The Bank of Japan is one of the latest institutions to make public its plans to experiment on how to operate its own digital currency, joining an expanding club of central banks, concerned with the rapid pace of private-sector innovation in the field of payments. Among its members, the club counts the central banks of Canada, Eurozone, Japan, Sweden, Switzerland, United Kingdom and United States. China is well ahead in this journey, having planned for a Central Bank Digital Currency (“CBDC”) since 2014.

The Digital Currency/Electronic Payment (“DCEP”) experiment of the People Bank of China provide some clues of what a CBDC may look like.

In its current incarnation, China’s central bank is responsible for issuing and distributing the digital yuan to commercial banks. Commercial banks will then distribute the digital money to end users.

Is DCEP really cash? Similar to M0 (banknotes and coins), DCEP is non-interest bearable, fully backed by the central bank and essentially a central bank liability. So far so good? Not really, a claim on an intermediary, albeit tightly controlled and regulated (and in the case of China, owned by the state), is not technically as strong as a claim on the central bank itself.

Risk managers describe this as counterparty credit risk, the risk, for example, that the intermediary defaults, having failed to maintain sufficient reserves at the central bank.

Like M0, DCEP can be exchanged off-line, but with some limitations and risks, fraud, for example, perpetrated by spending the same coins prior to updating the central ledgers.

There the similarity ends: unlike cash, DCEP transactions are not completely anonymous. Traders are not publicly disclosed but the banks that distribute the currency can track trading information. This makes DCEP an instrument more akin to mainstream electronic payment methods – for example debit cards or bank transfers – where the onus of ensuring compliance with rules and regulations is delegated to intermediaries. Even this parallel is short-lived: DCEP differs fundamentally from any type of money that mankind has ever seen, as the central bank retains full access to trade information. Distributed ledgers, the technology at the heart of DCEP, support complex data access control paradigms. A node owned by the regulator, for example, can be appointed as a primus inter pares, with the right to access information otherwise private. Distributed ledger is not synonym of crypto or blockchain as CDBC ledgers will be controlled and permissioned by the authorities – as opposed to a blockchain that is controlled by the rules built into the algorithm that powers it.

Furthermore, DCEP gives the Chinese central bank the ability to transmit its monetary policy decisions to the real economy directly – something that physical cash cannot achieve.

Andrew Haldane, chief economist and member of the monetary policy committee of the Bank of England (BoE), praised this feature in a recent speech:

“On the monetary policy side, one of the most pressing issues for monetary policymakers today is the zero (or close to zero) lower bound (ZLB) on interest rates. At root, the ZLB arises from a technological constraint on the ability to pay or receive interest on physical cash, whether positive or negative. In principle, a widely-used digital currency could mitigate, if not eliminate, that technological constraint by enabling interest rates to be levied on retail monetary assets.”

“Technological constraints” is interesting wording chosen to criticise cash, an instrument that in its current paper form is over 1000 years old and, as a social construct, is probably as old as human societies. Unlike Europe, the UK have yet to experience negative rates but data show that individuals clearly understand the risk and consequences of negative rates and that cash is not just useful for payments.

