United States President Donald Trump on Monday extended his trade truce with China for another three months until November 10, pausing the triple-digit import duties that the two countries would have levied on each other’s goods.

Trump’s move — “to continue the suspension” of the prohibitive 145% tariff on Chinese goods and keep it at 30% following an earlier executive order dated May 12 — comes in the wake of Beijing’s strong response with retaliatory measures of its own.

That included not just imposing a 125% tariff on US shipments (since lowered to 10%), but also curbing exports of rare-earth metals and magnets, impacting American auto, aerospace, defence, and semiconductor manufacturers.

However, it isn’t just the choking of the supply of critical minerals that China has used as a leveraging tool to bring Trump to the negotiating table. In its ongoing, albeit temporarily halted, trade war with the US, China has also employed a ‘trump card’ in the form of agricultural imports.

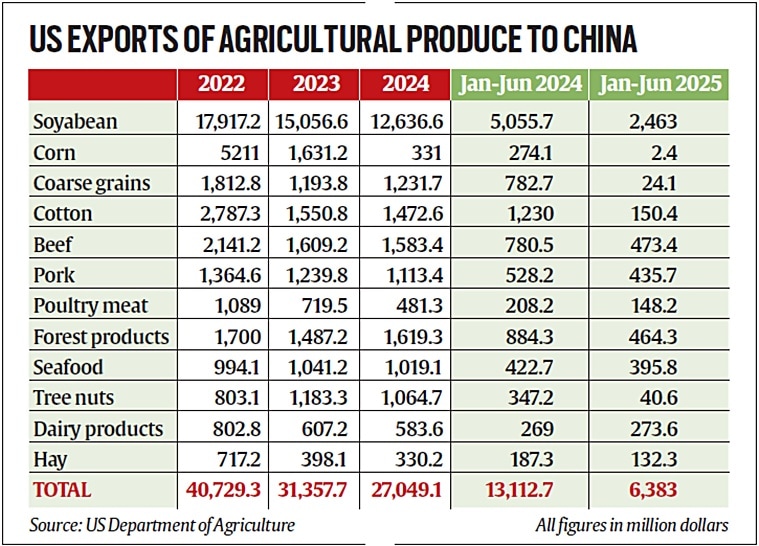

The accompanying table shows that the exports of US farm produce to China have more than halved, from $13.1 billion during January-June 2024 to $6.4 billion in the first six months of 2025. It comes on top of declines in the last two years, and is a far cry from the peak of $40.7 billion scaled in 2022.

Hitting where it hurts

The fall in agricultural imports has been led by soyabean, with China importing hardly $2.5 billion worth of the leguminous oilseed from the US in January-June 2025, as against over $17.9 billion in 2022.

That explains why Trump, in a post on his Truth Social platform on Monday, urged China to “quickly quadruple” its soyabean imports from the US. He wrote, “Our great farmers produce the most robust soybeans…Rapid service will be provided. Thank you President Xi [Jinping]”.

Story continues below this ad

Soyabean apart, China has massively reduced its purchases of US corn (maize), coarse grains (mainly sorghum and barley), cotton, beef, pork, poultry meat, and even forest products and tree nuts such as almonds, pistachios and walnuts.

China is a huge importer of agri-commodities. Till two years ago, it was the world’s biggest buyer of soyabean, rapeseed, wheat, barley, sorghum, oats and cotton, and No. 2 for corn (after Mexico) and palm oil (after India).

A lot of these imports — 105 million tonnes (mt) of soyabean, 14.2 mt of barley, 13.8 mt of corn, 11.2 mt of wheat and 8.7 mt of sorghum in 2024 — went to meet the protein and energy requirements of its humungous swine herd and poultry flock.

In 2024, China imported 74.7 mt of soyabean from Brazil and only 22.1 mt from the US. By sourcing more from Brazil, Argentina, Canada, Paraguay and other countries, it is hurting the interest of farmers in the US “corn belt” states stretching from Ohio, Indiana, Illinois, Iowa, Minnesota, Wisconsin and Missouri to North and South Dakota, Nebraska and Kansas. In addition, there are the beef farmers in Texas and Oklahoma, and the tree nut growers in California, Oregon, New Mexico, and Georgia, who stand to lose from a trade war with China.

Story continues below this ad

Simply put, China is not only leveraging its control over the global rare-earth elements market — from mining and refining to exports — but also its power as an agri-commodities importer to push Trump to continue “productive discussions” with Beijing “to resolve trade disputes and strengthen economic ties”.

Contrast with India

While US exports of farm produce to China have plunged by 51.3% in January-June 2025 over January-June 2024, that to India have soared 49.1% for the same period.

As reported in this newspaper, agricultural trade between India and the US has actually been booming.

Based on shipment value trends so far, both exports from the US to India and that from India to the US are set to top $3.5 billion and $7.5 billion respectively. India has, in fact, overtaken China to emerge as the biggest market for US tree nuts, with exports at more than $1.1 billion in 2024 and growing by 42.8% year-on-year to $759.6 million in January-June 2025. The US, likewise, has a 35% share in India’s seafood exports. In frozen shrimps and prawns, more than $1.9 billion out of the $4.5 billion of Indian exports during 2024-25 (April-March) went to the US.

Story continues below this ad

It’s another thing that despite this robust two-way trade engagement — more so in a sector that has become a sticking point in the ongoing bilateral trade talks — the Trump administration has doubled the tariff on Indian imports to 50%, effective from August 27. That includes a 25% “penalty” for the purchase of Russian oil, which China has also been doing without inviting any such coercive duty.