In 2009, Bitcoin emerged as a niche experiment discussed mainly in cryptography forums. Fast forward to 2025, and we’re seeing crypto wallets in the hands of ride-hail drivers in Lagos, small business owners in Buenos Aires, and even grandparents in Ohio using stablecoins to hedge inflation. The landscape of cryptocurrency adoption has dramatically evolved, not just in scale but in character. It’s no longer just about investing; it’s about access, utility, and empowerment in a digital-first financial world. This article unpacks the countries driving that adoption, who’s holding what, and how governments and economies are responding.

Key Takeaways

- 1Global crypto adoption reached 12.4% of the internet-connected adult population in 2025.

- 2Stablecoin usage has grown globally by 21.7% in 2025, driven by inflation concerns and remittance demand.

- 3Mobile wallet installations linked to crypto platforms rose to 982 million globally in 2025, a 13.8% increase from the previous year.

- 4The top 5 countries by crypto exchange traffic are the U.S., India, Brazil, Russia, and Turkey.

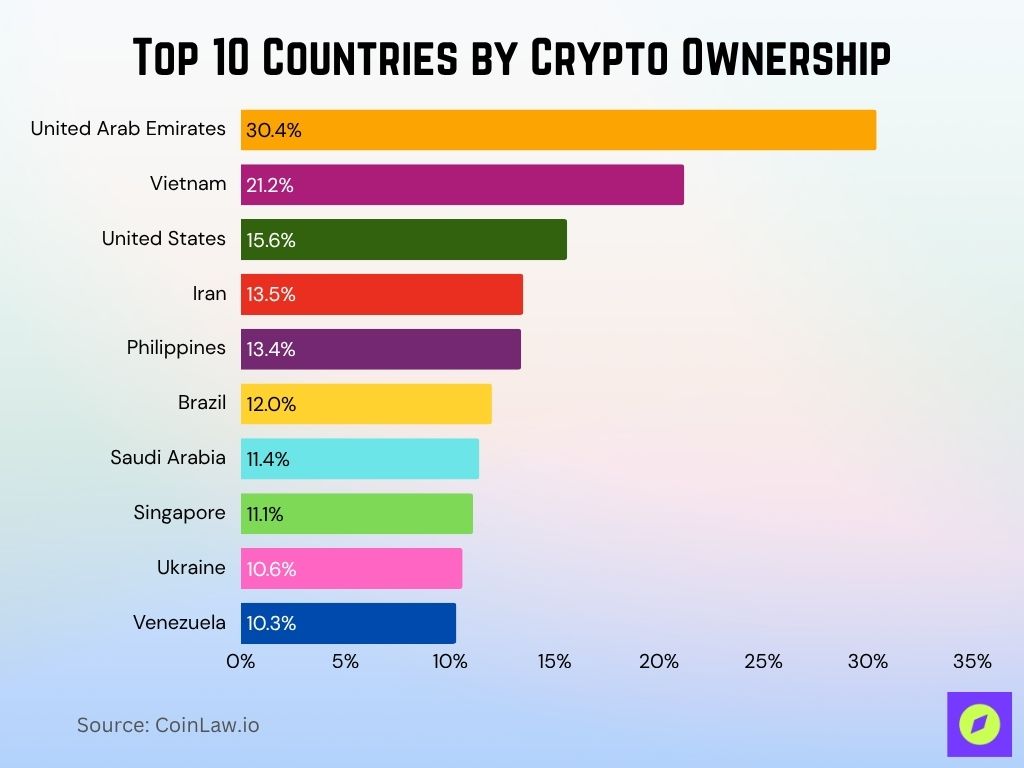

Top 10 Countries by Crypto Ownership

- The United Arab Emirates has the highest crypto ownership rate, with 30.4% of its population owning crypto, totaling around 3 million users.

- Vietnam comes second with 21.2% of its population involved in crypto, representing a sizable 21 million crypto owners.

- The United States ranks third by percentage (15.6%) but leads in total number with a massive 53 million crypto users.

- Iran shows a strong crypto presence with 13.5% of its population using digital assets, translating to 12 million individuals.

- In the Philippines, 13.4% of the population owns crypto, amounting to 16 million users, among the highest in Southeast Asia.

- Brazil has a 12.0% crypto adoption rate, equal to approximately 26 million users.

- Saudi Arabia holds a notable 11.4% adoption rate, contributing to 4 million crypto holders.

- Singapore boasts 11.1% crypto penetration, with 665,000 citizens actively participating in the digital asset economy.

- Ukraine sees 10.6% of its population engaged in crypto, equal to about 4 million people.

- Venezuela rounds out the list with 10.3% of citizens owning crypto, equivalent to 3 million users.

Global Overview of Cryptocurrency Adoption Rates

- The global crypto ownership rate in 2025 is 12.4%, showing continued steady adoption.

