“Technology”

What comes to mind when you read that word? Phones? Laptops? Games consoles?

Today, we are perhaps two thirds of the way through the Digital Age. Beginning somewhere in the 1950s or 60s, with the widespread commercial application of computers, passing through the creation of the Internet, the PC, the World Wide Web, the smartphone, and now generative AI. With many other vital and world-changing inventions along the way. And a few more to come.

We are so deep in the Digital Age now, our lives so completely defined by it, that digital things colour our whole definition of technology.

We are so deep in the Digital Age now, our lives so completely defined by it, that digital things colour our whole definition of technology. It’s hard to see beyond them. But technology is much older than the transistor. And many technologies have arguably had an even greater impact.

Wheels and Bricks

The obvious example is the wheel. To our eyes now it looks so simple that it’s hard to think of it as technology. But so much goes into the creation of the wheel. The recognition that round things roll. The technique for shaping circular things, from carving them from a single piece of wood, to the complex combinations of different woods and iron of cart wheels, to modern alloys and tyres. The wheel spawned not just transport but most mechanical items in our lives, clocks, looms, printing presses.

What about the brick? Another simple technology that was foundational to the growth of cities. With cheap, mass-produced construction material, people could build more, and bigger, faster. No bricks? No cities. Or plant breeding? Without that, we couldn’t support our large population.

While most people are focused on the innovations coming in the last third of the Digital Age – quantum computing, artificial general intelligence (AGI), the metaverse – I think a lot of the smart money is looking beyond that. At the technologies that might be the foundation of the next age. Deep technologies that might themselves spawn many new applications. And there are a few obvious candidates.

New Materials

A few years ago I spent some time as the resident futurist at the National Graphene Institute in Manchester. What I saw there shocked me.

Most people have heard of graphene now: strong, flexible, light, thin, conductive. An incredible material, but perhaps one that most people have forgotten about again, after the initial hype. The problem with graphene is that it is hard to manufacture in large consistent sheets. And if there are flaws in the sheet, then it loses a lot of its most valuable properties. But just because we’re not making giant sheets of the stuff, doesn’t mean it isn’t finding applications. Graphene pops up in paints, batteries, race cars, sensors, tennis rackets and more.

I often tell people that the Digital Age has changed the way the world works, but the Materials Age will change the way the world looks.

But graphene wasn’t even the most exciting thing I saw at the NGI: it was the other 1,000-plus single-layer materials and composites that they were researching there.

This is why materials science is so exciting right now. Our understanding of the atomic – and sub-atomic – structure of materials has advanced to the point where we can discover, design and produce new materials with novel properties both mechanical and electrical.

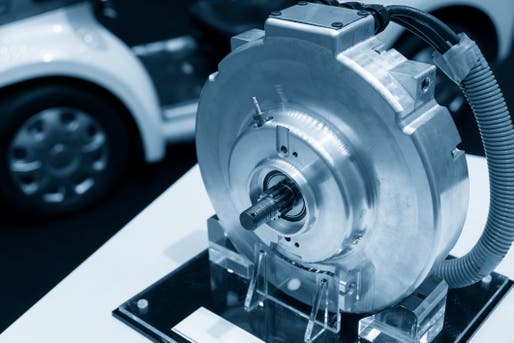

This research is happening all over the world. And it is finding a huge range of applications. Like magnets for EV motors that don’t need rare earth minerals. Or thermoelectric generators that efficiently convert heat to electricity.

As the example of graphene shows, it can take a long time to fully realise the value of materials science discoveries. Not least because once we have discovered or invented a material with incredible properties, there’s an equal challenge in learning how to manufacture it at scale. But when we can, the potential is incredible.

I often tell people that the Digital Age has changed the way the world works, but the Materials Age will change the way the world looks. If you’ve ever seen the cover of a science fiction novel, all improbably-shaped cities, fantastical space ships, and organic-looking robots, then that’s the scale of change The Materials Age might bring about.

