Three small firms shut their Canadian headquarters in the past nine months

Article content

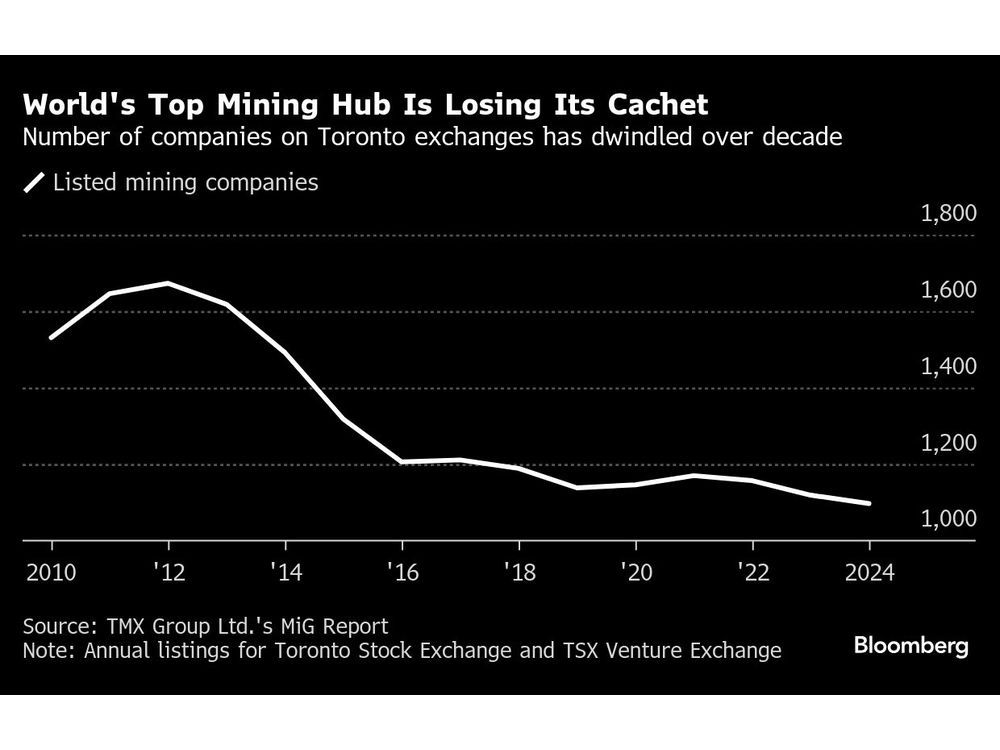

Toronto’s claim as the world’s top mining hub is under threat as exploration companies leave Canada and listings dwindle on the nation’s resource-heavy stock exchange.

Article content

Article content

Canada’s once-thriving mining industry is facing challenges to its decades-old model, in which explorers and developers woo investors with promises of mining breakthroughs and established producers feed on their success, swallowing them in lucrative takeovers. Industry consolidation has reduced head offices and eliminated listings, companies find it harder to attract investors, and government rules on foreign investment have become more restrictive.

Advertisement 2

Article content

“The industry that has fuelled most of the great Canadian minerals discoveries over the past 50 years is but a skeleton of itself,” said mining financier Pierre Lassonde, who co-founded Franco-Nevada Corp. “We should be extremely concerned.”

Three small firms shut their Canadian headquarters in the past nine months to relocate to other countries: Lithium Argentina AG, Solaris Resources Inc. and Falcon Energy Materials PLC. At least two others — Cornish Metals Inc. and Almonty Industries Inc. — are embarking on similar plans. It’s not just small companies: Toronto-based Barrick Gold Corp., the world’s No. 2 miner, has mused about redomiciling to the United States.

As executives, bankers and investors gather this week for the annual Prospectors and Developers Association of Canada conference in Toronto, the health of the industry is top of mind for attendees visiting this global mining epicentre.

The Toronto Stock Exchange and the TSX Venture Exchange represent 40 per cent of the world’s public mining companies, providing home to 1,097 listings, exchange owner TMX Group Ltd. said in its latest listings guide. That’s down from 2010, when the exchanges had 1,531 mining companies to account for 56 per cent of global listings for the industry. The decline comes as stock markets in London, Sydney and New York have been competing to attract mining companies.