- Asia-Pacific leads regional ownership, with 6 out of the top 10 countries in terms of adoption rates located in this region.

- In Europe, crypto adoption grew to 8.9% in 2025, boosted by increased institutional access and clearer regulatory frameworks.

- Latin America recorded a sharp rise, with average national adoption increasing to 15.2%, primarily driven by inflation hedging.

- Africa saw the fastest relative growth in 2025, increasing crypto users by 19.4%, led by Nigeria, Kenya, and South Africa.

- The Middle East maintained strong momentum, with 11.3% of adults holding digital assets.

- Institutional investment accounted for 16.5% of global crypto transaction volume in 2025.

- Stablecoin dominance in transaction volume rose to 33.2%, signifying a shift from volatile assets to utility-based tokens.

- Blockchain-based remittances comprised 9.6% of global remittance flows in 2025.

- Cross-border B2B transactions using cryptocurrency accounted for 5.4% of global trade settlement value in 2025.

Regional Trends in Crypto Usage

- In North America, usage is primarily investment-driven, with 58.4% of holders using crypto as an asset class.

- In Latin America, 43.6% of users engage with crypto for daily spending or cross-border payments.

- Sub-Saharan Africa shows dominant mobile-based crypto usage, with 72.9% of transactions happening on smartphones.

- Western Europe has seen a rise in regulated custodial wallets, now accounting for 41.2% of total user accounts.

- In Eastern Europe, crypto usage is more mixed, with a 22.8% focus on international transfers due to regional instability.

- Southeast Asia has integrated crypto into gaming and freelance markets, with 29.3% of users earning income through blockchain platforms.

- Middle Eastern countries, like the UAE, report institutional-driven usage, with $7.1 billion in crypto AUM in 2025.

- Central Asia has experienced a 12.5% rise in mining-linked adoption, particularly in Kazakhstan and Uzbekistan.

- Australia and New Zealand report 10.8% ownership combined, driven by self-directed pension investments and Web3 startups.

- China remains restricted, but underground usage and offshore holdings contribute to an estimated 5.2% ownership rate.

