Cryptocurrency Payment Apps Market Size

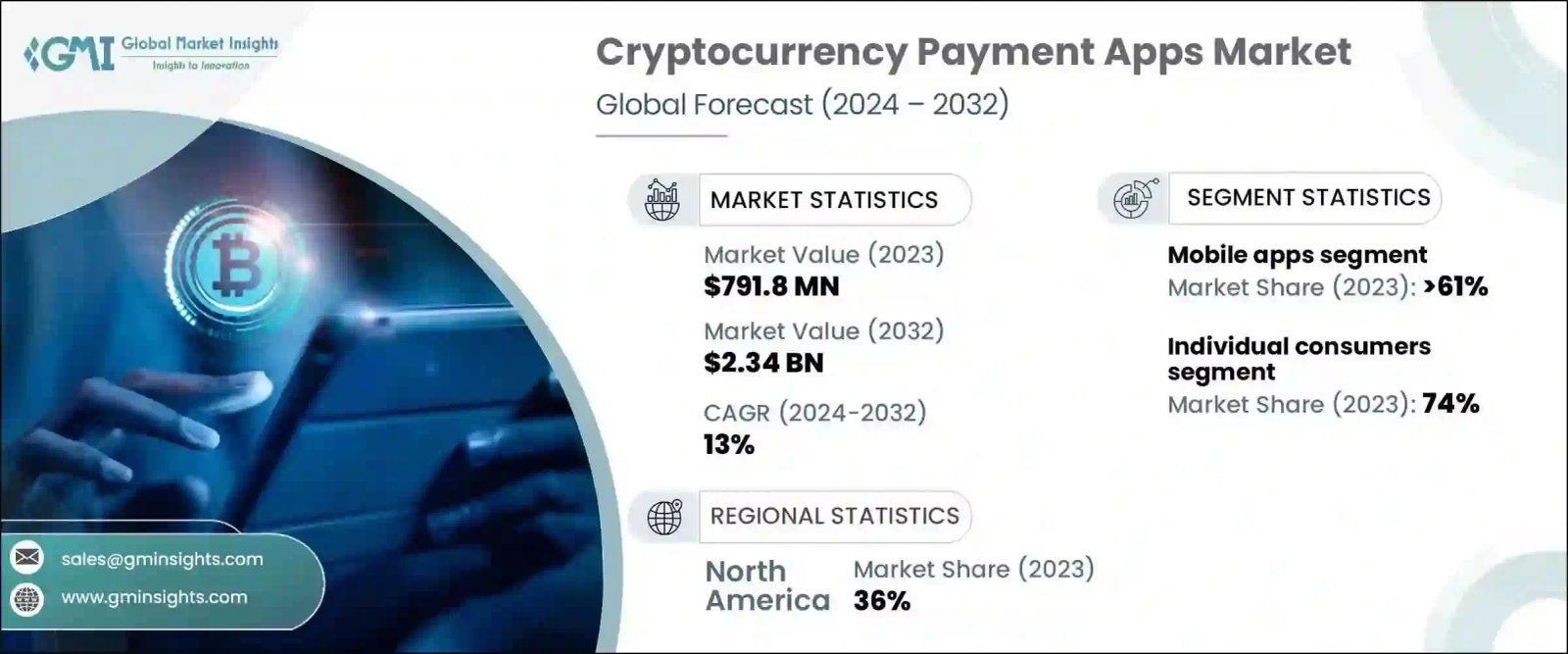

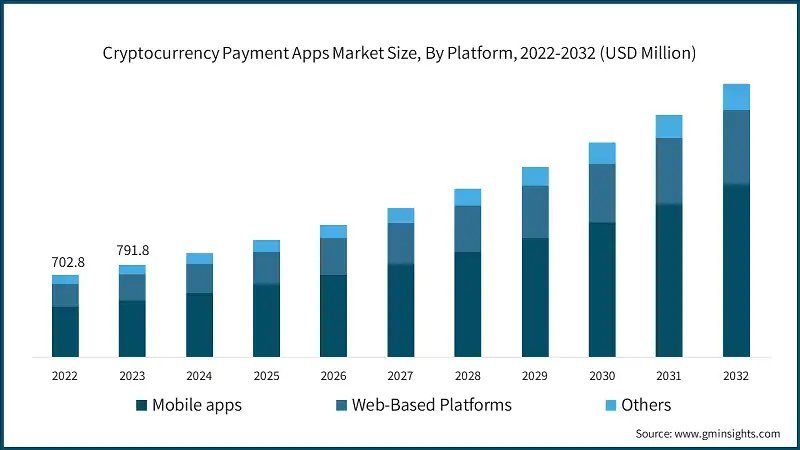

Cryptocurrency Payment Apps Market size was valued at USD 791.8 million in 2023 and is estimated to register a CAGR of around 13% between 2024 and 2032. The increasing adoption of digital currencies for everyday transactions is fueling market expansion. As more businesses and consumers embrace cryptocurrencies, demand for seamless payment solutions grows among its end users. Enhanced technology, such as improved user interfaces and integration with traditional financial systems, further drives this growth by making digital currency transactions more accessible and practical for a broader audience.

For instance, in July 2024, Ka.app introduced the Ka. Debit Card, a Visa-compatible card aimed at streamlining cryptocurrency usage for daily transactions. This new offering enables users in the European Economic Area (EEA) to effortlessly spend their crypto in euros for both in-store purchases and online shopping, enhancing the practicality of digital currencies in everyday financial activities.

| Report Attribute | Details |

|---|---|

| Base Year: | 2023 |

| Cryptocurrency Payment Apps Market Size in 2023: | USD 791.8 Million |

| Forecast Period: | 2024 to 2032 |

| Forecast Period 2024 to 2032 CAGR: | 13% |

| 2032 Value Projection: | USD 2.34 Billion |

| Historical Data for: | 2021 – 2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 300 |

| Segments covered: | Platform, Cryptocurrency, Functionality, Application, End User |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

Furthermore, the rise in financial inclusion and digital banking solutions is accelerating expansion in the sector. As more people gain access to smartphones and internet banking, they are increasingly able to use digital currencies. The proliferation of digital wallets and the integration of cryptocurrencies with traditional banking services further promote adoption. This increased accessibility enables a wider audience to participate in digital currency transactions, driving growth and enhancing the overall cryptocurrency payment apps market reach.

