Dubai: e& money, the fintech arm of e&, has announced plans to launch a partnership with PayPal to introduce account linking and instant withdrawals in the UAE. Once live, this collaboration will make e& money the country’s first and only digital wallet that links directly to PayPal, giving users access to their balances in UAE dirhams (AED) through the e& money app.

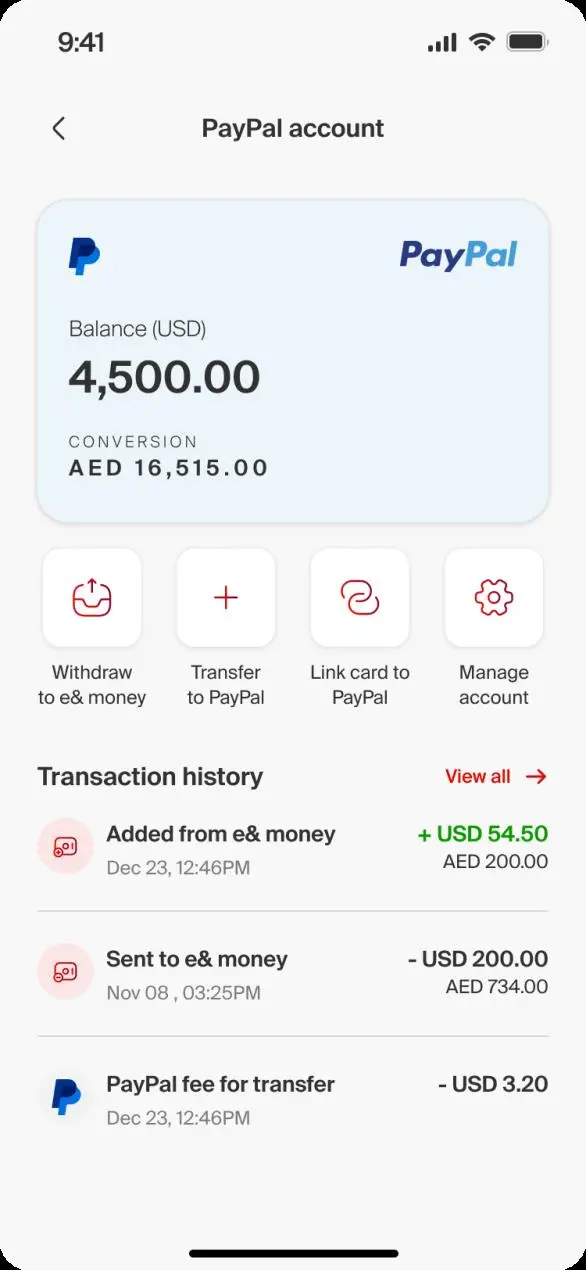

When the service becomes available, PayPal customers will be able to link their accounts to e& money and move funds into their wallets instantly, converting US dollars to AED at a fixed exchange rate with no hidden fees. A second phase is planned that will let users send money from e& money back to PayPal, creating a two-way bridge between the two platforms. As part of this roadmap, e& also intends to join PayPal World — a series of global partnerships connecting many of the world’s largest payment systems and digital wallets on a single platform.

Otto Williams, SVP, Regional Head and General Manager at PayPal Middle East and Africa, said: “The UAE continues to stand out as one of the world’s most dynamic markets for digital innovation. Partnering with e& demonstrates PayPal’s commitment to fuelling growth and opportunity for the future. By combining our global network and trusted capabilities with e&’s regional leadership, we’re empowering people and businesses to shop, send money, and transact across borders with greater ease than ever before.”

Melike Kara, CEO of e& money, said: “Cross-border commerce depends on fast, reliable payment rails. By joining forces with PayPal, we’ll be eliminating the friction freelancers, creators, and everyday consumers face when bringing their earnings into the local economy. This is what financial inclusion looks like in action: Instant, transparent, and secure.”

The partnership will bring immediate access to PayPal users: funds will be transferred within moments, 24 hours a day, and will be ready to spend on bill payments, peer-to-peer transfers, cash out to their bank accounts or spend with the e& money card. Exchange rates will be fixed up-front, and fees disclosed in advance, ensuring transparency so customers avoid the surprise charges common in traditional payout channels.

For the UAE’s growing freelancers and digital creators community, instant withdrawals eliminate cash-flow bottlenecks and reduce dependence on costly third-party services. Everyday consumers will also be able to use their PayPal balances locally for shopping, bills or transfers, without waiting days for a bank-clearing cycle.

At the national level, this partnership will support the UAE’s financial inclusion agenda and accelerate the shift toward a cashless economy, aligning with the country’s digital economy strategy and its target for the digital economy to reach 19.4 percent of GDP by 2031.