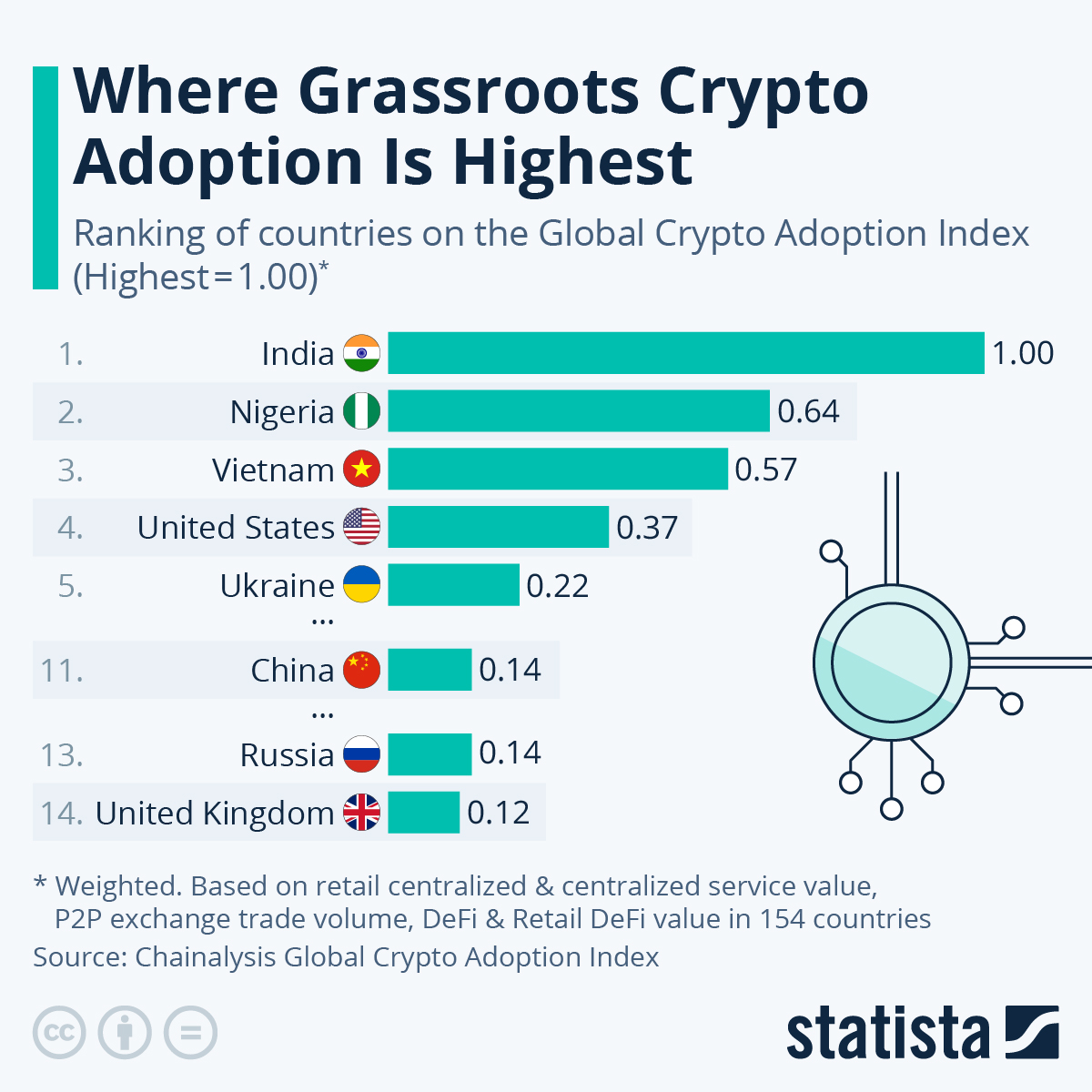

Global Grassroots Crypto Adoption Rankings

- India leads the Global Crypto Adoption Index with a perfect score of 1.00, showing the strongest grassroots adoption worldwide.

- Nigeria ranks second with an impressive index score of 0.64, reflecting high engagement in retail and P2P crypto use.

- Vietnam holds the third spot at 0.57, continuing its trend as a leading crypto-active nation in Southeast Asia.

- The United States is ranked fourth with a score of 0.37, showing strong DeFi and centralized exchange activity.

- Ukraine comes fifth at 0.22, despite ongoing economic and geopolitical challenges.

- China, while lower on the list, still records 0.14 (ranked 11th), indicating notable activity despite strict regulations.

- Russia is also at 0.14, showing similar adoption levels to China.

- The United Kingdom ranks 14th with a grassroots adoption score of 0.12, trailing behind major crypto economies.

Government Policies and Regulations by Country

- The United States maintains a patchwork framework, with 47 states having crypto-specific laws as of 2025, and the Digital Asset Regulation Modernization Act still pending federal approval.

- European Union countries implemented MiCA across all 27 member states, resulting in uniform licensing rules for exchanges and custodians.

- Japan enforces some of the strictest custody rules, requiring 100% asset segregation and monthly audits by licensed exchanges.

- El Salvador continues to lead with full legal tender status for Bitcoin, and 82% of small businesses accept BTC as of 2025.

- Nigeria’s central bank shifted to a regulatory sandbox model, resulting in the issuance of 19 new virtual asset licenses in the past year.

- India imposes a flat 30% tax on crypto gains, but the proposed 2025 Crypto Tax Review Bill may lower it to 15% for retail investors.

- Brazil’s central bank launched its digital real pilot in Q2 2025, now in use by 6.2 million test users.

- Turkey passed a crypto regulation act in March 2025, legalizing exchanges under the oversight of its Capital Markets Board.

- Singapore remains a global leader, requiring crypto exchanges to comply with PSA licensing and AML/CFT compliance under its 2024 revision.

- South Korea mandates real-name bank account integration for all exchanges, enforced by 19 domestic banks in 2025.

Cryptocurrency as a Payment Method: Country Comparisons

- El Salvador leads globally, with 82% of surveyed vendors accepting Bitcoin for payments.

- In Japan, more than 31,000 retailers accept crypto payments, including major convenience store chains and tech stores.

- Germany permits crypto for online purchases through over 26 fintech partnerships, representing 9.3% of all e-commerce checkouts in 2025.

- Philippines has over 1.1 million merchants integrated with crypto payment processors like Coins.ph and GCash crypto wallet.

- United States adoption is more fragmented; 17.4% of small and mid-sized businesses accept crypto, primarily stablecoins like USDC.

- Brazil experienced a 22.7% increase in crypto-enabled POS terminals in 2025, reaching over 92,000 installations.

- South Africa has seen a sharp rise in peer-to-peer payments, with 15.6% of mobile-based transactions using stablecoins.

- In UAE, luxury retail and hospitality sectors lead adoption, with 43% of 5-star hotels accepting crypto directly.

- Ukraine has implemented crypto-based payroll systems in over 800 tech startups, particularly for cross-border freelancers.

- Thailand restricts crypto payments for goods but allows them for travel and digital services, supported by licensed platforms.

