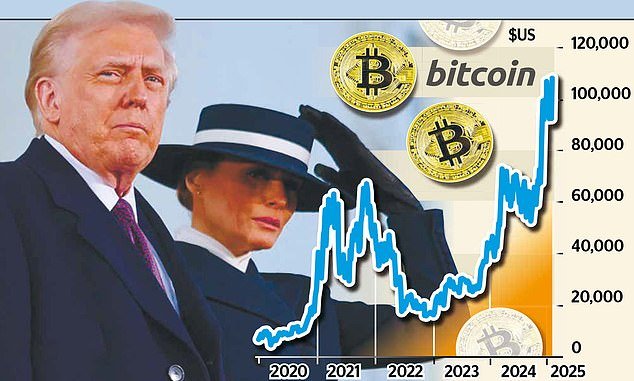

Bitcoin hit an all-time high yesterday as Donald Trump returned to the White House.

The crypto currency soared to a record $109,071 in the hours before his inauguration as the 47th US president.

Trump and his wife Melania also launched their own ‘meme coins’ in a move that was viewed as a further show of support for digital currencies. The value of the 200m $TRUMP coins in circulation soared to as high as £12billion before retreating.

The remaining 800m coins are due to be issued over the next three years. At their peak, the 1bn coins were theoretically worth a total of £60billion.

Meanwhile, the dollar fell sharply – sending the pound up more than 1 per cent to back above $1.23 – after an official said that Trump would not impose new trade tariffs on his first day in office.

He has pledged to add a 10 per cent levy to global imports, 60 per cent on Chinese goods and a 25 per cent import surcharge on Canadian and Mexican products.

Crypto rally: Bitcoin soared to a record $109,071 in the hours before Donald Trump’s inauguration as 47th US president

US markets were closed yesterday due to Martin Luther King Day, the fourth time the annual commemoration of the civil rights activist has coincided with a presidential inauguration. In London, the FTSE 100 index of blue-chip stocks closed at a record high of 8520.54.

Bitcoin has been turbocharged by Trump’s election victory after he promised to be a ‘crypto president’.

Despite an earlier anti-crypto stance, he became the first presidential candidate to accept digital assets as donations to his campaign. His family launched a crypto currency firm called World

Liberty Financial during the race for the White House. And he has unveiled plans to build a strategic bitcoin stockpile in the US, launch a crypto advisory council and remove regulatory roadblocks to bring the digital currency into the mainstream.

However, the plans are not set in stone and any wavering could see the price of bitcoin and other crypto currencies plunge.

‘As always, the devil will be in the detail,’ said Russ Mould, investment director at investment platform AJ Bell.

Kathleen Brooks, a research director at online broker XTB, said: ‘Any delay could trigger a steep sell-off in crypto which is famously volatile.’

Launched on Friday, Trump’s meme coin $TRUMP soared from less than £8 on Saturday morning to as high as £60.70 yesterday, to give it a value of £12billion before giving up some of its gains. The First Lady also launched her own coin,

$MELANIA, on Sunday that rallied in price to take its market cap to more than £1billion.

The inauguration triggered a ‘buying frenzy amongst crypto investors’, said Simon Peters, an analyst at trading platform eToro, adding: ‘Markets will now be looking to see how he goes about implementing his proposed pro-crypto policies.’

Mould said: ‘Pending more information on how Trump plans to achieve policy goals, certain investors have focused on the here and now, and that’s a world in which the new president embraces crypto currencies.

Bitcoin has gone bananas after Trump launched his own crypto currency.’

Susannah Streeter, head of money and markets at broker Hargreaves Lansdown, said: ‘There are expectations that crypto will be brought more into the financial mainstream, with clearer rules about how individuals and firms can trade such assets.

All these are high hopes, which just a few years ago looked “pie in the sky” but now appear much closer to reality, given how Trump has turned such a cheerleader for crypto.’

But she warned that ‘it’s still a highly volatile asset and has a history of dropping sharply after steep climbs’.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.