Article content

Advertisement 3

Article content

Allied Gold Corp. is applying for a listing on the New York Stock Exchange, joining an industrywide migration to the world’s top bourse. The Toronto-based company would join a long list of gold miners that are on both Canadian and U.S. exchanges.

New York’s status as a global hub for gold equities expanded in recent years after a series of major deals transformed the industry and created two North American titans — Newmont Corp. and Barrick — that trade in the U.S. city. Barrick has long been headquartered in Toronto, though last month the Globe and Mail reported that chief executive Mark Bristow said he was considering redomiciling to the U.S. Barrick didn’t respond to requests for comment.

Toronto’s dwindling mining listings over the past decade can be partly chalked up to consolidation and shifting focus, according to TMX Group. About half of mining delistings were tied to mergers and acquisitions, and 27 per cent were companies that converted to cannabis firms.

A dearth of initial public offerings in recent years hasn’t helped stem the decline. There were no significant mining IPOs in the past year. Back in 2010, 90 miners went public after collectively raising US$1.26 billion.

Advertisement 4

Article content

The roots of the financing drought can be traced back to the commodities boom of the early 2010s, when miners borrowed heavily to fund ambitious exploration targets and mammoth takeovers. When markets crashed, it left balance sheets shredded and shareholders with dramatic losses.

“The junior miners have been in a nuclear winter ever since,” said David Garofalo, chief executive of Gold Royalty Corp. “The sector overspent on exploration, it overspent on expansions, and so there was a major hangover — massive amounts of debts on balance sheets, and significant cost escalation.”

Meanwhile, the growth of investor interest in exchange-traded funds has supplanted smaller, resource-focused funds that take positions in junior miners.

“We’ve seen a market evolution over the last 10 years — a rotation away from those smaller resource funds into larger funds that are more passive,” said Jeff Killeen, director of policy and programs at the PDAC. “And that inherently brings up the threshold for minimum investment.”

That’s left smaller companies chasing financial support from other sources, including Chinese investors willing to make bets on their prospects. The reliance some small firms have on Chinese funding is a testament to a lack of alternatives, said Lassonde, who’s leading a campaign calling for Canadian pension fund managers to boost investment in domestic companies.

Advertisement 5

Article content

“As juniors, you get the money wherever you can,” he said. “And if Canada can’t be there for them, they leave.”

For those staying in Canada, it’s getting harder to find financial backers. Prime Minister Justin Trudeau’s government has been cracking down on foreign investment in mining since late 2022, after his government ordered three Chinese firms to divest from a trio of Canadian lithium explorers. The move came amid a broader push by Western countries to tackle China’s growing dominance in the critical minerals supply chain. The federal government further tightened mining investment rules last July, prompting some departures.

“I don’t think it’s going to start a stampede for the door, but it shows how these policies have been viewed as relatively aggressive and broad in scope,” said Braden Jebson, a mergers and acquisitions lawyer at Torys LLP. “Companies with limited Canadian connections are assessing if those are worth the limitations of these investment policies.”

Among the exits, Solaris Resources moved to Ecuador after the copper company called off a financing deal with Zijin Mining Group that would have given the Chinese firm a 15 per cent stake and a board seat.

Advertisement 6

Article content

Falcon Energy moved to Abu Dhabi after failing to secure a US$12.7 million investment from China’s Carbon ONE New Energy Group Ltd. The move gave the company previously known as SRG Mining Inc. “expanded strategic options” while seeking to build a graphite mine in New Guinea, it said at the time.

Recommended from Editorial

And Lithium Argentina, which has partnered with China’s Ganfeng Lithium Group Co., relocated its Vancouver headquarters to Switzerland in January, calling it the “best jurisdiction from a strategic, commercial and legal perspective” and noting the move provided expanded financing flexibility.

“If the government keeps making it harder for companies to access global capital, it could impact Canada’s overall health in the medium to long term,” said Dean McPherson, TMX Group’s global mining head. “It means a loss of potential revenue and a loss of strength for Canada as a global destination for mining companies to be domiciled.”

With assistance from Geoffrey Morgan.

Article content