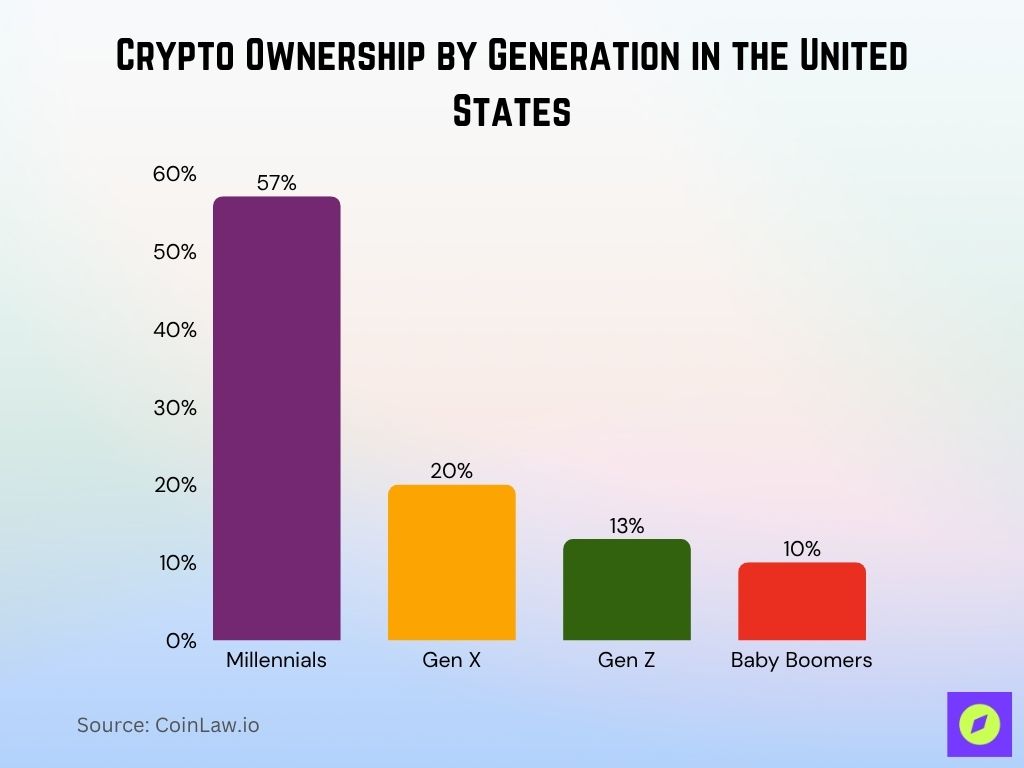

Crypto Ownership by Generation in the United States

- Millennials dominate the crypto space, accounting for 57% of all crypto owners in the U.S.

- Gen X makes up 20% of crypto holders, showing strong adoption among those in their 40s and 50s.

- Gen Z represents 13% of crypto users, highlighting growing interest among the younger digital-native crowd.

- Baby Boomers trail behind, holding just 10% of the crypto ownership share in the country.

Demographic Patterns of Crypto Users Across Nations

- Globally in 2025, the average crypto user is 34.6 years old, with a median portfolio size of $1,220.

- In the U.S., 26.5% of Gen Z adults own crypto, the fastest-growing age bracket since 2024.

- Latin America skews younger, with 61% of crypto users aged 18–34, often using it for remittances and P2P payments.

- In India, men still dominate ownership (78%), though female participation has risen to 22%.

- South Korea reports that high-income professionals aged 30–44 make up 53% of all crypto holders.

- Germany shows a broadening user base, with crypto ownership among the 55+ age group rising to 9.8% in 2025.

- Nigeria has the highest youth engagement, with 74% of holders under 30, largely driven by mobile-first platforms.

- Indonesia has a gender parity ratio of 46% female crypto users, the highest among Southeast Asian nations.

- In the UK, crypto use among freelancers and gig workers has grown 3.6x since 2022, now comprising 14.1% of users.

- Brazilian crypto users are 47% urban middle-class, with most concentrated in São Paulo and Rio de Janeiro metros.

Impact of Economic Conditions on Crypto Adoption

- In countries with inflation over 20%, crypto adoption is 2.7x higher on average than in stable economies.

- Argentina has the highest correlation, with crypto ownership at 29.4% amid annual inflation of 85% in 2025.

- Venezuela shows an estimated 16.3% of households using crypto for daily survival, often through USDT or BTC.

- In Turkey, ongoing Lira depreciation has pushed crypto trade volume up by 31.5% year over year.

- Egypt’s crypto activity increased 42.8% in 2025, triggered by prolonged currency devaluation and capital controls.

- Zimbabwe reports unofficial crypto transaction volumes equivalent to 6.2% of GDP, the highest per capita.

- In the U.S., crypto holdings surged during 2025’s Q1 recession dip, with 15.2 million new wallet activations.

- Lebanon, experiencing banking crises, has 19.8% of citizens using crypto wallets as their primary store of value.

- Pakistan saw crypto remittances rise 18.7%, particularly through Binance P2P, due to the rupee’s volatility.