Today’s announcement marks the first milestone in a broader roadmap. e& money and PayPal plan to co-invest in marketing and further product innovation to integrate global digital platforms even more seamlessly into everyday life in the UAE.

About e& money

e& money is the fintech arm of e& life and the first digital payment service regulated and licensed by the UAE Central Bank that has ushered in a new era of digital payments in the country. e& money is a financial super-app aimed at providing all UAE citizens and residents with safe, convenient and fast payment solutions through an easy-to-use mobile application designed for a seamless user experience.

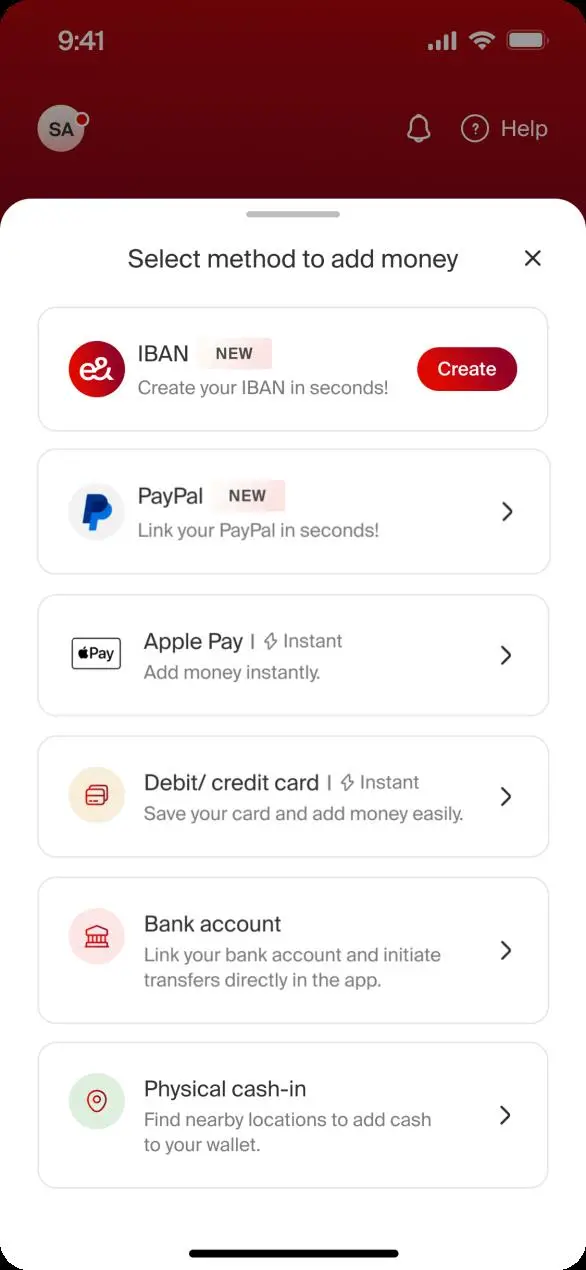

e& money caters to both the banked and unbanked segments of society, with the fastest registration and account opening journey in the UAE. Customers can easily fund their e& money accounts through various channels such as bank accounts, debit cards, agents and kiosks.

e& money is pushing the boundaries of product innovation and customer experience by offering a full range of fintech products in seamless and interconnected user journeys, including remittances, merchant payments, bill payments, card payments, investments, loans and insurance services available via smartphone applications for consumers.

To learn more about e& money, please visit https://www.eandmoney.com/.

About PayPal

PayPal has been revolutionizing commerce globally for more than 25 years. Creating innovative experiences that make moving money, selling, and shopping simple, personalized, and secure, PayPal empowers consumers and businesses in approximately 200 markets to join and thrive in the global economy. For more information, visit https://paypal.com, https://about.pypl.com, and https://investor.pypl.com/Opens in a new window.

Forward Looking Statements About PayPal

This announcement contains forward-looking statements about the timing, features, and anticipated benefits of PayPal World services. Forward looking statements may be identified by words such as “may,” “will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “continue,” “strategy,” “future,” “opportunity,” “plan,” “project,” “forecast,” and other similar expressions. Forward-looking statements involve risks and uncertainties which may cause actual results to differ materially from the statements made, and readers should not place undue reliance on such statements. Factors that could cause or contribute to such differences include, but are not limited to, our ability to timely enter into definitive agreements with wallet partners, the extent to which wallet partners use services offered by PayPal World, potential delays in the launch of PayPal World’s services, the reaction of competitors, inability of participants to obtain necessary regulatory approvals, and unanticipated difficulties in operationalizing PayPal World.

More information about these and other factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements can be found in PayPal Holdings, Inc.’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other filings with the Securities and Exchange Commission. All information in this announcement speaks only as of the date hereof. PayPal assumes no obligation to update any forward-looking statements contained herein.