High transaction fees for certain digital currencies can be a significant barrier for users of cryptocurrency payment apps. Elevated fees can deter users from making frequent transactions, especially for smaller payments where the cost outweighs the benefit. This issue can limit the practical use of these currencies for everyday purchases and reduce overall user engagement. Additionally, high fees may drive users to seek alternative cryptocurrencies or payment solutions with lower costs, potentially impacting the adoption and growth of the affected currencies and undermining the effectiveness of these payment apps.

Cryptocurrency Payment Apps Market Trends

There is a growing focus on global expansion for digital currency payment solutions. Companies are increasingly targeting international markets by adapting their platforms to various currencies and regulatory requirements. This expansion aims to accommodate diverse user needs and enhance global accessibility, fostering broader adoption and integration of digital currencies across different regions and economies.

For instance, in June 2024, Strike, the Bitcoin payments app, officially launched its services in the United Kingdom as part of its global expansion strategy. This introduction offers UK users access to features such as buying, selling, sending, and withdrawing Bitcoin, along with utilizing the Lightning Network for expedited transactions. The app is tailored to meet local regulations and seeks to boost Bitcoin adoption in the UK, which is Europe’s second-largest economy and presents considerable growth opportunities.

Moreover, technological advancements in blockchain and security are significantly shaping the landscape. Enhanced blockchain protocols and robust security measures, such as advanced encryption and multi-signature authentication, are improving transaction speed and safety. These innovations are making digital currency transactions more secure and efficient, thereby increasing user confidence and driving adoption across various platforms and industries.