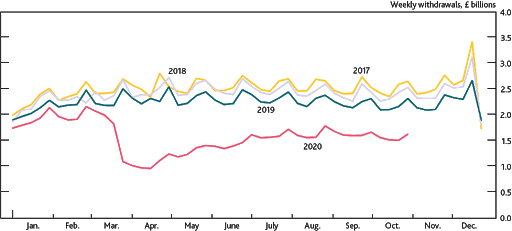

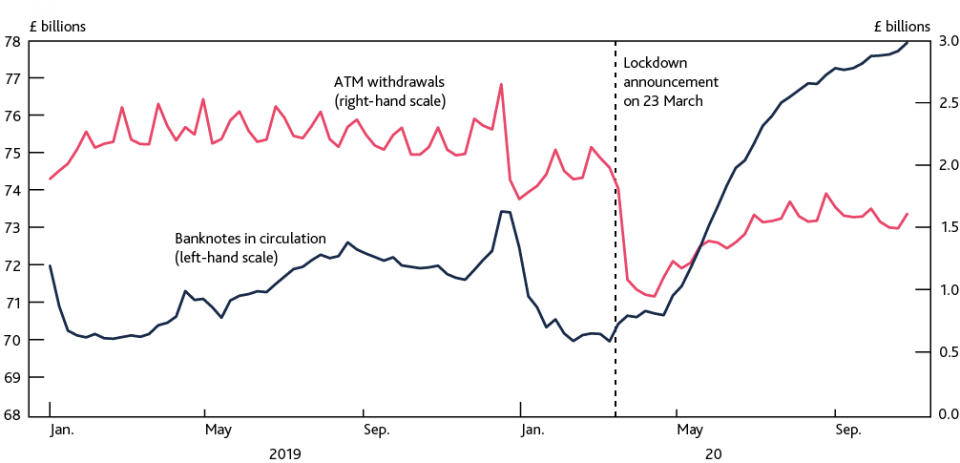

The chart above shows weekly ATM withdrawals in 2020 compared to the statistics of the previous three years, a proxy measure of cash payments. The current pandemic exacerbated a trend that already saw cash role in the UK payment system declining. Reduced spending overall explains well the sharp fall in the use of cash, but the recent growth in the demand for banknotes is there to remind us of the role of cash as a store of value. The chart below shows the sharp increase of banknotes in circulation since the first lock-down was announced at the end of March.

Will the digital Renminbi or any other “general purpose” CBDC that central bankers are designing in line with its blueprint represent a good store of value for the public? In other words, would have people (and corporates) amassed digital Pounds or Euro knowing well that central banks would have slashed their holdings to collect negative interest rates?

Banknotes provide no yield, but they do not evaporate overtime. People increasingly choose electronic payments methods for their convenience and lower cost compared to cash. Holding and handling cash has a cost which gives a good measure for the lower bound on interest rates, the bound that central banks are keen to remove.

Wholesale CBDCs are a totally different breed of instruments: they represent a liability of the central bank that is accessible only to regulated intermediaries. Project Helvetia demonstrated the characteristics of different approaches in the design of a wholesale CBDC:

- issuing a wholesale CBDC onto a distributed digital asset platform; and

- linking the digital asset platform to the existing wholesale payment system.

Both avenues conceptually allow settlement among intermediaries of (tokenised) assets in central bank money. The purpose of wholesale CBDCs is to better manage counterparty credit risk rather than provide a durable store of value.

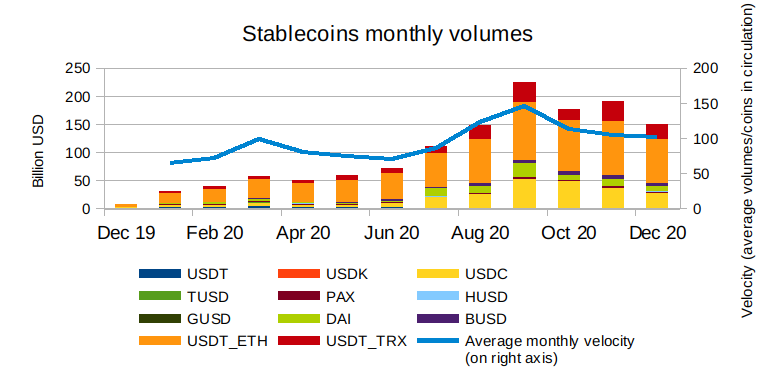

Will foreign and Chinese tourists use the digital Renminbi at the 2022 Winter Olympic Games in Beijing? Probably yes, as the support of the Chinese authorities for the project is strong, as is their power to enforce it. But will people around the world increasingly adopt stablecoins as an efficient alternative to cash? Most definitely yes. The chart below shows daily volumes of stablecoins pegged to the US dollar.

Data paint an impressive picture: hundreds of billion of digital dollars are exchanged every month and the circulation of this new cash, measured as the ratio of volumes transacted over the stock in circulation, is impressive and accelerating – about 50 for the past 12 months and well above 100, if measured on a monthly average.

If these figures do not look impressive enough, it should be noted that the these data refers to blockchain transaction only, but true transaction volumes are likely to be far greater, as stablecoin intermediaries settle internal client transactions on their ledgers. Volumes could be 20 to 30 times greater, if data reported by intermediaries is to be believed.

Perhaps, 2021 will see experiments intensify in the field of general purpose CBDC, but what governments and markets should really focus on are wholesale CDBC and stablecoins, to complement and strengthen domestic and global payment systems.

Francesco Roda, CRO of Koine, an institutional post-trade service provider for digital assets. For further information please visit https://www.koine.com

Crypto AM: Technically Speaking in association with Zumo