Earlier this week, famed investor Paul Tudor Jones shocked investors as he made that case that inflation is only going to get worse. He says that’s the only way out of the debt situation we’ve let our politicians get us into. And he says the only way to hedge against the risk is by owning hard assets. When he says that, he’s talking about things like real estate and commodities.

But after 20 years of tech-driven profits, many investors aren’t even sure what a commodity is anymore. So today I want to answer the question, “What are commodities?” and give you a list of my favorites for profiting from what’s to come. But first, let’s talk a little about what Mr. Jones had to say and why you should care…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no comission.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox

daily.

Who’s Paul Jones?

When it comes to insiders, Paul Tudor Jones could be considered the insider’s insider. He’s supported both Republican and Democrat politicians such as Mitt Romney, John McCain, and Barack Obama. He even hosted a fundraiser at his home for Obama back in 2008.

Jones got his start back in the 1970s trading cotton futures on the New York Cotton Exchange. He actually served as both treasurer and chairman later in his life. Jones was also instrumental in the creation of FINEX, the financial futures segment of the New York Board of Trade, where he helped to develop their U.S. dollar index futures contracts.

Later, Jones became a commodities broker for E.F. Hutton & Co. before founding his own firm, Tudor Investment Corporation. That firm gained fame and fortune when Jones predicted the 1987 Black Monday stock market crash.

His bet against the market earned his clients 125.9%, even after fees worth an estimated $100 million! The next time Jones smelled disaster in the markets was in 1990 in Japan. He saw an equity bubble ready to burst, bet against it, and returned 87.4% to his clients by shorting the market.

The Wall Street Journal once called him, “the most-watched, most-talked-about man on Wall Street.” Reuters calls him “one of the giants.” He’s in the Hedge Fund Manager Hall of Fame (I didn’t even know there was such a thing).

Suffice to say that this guy has seen a lot and done a lot and knows a few things and a few people. So when he says that we’re facing a tough time ahead, you should probably listen. Because he knows better than most…

“All Roads Lead to Inflation”

And right now Mr. Jones says that all roads forward lead to inflation. He says that the government’s debt burden has gotten to the point where they only have a couple of options. They can fail to pay it and go bankrupt. And they cut spending and raise taxes and pay off the debt. But that’s not likely. Nobody’s even talking about it.

Or they can use inflation to make the debt go away. It sounds counterintuitive, but it makes sense… for everyone but the poor people who will be hurt the most. You see, a government can intentionally generate increasing inflation in order to reduce the value of its debt.

The way this works is that inflation eats away at the purchasing power of a currency — in this case, the U.S. dollar. And as inflation rises, the nominal value of the debt stays the same while the real value of the debt decreases. Inflation erodes the value of the debt by decreasing the power of the currency used to repay it.

So governments can pay their debt back with currency that’s worth less than it was when the debt is issued. And that’s what Paul Tudor Jones is worried about. He’s pretty sure that’s the plan. We’re going to keep spending and keep selling debt on the market to fund it. And that’s going to drive up inflation and weaken the dollar so those debts are easier to pay back.

But that’s going to crush anyone who doesn’t own assets. Because asset prices are going to go through the roof. And that’s why Jones is warning investors. That’s also why he’s imploring folks to get exposure to hard assets like real estate and commodities.

And that’s why it’s so important you know how to answer the question…

What Are Commodities?

The simplest way to define commodities is as the raw materials used to manufacture consumer products. They’re the things we use to make the things we use. They’re basic resources that are essentially uniform across producers. And they’re going to be very important for investors over the coming years…

Now, I’d call all commodities “hard assets,” but they’re described as both hard and soft. Hard commodities are things we extract from the earth. Think metals, ores, and petroleum. And soft commodities are things we grow. These are agricultural products like wheat, cotton, coffee, sugar, and soybeans.

They’re typically priced in U.S. dollars. And they’re traded on public exchanges in the form of futures contracts, making them easy for investors to access. They’re also often produced by publicly traded companies, so investors have a lot of choices of how to get exposure.

Why You Need to Own Commodities

But why are they so important if inflation is about to (be allowed to) rip higher? Well, part of that is because of the currency they’re priced in. If the U.S. dollar loses purchasing power due to inflation, it will take more dollars to buy those commodities.

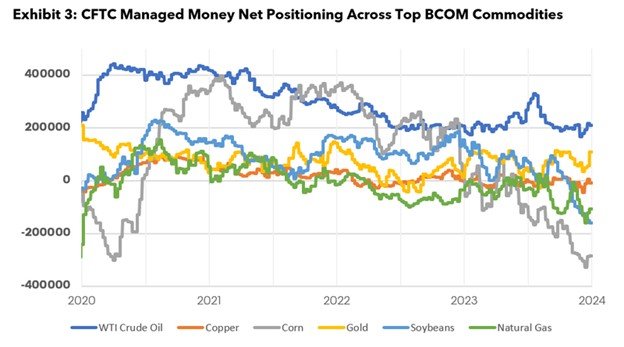

So investors who own those hard assets will have inflation protection built in as the commodity prices rise along with the rate of inflation. But currently, allocations to commodities are at historic lows as investors position themselves for a soft landing.

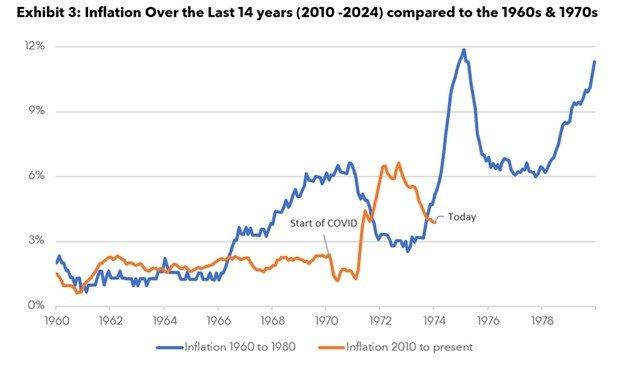

That’s not going to be a pretty picture if the Fed fails to stop inflation as it has failed to do in the past. In fact, if we chart our current situation against that of the 1970s, we see that things could get a whole lot worse if we get another spike of inflation. We also see that’s a very likely possibility.

What Commodities Should You Own?

But there are a ton of commodities out there. How do yo know which ones you should own? Well, I can tell you that in the 1970s, the top four asset classes were gold and silver, real estate, energy, and infrastructure.

Now gold and silver are both commodities and both assets you should be invested in. But they’re not the only ones. When it comes to energy commodities, you’ve got your choice of oil and natural gas, coal, uranium, even lithium. Right now fossil fuel producers are priced as if we’ll never need their commodities again. That could present an opportunity.

Our infrastructure is in pretty dismal shape too. We need lots of copper and aluminum to build out our electrical grid. We also need lots of cement and bitumen to repair our highways and bridges. We need chemicals to process our hard commodities.

And even when prices are high, people still have to eat, so those agricultural commodities aren’t likely to go out of style. So I’d say that you need to at least have some exposure to silver and gold, fossil fuels, copper, agricultural products, and maybe some uranium and lithium, too.

It’s a long list, but my colleagues and I are here to help you find the top uranium stocks, the best lithium plays, the best gold miners, and all the other top commodities for the coming supercycle.

So keep coming back to Wealth Daily and keep your eyes out for our articles. We’ve got a whole lot more coming your way.