- Ukraine reports $2.1 billion in crypto aid donations and DAOs supporting local defense and humanitarian initiatives.

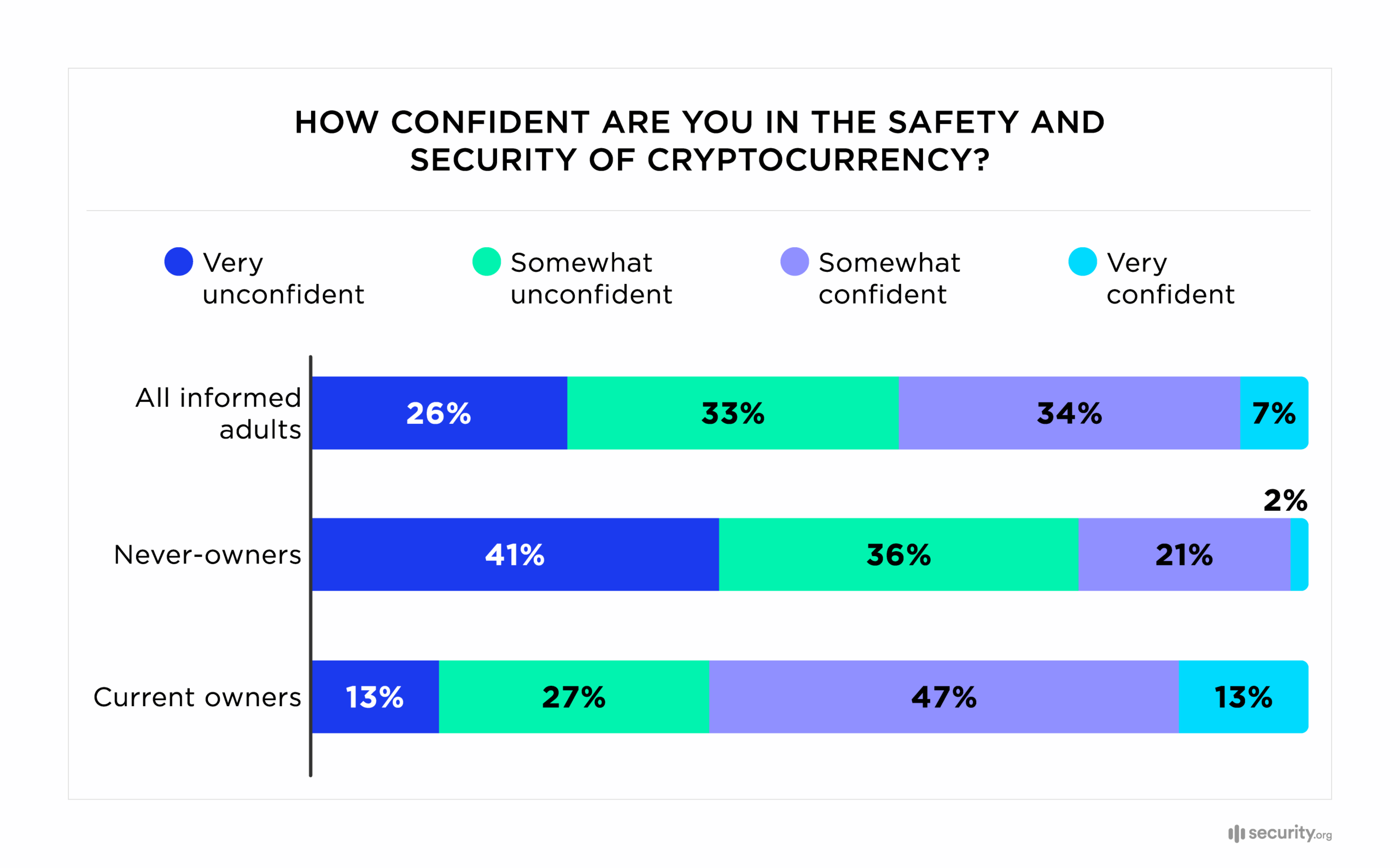

Confidence in Cryptocurrency Safety and Security

- Among all informed adults, 26% are very unconfident, 33% are somewhat unconfident, 34% feel somewhat confident, and only 7% are very confident.

- Among never-owners of crypto, skepticism is high: 41% are very unconfident, 36% are somewhat unconfident, with just 21% somewhat confident and a mere 2% very confident.

- In contrast, current crypto owners are far more optimistic: only 13% are very unconfident, 27% are somewhat unconfident, while 47% are somewhat confident, and 13% feel very confident.

Mobile Wallet and Exchange Usage by Country

- Global crypto wallet installations reached 982 million in 2025.

- Trust Wallet leads globally, with over 124 million active users across 93 countries.

- In India, WazirX and CoinDCX reported a combined user base of 56 million.