Programmable Biology

It’s easy to underestimate the complexity of biology, and I will try not to fall into that trap here. There is still a huge amount we don’t know about the way that nature works, whether that’s inside our own bodies and brains, or in the infinite array of flora, fauna, bacteria and viruses with which we share the planet. But we’re getting to the point where we understand enough, and we have the tools, that biology becomes just another building block, another resource for our innovation.

Ten years ago now, I ran a small conference on the future. As part of it, we ran a workshop where a small group of businesspeople got to genetically engineer bacteria to make it glow in the dark. The materials required for this were no more sophisticated than you might find in a high school science class. In fact, 90% of what you need would be found in a primary school art class. No expertise was required from the participants.

Fast forward ten years and our further understanding of genetics combined with tools like the CRISPR family of gene editors, means that we can see the day when we can treat DNA and RNA as just another programming medium. Where we can write code (or tell our AIs to write it for us) that translates into changes to biological behaviour – or even entirely new forms of life.

Now this is clearly a technology – like every other – that has risks. You don’t get pottery wheels without war chariots, and you don’t open up the possibilities of programmable biology without also offering a terrifying array of biological warfare to users with limited understanding. If you want to get a sense of how difficult controlling this technology might be, just look at the robotic warfare being waged between Russia and Ukraine using low-cost devices that would have been science fiction just a couple of decades ago.

Nonetheless, the positive potential of this technology is nearly limitless. Curing disease. Capturing carbon. Feeding the world. Perhaps even ending ageing. This is a technology that tackles the big problems of our age.

From an investment perspective, picking out future individual winners can be one of the most exciting and rewarding processes – but it’s also the most risky, especially if not in an area of your expertise. So when trying to get ahead of the curve or branch outside your usual focuses – whether that’s for future exponential growth sectors or current technology trends – looking at funds or trusts might be the better play. Having industry experts manage where the money goes can give a broader chance of success, while the alternative is to find the common factor which links all those potential future alternatives – like energy production, perhaps.

Karl Matchett, The Independent’s Business and Money Editor

Patience Required

There are other candidates for world-transforming tech too. Like energy. While fusion has been long promised it does look like serious progress is being made towards viable generation. Even fission looks to be back on the agenda, with lots of innovative reactor designs around. But all of these technologies share similar problems from an investment perspective: risk, uncertainty and time to reward.

One thing you learn as a futurist is that seeing what is going to happen is often quite straightforward. I’m confident that fusion power, sheet graphene, and rare-earth-free magnets will all one day be viable, scalable technologies. But when will that happen? That’s much harder to say.

The when is not about whether the technologies are useful or valuable. It’s about finding the investment to bring them to market and overcoming the engineering challenges of production. It’s about policy and regulation, and the scale of the competitive moat of legacy technologies and companies.

But at this point in the Digital Age, there is a force to mitigate these risks and accelerate returns: AI. A June 2025 report from McKinsey estimated that “the top end of the ranges of throughput acceleration ranges from 75 percent for chemicals R&D to more than 100 percent for pharmaceutical discovery.” In other words, AI can double the speed of some innovation processes, by acting as research assistant, modelling platform, and analysis tool.

Clients of mine in other industries have backed up this story of acceleration, sometimes with even more dramatic figures. Computing has always been an accelerator of business capability. AI, its latest iteration, offers incredible innovative power.

Time to Invest?

The counterpoint to the risks and delays inherent in investment into deep tech is the scale of the possible returns. Imagine having a share in the wheel, or the first wheel makers. Wouldn’t that have been quite the investment?

You might still need a degree of patience, and an acceptance of a high failure rate. Lots of deep tech start-ups might be too early to market, unable to overcome the engineering challenges or the competitive barriers within their runway. But it feels like there are some big success stories on the near horizon.

If you’re looking at your next tech investment, maybe think beyond AI, beyond quantum computing, beyond the Digital Age, and take a look at what’s next. If nothing else, you might get an early sight of the future. And it might look very different from today.

Build wealth tax-free with the T212 Stocks ISA

Invest with 0 commission and 0 account fees. Make the most of your £20,000 2025/26 ISA allowance and put every pound to work. When you invest, capital is at risk. Other fees may apply.