The Chartered Institute of Bankers of Nigeria (CIBN) has said it will focus on artificial intelligence, digital currencies, and new operational frameworks at its 18th Annual Banking and Finance Conference in Abuja.

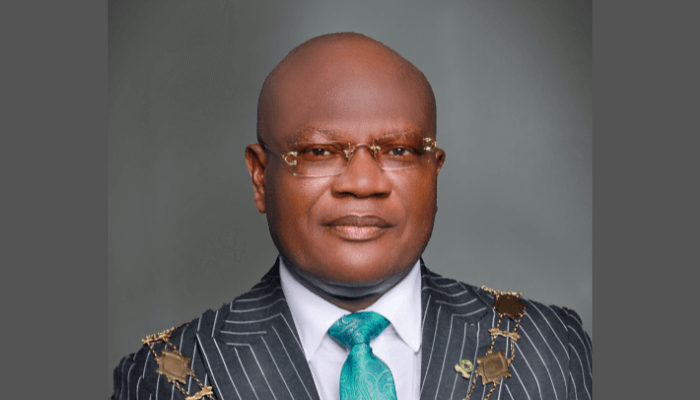

Pius Olanrewaju, President and Chairman of Council, CIBN who disclosed this in Lagos, said the flagship event, scheduled for September 9th to 10th in Abuja, expected to attract over 10,000 participants globally, would explore the intersection of banking, policy, and technology under the theme “The New Economic Playbook: The Intersection of Banking, Policy and Technology.”

“In line with our core mandate to consistently build the capacity of banking and finance professionals, the Institute is set to host the 18th annual Banking and Finance conference, reputed to be the largest gathering of banking and finance professionals in Africa.

Read also: Banking sector remains resilient amid economic headwinds – CIBN

“The previous edition was the most trending event globally that day, and with the support we have from regulators, supervisors, and partners, this year promises to be another grand occasion,” Olanrewaju said.

He added that the theme of this year’s conference is both timely and thought-provoking.

“The flagship event, which is hosted annually serves as a platform for all stakeholders in the banking and finance ecosystem, which includes policy makers, regulators, financial operators, academics, clients, and other interest groups to be informed and also to deliberate on critical developments within the sector and also the broader economy as a whole.”

Also speaking, Mariam Olusanya, Chair of the Consultative Committee and Group Managing Director of Guaranty Trust Holding Company PLC, said the conference would address the realities of digital currencies, AI-driven systems, embedded finance, and the need for new operational models amid geopolitical and economic shifts.

She said: “I am honored to welcome you today as we unveil plans for the 18th Annual Banking and Finance Conference with the theme, The New Economic Playbook: The Intersection of Banking, Policy and Technology, which captures the shifts in the financial services industry, now and in the future.

“The economic assumptions of the past continue to be challenged, so therefore there is a need for us to continuously create new operational frameworks.”

“We will convene the most respected voices in finance, technology, and policy to provide local, regional, and global perspectives.”

According to Olusanya, three business sessions will focus on Unlocking Nigeria’s Economic Potential, Adapting to Global Shocks, and Navigating the AI Revolution.

The CIBN added that the conference will seek to strengthen dialogue between policymakers, regulators and private sector leaders while inspiring actionable ideas for the financial services industry.