- Nigeria’s Binance Wallet usage surged to 28.1 million users, with a monthly growth of 4.2% in early 2025.

- Brazilian platform Mercado Bitcoin reached 19 million users, representing 33.5% of the country’s adult online population.

- U.S.-based Coinbase retains 43.7 million verified users, with 58% reporting active use in the past 60 days.

- Turkey’s Paribu app ranks among the top 5 most downloaded finance apps, with 7.6 million verified accounts.

- In Vietnam, VNDC Wallet crossed 10 million installations, supporting both crypto and local fiat deposits.

- South Korea’s Upbit commands 78% of the local market share with 12.3 million active traders.

- Kenya’s BitPesa Wallet is used by 5.9 million citizens, primarily for remittances and microtransactions.

Influence of Internet Penetration and Digital Literacy

- Countries with internet penetration over 85% show an average crypto adoption rate of 14.3%, compared to 6.7% in nations below 60%.

- South Korea, with 98.2% internet access, has a crypto usage rate of 12.8%, emphasizing the tech infrastructure’s role.

- Sweden reports 93.4% digital literacy and 11.1% crypto ownership, and most users interact through integrated fintech apps.

- Kenya, despite a lower internet penetration of 49.6%, shows high mobile-based adoption, with crypto usage at 13.4%, driven by mobile-first platforms.

- In the UAE, where 100% of adults have internet access, 9 out of 10 crypto users access platforms via smartphones.

- Vietnam, with improving digital infrastructure, achieved 79.3% internet penetration and 27.1% crypto ownership in 2025.

- Estonia, a pioneer in e-governance, boasts digital literacy above 90%, with 8.7% of its population engaged in blockchain-based transactions.

- India’s rising rural internet adoption (now at 51.5%) has catalyzed tier-2 and tier-3 city growth in crypto, with usage outside metros growing 33.1% year-over-year.

- Indonesia links its crypto education programs with rural broadband expansion, contributing to 13.6 million new wallets in 2025.

- Colombia’s national fintech program includes crypto literacy, leading to 10.2% of the adult population holding digital assets as of 2025.

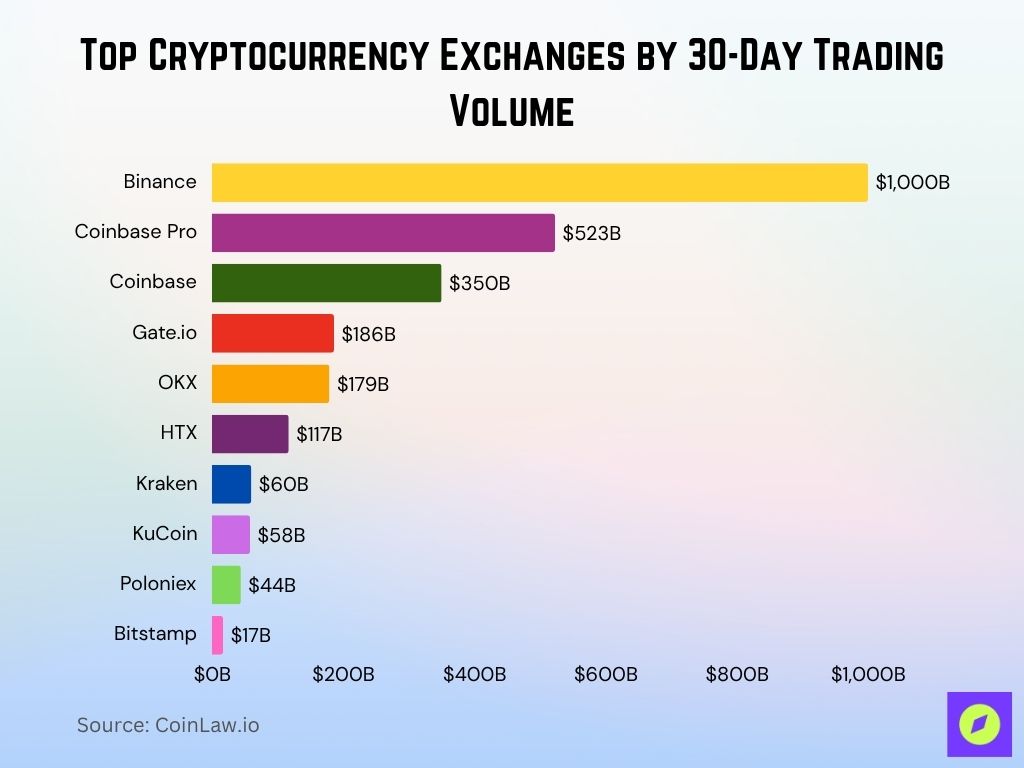

Top Cryptocurrency Exchanges by 30-Day Trading Volume

- Binance dominates the market with a massive $1,000B in 30-day trading volume, far ahead of all competitors.

