purchasing Bitcoin at a discount.”

#3 Lack Of Productive Contribution

The ECB paper asserts that BTC’s rising price creates positive consumption effects for holders but does not increase overall productivity or economic growth. The rebuttal disputes this by highlighting BTC’s significant role in driving financial innovation and efficiency. “Bitcoin functions as a technological protocol, similar to the TCP/IP protocol that underpins the Internet, enabling the development of new financial services,” they argue.

The authors also emphasize the impact in developing regions, particularly in the remittance market. “For countries that derive a large proportion of their GDP from remittances, slashing transaction costs could have dramatic impacts among the poorest households, who are traditionally excluded from banking services,” the paper notes.

#4 Bitcoin Wealth Redistribution

Bindseil and Schaaf suggest that Bitcoin’s price appreciation results in wealth redistribution, benefiting early adopters at the expense of non-holders and latecomers. The rebuttal counters that this argument disregards the voluntary nature of BTC markets, where participants freely choose to enter based on their own assessment of the asset’s potential.

“Like early investors in stocks or venture capital, Bitcoin’s early adopters assumed significant risk in exchange for potentially high returns—an inherent feature of markets for emerging technologies,” they explain. They also highlight the broader implications of inflation, which redistribute wealth from savers to debt holders through inflationary policies. “Bitcoin’s fixed supply and deflationary characteristics counteract this erosion, offering a long-term store of value,” they assert.

#5 Lack Of Intrinsic Value

The ECB paper claims that Bitcoin lacks intrinsic value and cannot be priced using traditional asset valuation models. The rebuttal argues that this narrow definition ignores the role that scarcity, decentralization, and utility as a store of value play in asset valuation.

“Bitcoin operates similarly to gold, providing an alternative store of value, particularly in periods of monetary instability,” they state. They further assert, “Their argument is fundamentally flawed: they claim BTC cannot be considered money because it cannot be valued as a security, whereas the reality is that it cannot be valued as a security precisely because it is money.”

#6 Bitcoin Is A Speculative Bubble

Addressing the assertion that BTC’s price movements are indicative of speculative bubbles, the rebuttal points out that volatility is a characteristic of emerging technologies. “Bitcoin’s price appreciation is driven by its scarcity, adoption, network effects, and recognition of its utility as a hedge against fiat currency debasement,” they explain.

#7 Failure As A Payment System

The ECB paper contends that Bitcoin has not fulfilled its original promise as a global payment system due to high fees and scalability issues. The rebuttal counters this by highlighting technological advancements like the Lightning Network, which have dramatically improved Bitcoin’s scalability, reducing fees and increasing transaction speed.

“By focusing on the early limitations, Bindseil and Schaaf fail to acknowledge the significant progress made in improving its scalability and efficiency,” they argue. They also address the authors’ critique of Nakamoto’s analysis of financial transactions, stating, “Nakamoto’s argument is not about the optionality of mediation in certain types of transactions; rather, it concerns the inherent costs and risks in a system where transactions rely on third-party credit institutions.”

The authors also challenge the ECB paper’s framing of CBDCs as superior to BTC. They highlight the risks of centralization inherent in CBDCs, including concerns about privacy, political manipulation, and surveillance. “Bitcoin’s decentralized architecture ensures censorship resistance and financial sovereignty,” they assert, contrasting it with the centralization of CBDCs.

The rebuttal raises concerns about potential conflicts of interest due to the authors’ roles within the ECB. Both Bindseil and Schaaf are deeply involved in developing the digital euro, a CBDC project that directly competes with decentralized digital currencies like BTC. “Their vested interest in advancing CBDCs likely skews their portrayal of Bitcoin as a speculative asset,” Porter et al. conclude.

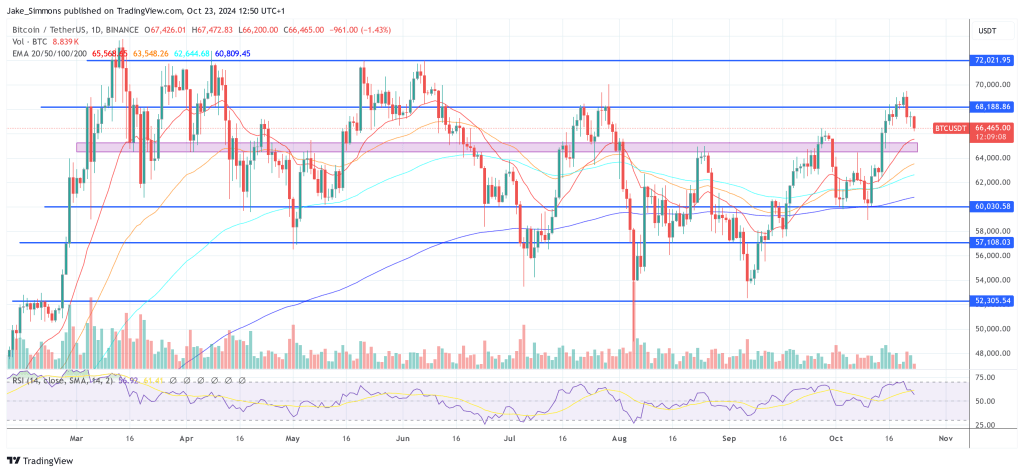

At press time, BTC traded at $66,465.

Featured image created with DALL.E, chart from TradingView.com