Cryptocurrency Payment Apps Market Analysis

Based on platform, the market is divided into mobile apps, web-based platforms, and others. In 2023, the mobile apps segment accounted for a market share of over 61%. These apps are increasingly adopting advanced security features, including biometric authentication and encryption, to bolster user safety. With mobile users placing a premium on secure transactions, these apps are implementing multi-layered protection methods to defend against fraud and unauthorized access. Such a strong emphasis on security is vital for cultivating user trust and promoting the broader acceptance of digital currency transactions on mobile platforms.

Moreover, mobile apps are embedding real-time transaction tracking and notifications, ensuring users receive immediate updates on their cryptocurrency activities. This enhancement not only boosts user experience but also offers heightened transparency and control over transactions. It empowers users to effectively monitor and manage their digital assets, staying promptly informed of any changes or potential concerns.

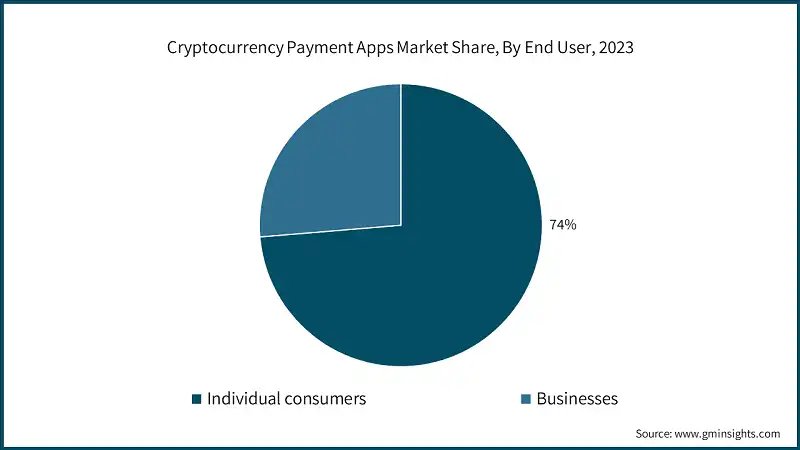

Based on end user, the cryptocurrency payment apps market is categorized into individual consumers, and businesses. The individual consumers segment accounted for around 74% of the market share in 2023. As cryptocurrencies gain traction in daily spending and investment, individual consumers are increasingly demanding user-friendly and seamless payment solutions. Mobile-first designs and simplified interfaces are now essential, allowing users to effortlessly buy, sell, and manage their digital assets.

Furthermore, consumers are increasingly drawn to integrated rewards within cryptocurrency payment applications. Features such as cashback, discounts, and loyalty programs linked to crypto transactions are on the rise. This trend highlights a desire for added benefits from digital currencies, enhancing their appeal for regular use and promoting wider adoption.

