According to The Energy Information Administration (EIA), “the US expects renewable energy to grow by 17% to 42 GW in 2024 and make for a quarter of electricity generation.”

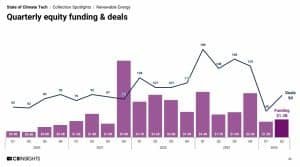

In Q2 2024, the renewable energy sector continued to experience significant investment activity, although it showed mixed results in terms of growth compared to previous quarters. The sector secured $1.3 billion in equity funding, reflecting a slight increase from Q1 2024, which saw $1.2 billion. However, this amount is lower compared to some previous quarters in 2022 and 2023, indicating a potential cooling in the pace of investments.

The overall trend in equity funding has seen fluctuations, with peaks in late 2021 and early 2022 when the sector experienced robust investment interest. The Q2 2024 funding level, while steady, is a reminder of the cyclical nature of investment in the sector.

Renewable Energy Deal Activity

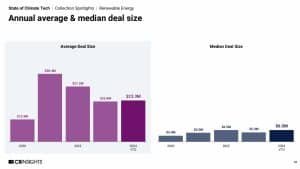

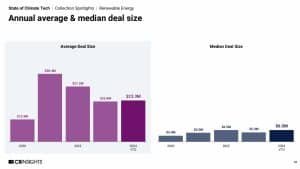

In the renewable energy sector, the average deal size has seen fluctuations over recent years, with a peak at $38.4 million in 2020, followed by a decline to $31.2 million in 2022. It further dipped to $23.3 million in 2024 year-to-date (YTD). Meanwhile, the median deal size has remained more stable, with figures showing $6.5 million in 2020, a slight drop to $5.0 million in 2022, and rebounding to $5.3 million in 2024 YTD. This data highlights a trend of mixed deal sizes ranging from both bigger and smaller deals in the industry over time.

Number of Deals: In Q2 2024, there were 82 deals, a slight decrease from Q1 2024’s 107 deals. This reduction in deal volume suggests a more cautious approach by investors, possibly due to broader economic conditions or market saturation in certain segments of renewable energy.

While the renewable energy sector remains a key focus for investors, Q2 2024 saw moderate investment levels compared to some previous quarters. The sector’s performance may be influenced by external economic factors and shifts in investor strategies.

By Global Region

Analyzing the funding on basis of global region, US is the top player having 41% in renewable shares, followed by Europe and Asia. Other regions, including Canada and all other regions, have remained relatively small contributors, with Canada fluctuating around 4% and other regions around 4-8%.

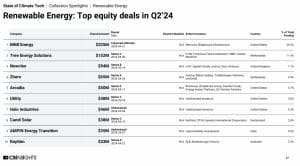

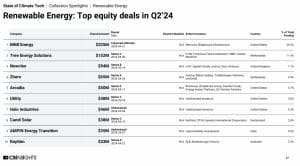

According to CB Insights, Who Leads the Pack?

1. MN8 Secures $325 Million for Expansion

MN8, one of the U.S.’s largest independent renewable energy companies, closed its first private placement, raising $325 million in April. The funds will support the Company’s expansion and growth plans.

This $325 million investment includes $200 million from Mercuria Energy Group and $125 million from Ridgewood Infrastructure, a top U.S. infrastructure investor. Stockholders will have the option to convert their preferred stock into common stock in the future.

The news release also revealed that, as part of the deal, Mercuria will gain one board seat and an observer seat on MN8’s board, while Ridgewood will receive an observer seat. The partnership will focus on discovering commercial opportunities to promote more sustainable, affordable, and reliable energy systems. It will merge MN8’s renewable energy expertise with Mercuria’s deep knowledge of energy markets.

In May, First Solar, Inc. the. U.S. solar technology firm announced that MN8 Energy LLC has ordered 457 megawatts (MW) of advanced thin film solar modules. This order includes 170 MW of Series 6 Plus bifacial modules and 287 MW of Series 7 modules. The solar modules will be used to power projects across the northeastern and southern United States.

MN8’s 3.2 (GW) portfolio provides renewable energy solutions to over 40 corporations, 70 government entities, and 20 utilities. In the last 12 months, MN8 Energy had revenue of $326.69 million and earned $191.84 million in profits.

2. Tree Energy Solutions (TES) Raises $152 Million to Power Green Energy Projects

Tree Energy Solutions (TES), a global leader in green energy, concluded its third, series C fundraising round, securing $152 million on April 4. The funds will fuel the development of TES’s global green energy projects, with a focus on e-NG (electric natural gas derived from green hydrogen). This round attracted top investors, including Azimut Group, Fortescue, E.ON, HSBC, O.G. Energy, and Zhero.

TES produces e-NG by combining green hydrogen with biogenic or recycled CO2, creating a green alternative to natural gas that uses existing infrastructure for transport and storage. The company has partnered with major energy firms like TotalEnergies, Osaka Gas, and ADNOC to build large-scale e-NG projects across North America, the Middle East, Australia, and Europe.

Additionally, TES is developing a green energy hub in Wilhelmshaven, Germany. This hub aims to decarbonize the German and neighboring energy markets by importing natural gas and e-NG, exporting CO2, and producing green hydrogen and power.

3. Newcleo’s Strategic Shift: Raising Funds and Expanding in Europe

Newcleo, a British nuclear startup, although new has made an impact in this space. The company recently raised around $528 million across three funding rounds, with the latest being a Series B round that secured $94 million in May 2024. They aim to tap into European Union resources by relocating their holding company from the UK to France. This move is part of their broader strategy to expand their operations within the EU.

While Newcleo shifts its focus to France, it still has big plans for the UK. The company intends to invest in and develop next-generation Small Modular Reactors (SMRs) to contribute to the UK’s electricity grid. However, their UK ambitions faced a setback when the government denied private companies access to the Sellafield site, leading Newcleo to shelve a planned project there. Despite this, Newcleo’s collaboration with France’s CEA to develop a lead-cooled fast reactor marks a significant step in their European expansion.

Here’s the complete list:

From this trend and analysis, it’s clear that 2024 has showcased substantial investment potential for renewable energy leaders. The significant funding, particularly in Asia and the U.S. highlights the demand and opportunity in the renewables. Media reports say, solar remains at the top while nuclear gaining a high momentum in the future.

Disclaimer: Data source CBInsights report