- Coinbase Pro follows in second place with $523B, reflecting strong U.S.-based institutional trading activity.

- Coinbase (retail-focused) holds the third spot with $350B in trading volume.

- Gate.io ranks fourth, reporting $186B in monthly trading volume.

- OKX trails close behind at $179B, making it a strong Asia-based contender.

- HTX (formerly Huobi) clocks in at $117B, maintaining a solid presence in the market.

- Kraken, a U.S.-based exchange, records $60B in trading activity.

- KuCoin shows steady user engagement with $58B traded over 30 days.

- Poloniex, one of the older exchanges, reports $44B in volume.

- Bitstamp, a long-established European exchange, rounds out the list with $17B.

Notable Growth in Emerging Markets

- Philippines crypto ownership grew from 17.8% in 2024 to 22.5% in 2025, spurred by play-to-earn games and remittances.

- Pakistan added 5.4 million new crypto users in 2025, bringing its total to 18.2 million, driven by cross-border earnings and freelance payments.

- Peru’s adoption jumped by 40.6% in one year, thanks to stablecoin payment integrations in retail platforms.

- Tanzania has seen a 6.8x growth in DeFi activity since 2023, with wallets increasing from 120,000 to 820,000.

- Bangladesh now has 3.1 million verified crypto users, largely influenced by remittance alternatives through stablecoins.

- Ghana grew crypto users by 38.2% in 2025, with education efforts targeting students and young professionals.

- Uzbekistan, following new mining-friendly laws, saw wallets grow by 19.5%, now totaling 4.6 million.

- Morocco’s central bank sandbox resulted in 7 licensed crypto projects, pushing national adoption to 5.4% in 2025.

- Kazakhstan’s investment in mining infrastructure helped boost wallet usage by 23.1%, reaching 6.7 million users.

- Cambodia, via Bakong (its national digital wallet), began integrating crypto access, with 740,000 users holding hybrid wallets.

Countries with Declining or Slowing Adoption Rates

- China’s ongoing restrictions led to a crypto ownership rate drop to 5.2% in 2025.

- India’s aggressive taxation policies caused retail participation to slow, with wallet growth rising only 3.8% YoY.

- The United Kingdom saw a 2.6% decline in active crypto users in 2025, attributed to stricter KYC requirements and exchange delistings.

- Germany’s tightening of crypto staking regulation led to a 7.3% decline in DeFi-related wallet activity.

- In France, crypto transaction volume fell 14.2%, impacted by consumer confidence issues following local exchange failures.

- South Africa’s tightening capital gains policies have discouraged higher-income users, with new wallet signups slowing to 2.1% growth.

- Canada’s crypto ETF market shrinkage led to a 5.4% dip in institutional investor flows.

- Japan, despite steady regulation, recorded a 3.2% decline in retail trading volume due to stagnant platform innovation.

- Norway and Finland saw negligible wallet growth (<1.5%), with most users holding legacy coins and not engaging in DeFi or NFTs.

- Malaysia experienced stagnation, with active users plateauing around 2.8 million.