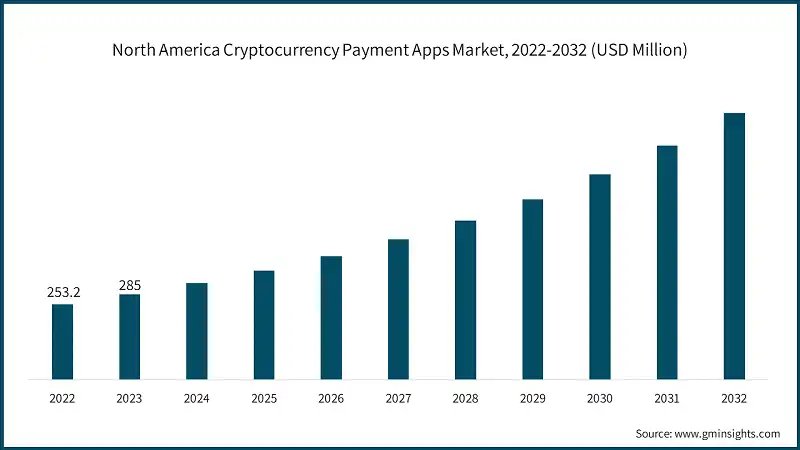

North America dominated the global cryptocurrency payment apps market, with a major share of around 36% in 2023. There is a growing focus on integrating cryptocurrency payment apps with traditional financial systems in the region. Financial institutions are increasingly partnering with crypto firms to offer seamless conversion between digital assets and fiat currencies. This integration enhances user experience and boosts adoption by providing more accessible and familiar ways to manage cryptocurrency transactions, fostering broader acceptance among both consumers and businesses.

In Europe, there is a significant push towards regulatory compliance and standardization for cryptocurrency payment apps. The adoption of stringent regulations, such as the Markets in Crypto-Assets (MiCA) framework, is shaping the industry by ensuring higher security and transparency. This regulatory environment is fostering trust among users and financial institutions, promoting the responsible growth and integration of crypto payment solutions across the region.

In Asia Pacific, there is a surge in the adoption of cryptocurrency payment apps driven by high mobile usage and technological innovation. Countries such as Japan and South Korea are leading the way with advanced digital infrastructure and supportive regulatory environments. This rapid adoption is fueled by the demand for efficient, borderless transactions and a growing interest in integrating digital currencies into everyday financial activities.

Cryptocurrency Payment Apps Market Share

Coinbase, Binance Pay, and Crypto.com hold a significant market share of 12% in 2023. Leading players such as Coinbase, Binance Pay, and Crypto.com are setting themselves apart with distinctive features and innovations. Coinbase prioritizes a user-friendly interface, complemented by a robust suite of trading and payment options. Binance Pay stands out with its extensive cryptocurrency support and competitive transaction fees. Meanwhile, Crypto.com boasts a holistic ecosystem, encompassing payments, staking, and DeFi services. This diverse array of offerings not only fuels competition but also propels technological advancements in the sector.

Through strategic partnerships and integrations, these companies are broadening their global reach. Coinbase is teaming up with financial institutions to bolster its payment infrastructure. Binance Pay’s integration with a myriad of merchants globally is paving the way for wider adoption. On the other hand, Crypto.com’s collaborations with international brands and sports entities are amplifying its visibility and acceptance. Such strategies play a pivotal role in enhancing market presence and boosting user engagement across diverse regions.

Cryptocurrency Payment Apps Market Companies

Major players operating in the cryptocurrency payment apps industry are:

- Coinbase

- BitPay

- Binance Pay

- Circle

- Crypto.com

- Wirex

- Worldline

Cryptocurrency Payment Apps Industry News

- In August 2024, Tezos, a decentralized blockchain platform, announced a partnership with the Oobit app to enhance global adoption of XTZ cryptocurrency payments. This collaboration is designed to simplify the process for users to send, receive, and trade Tezos (XTZ) tokens through Oobit’s user-friendly mobile app.

- In April 2024, Paycio launched a crypto payments app that simplifies transactions by allowing users to conduct them via mobile numbers. This innovative “first-of-its-kind” app significantly enhances the accessibility of cryptocurrency, enabling users to send and receive over 100 cryptocurrencies worldwide without the usual complexities associated with traditional crypto transfers.

The cryptocurrency payment apps market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($Mn) from 2021 to 2032, for the following segments:

Click here to Buy Section of this Report

Market, By Platform

- Mobile apps

- Web-Based Platforms

- Others

Market, By Cryptocurrency

- Bitcoin

- Ethereum

- Litecoin

- Ripple

- others

Market, By Functionality

- Peer-to-peer transfers

- Merchant payments

- Bill payments

- Others

Market, By Application

- E-commerce

- Retail

- Travel and Hospitality

- Gaming

- Others

Market, By End User

- Individual consumers

- Businesses

The above information is provided for the following regions and countries:

- North America

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Nordics

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- South Africa

- UAE

- Saudi Arabia

- Rest of MEA