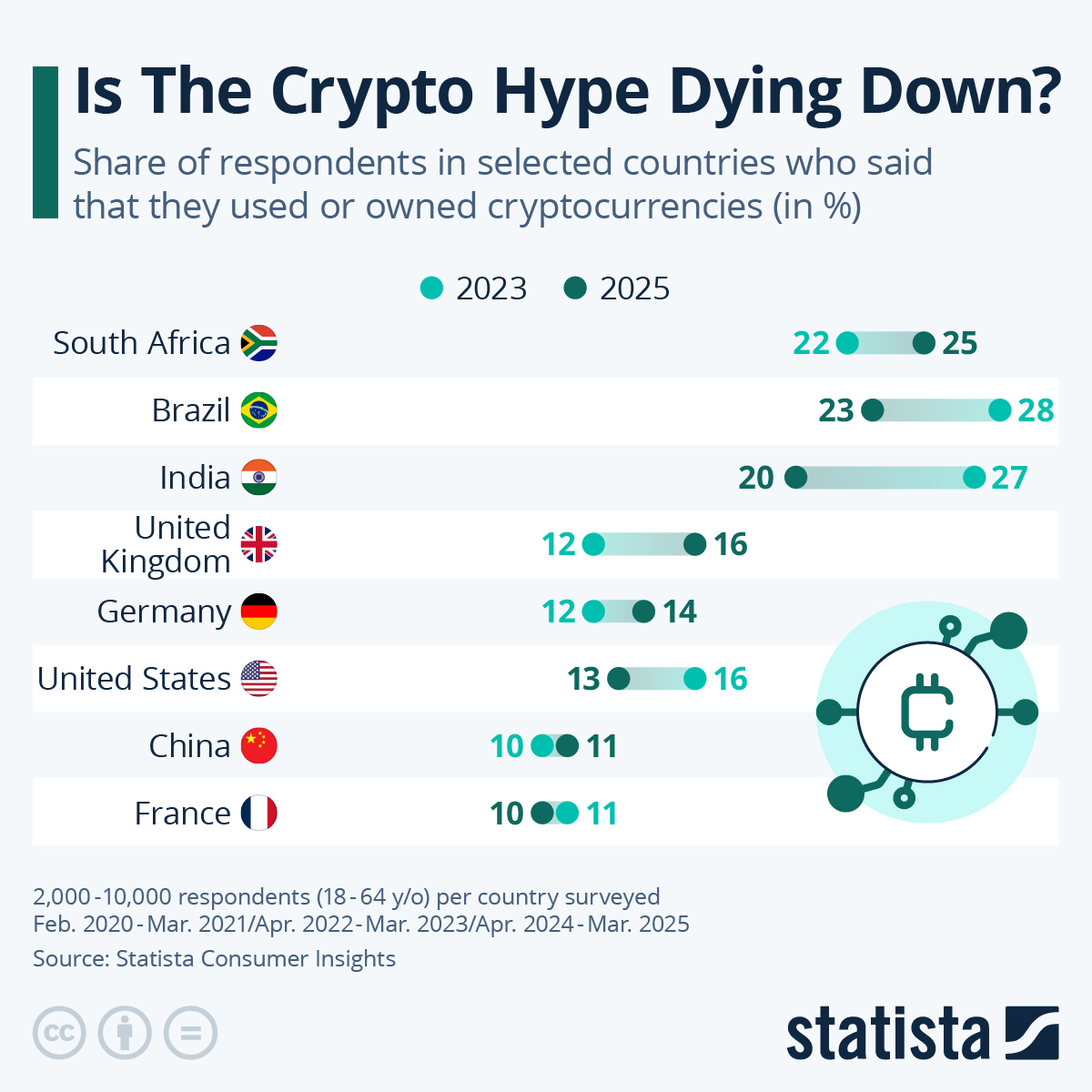

Is the Crypto Hype Dying Down?

- South Africa saw a modest rise in crypto usage from 22% in 2023 to 25% in 2025.

- Brazil shows continued enthusiasm, increasing from 23% to 28%, one of the largest jumps.

- India experienced significant growth, climbing from 20% in 2023 to 27% in 2025.

- United Kingdom crypto usage rose from 12% to 16%, signaling growing adoption.

- Germany moved from 12% in 2023 to 14% in 2025, a more modest increase.

- The United States showed a steady uptick from 13% to 16%, mirroring the UK’s pace.

- China and France both edged up slightly from 10% to 11%, indicating slower growth in crypto interest.

Recent Developments in Global Cryptocurrency Adoption

- 2025 marked the first year when stablecoins represented over 50.1% of global crypto transaction volume.

- The IMF issued new guidance in May 2025, encouraging member countries to create regulatory clarity for crypto exchanges and custodians.

- El Salvador launched its second Bitcoin-backed bond, raising $753 million, to fund national infrastructure and digital banking.

- Visa and Mastercard now support direct crypto payments in 43 countries, with USDC and EURe topping merchant usage.

- Binance resumed operations in Canada after reaching compliance with updated securities regulations.

- BlackRock’s digital asset division launched 3 tokenized ETF products, accessible to retail users in 7 countries.

- Ethereum’s Cancun upgrade, rolled out in Q1 2025, reduced average gas fees by 37.9%, reinvigorating retail interest in NFTs and gaming dApps.

- Ripple Labs expanded its On-Demand Liquidity service to 14 new corridors, powering $1.9 billion in remittance flows.

- Robinhood and PayPal extended their crypto services to 8 new European markets, triggering an average 17.6% increase in wallet downloads.

- Circle released its USDC wallet in Latin America, reaching 6.3 million users within the first two quarters.

Conclusion

The global crypto ecosystem in 2025 reflects a story of resilience, adaptation, and diversification. Emerging markets are no longer just catching up; they’re leading innovation in usage models, remittances, and mobile-first ecosystems. Meanwhile, mature economies are transitioning from hype to infrastructure, with increased institutional involvement and tighter regulatory guardrails. As macroeconomic challenges persist and digital transformation accelerates, cryptocurrency is cementing itself not just as an asset class but as an integral tool in daily commerce, savings, and international connectivity.

Disclaimer: The content published on CoinLaw is intended solely for informational and educational purposes. It does not constitute financial, legal, or investment advice, nor does it reflect the views or recommendations of CoinLaw regarding the buying, selling, or holding of any assets. All investments carry risk, and you should conduct your own research or consult with a qualified advisor before making any financial decisions. You use the information on this website entirely at your own risk.