Gold and silver rallied in the days leading up to Christmas, giving precious metals investors yet another gift in 2025.

Gold’s move to almost $4,500 (£3,330) an ounce (oz) came from continued Chinese central bank and retail buying, alongside a weaker dollar. Copper also hit a new all-time high as traders stayed at their desks during the run-up to 25 December, climbing to almost $12,000 a tonne.

But there were also surprise winners in 2025, where prices surged due to government action or worries over future supplies.

This included cobalt, after the Democratic Republic of Congo suspended exports; tungsten, driven up because of its use in military equipment and Chinese dominance in the market; and platinum group metals, pushed up by investment buying and declining mine output.

Looking ahead, several analysts think lithium will climb further next year, after gaining some price momentum in the last months of 2025. The metal has been in oversupply for years after a rush of investment early in the electric vehicle (EV) boom.

Read more from Investors’ Chronicle

This cycle has happened several times in the past decade. The most recent bull run was 2022, when the lithium carbonate price hit $80,000 a tonne.

This year, the low was $8,300 a tonne in June, before a final-quarter rebound saw it rise to $13,350 a tonne, as per FactSet.

Lithium prices are volatile because of the abundant reserves in South America and Australia, with mines quick to reach production (in Australia particularly). Several major operations are currently suspended due to low prices.

The principal demand focus has been EVs, but lower growth than expected a few years ago has hit the market. EV sales hit 18.5mn globally in the year to November, according to energy consultancy Rho Motion. This compares with 6.6mn in 2021, and still represented a 21 per cent increase on the same period in 2024.

But the 2025 enthusiasm for lithium came from stationary energy storage, often used alongside renewables to ensure consistency of electricity supply. UBS analysts said this could be a “game changer” for lithium, sending up demand significantly within a few years.

This has sent the bank’s price forecast for lithium carbonate for next year up from $11,000 a tonne to $16,500.

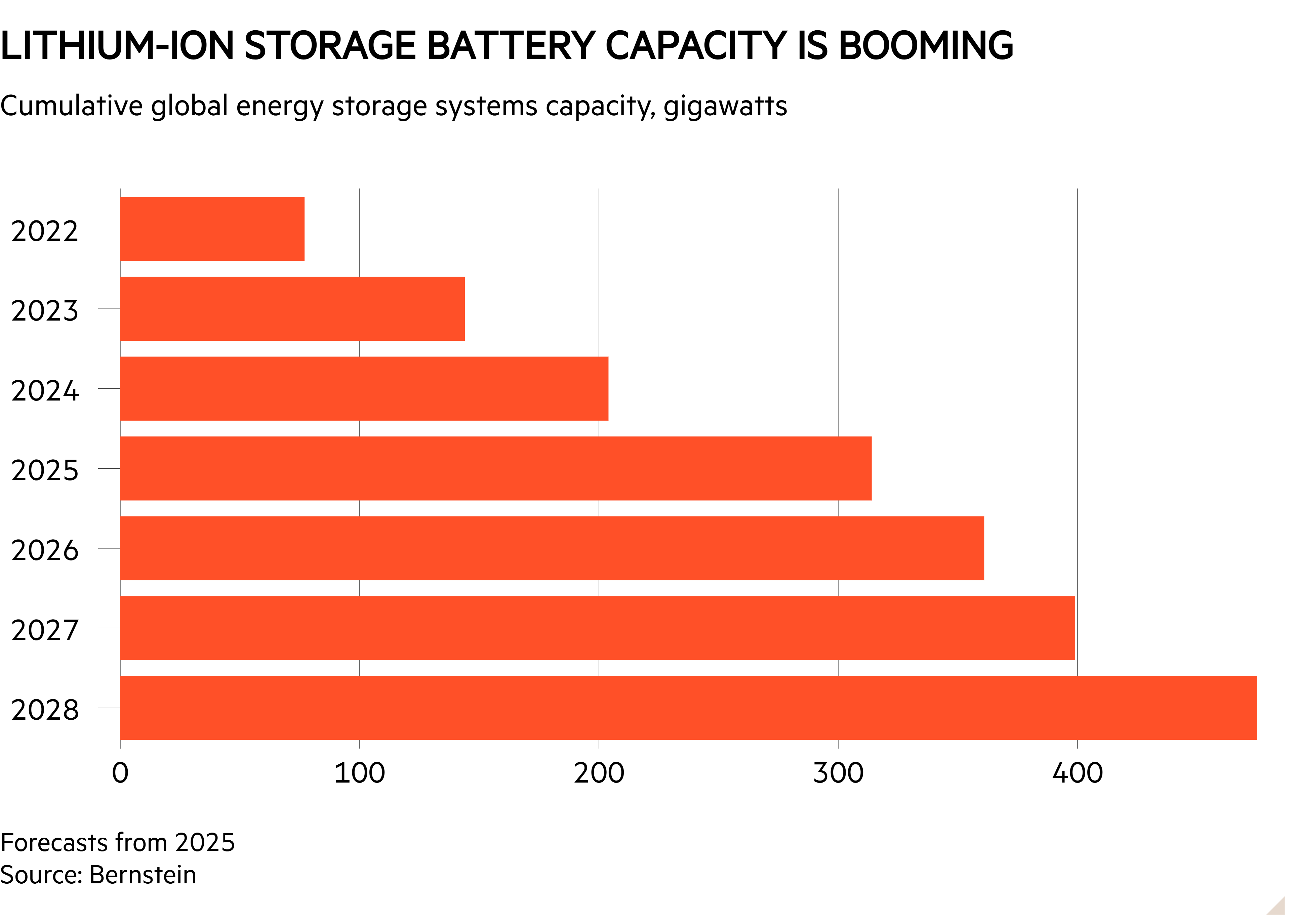

The rally in recent months emerged because of a shift in stationary storage forecasts. In September, the Chinese government said it would double “new energy storage” capacity to 180 gigawatts (GW) within two years. This “represents a substantial boost to market forecasts”, said BMO, which also highlighted the $35bn in spending pledged alongside the goal.

Analysts there said lithium demand for stationary storage climbed 40 per cent in 2025, to around 260,000 tonnes, and should climb again to almost 300,000 tonnes in 2026. This is less sharp year-on-year growth, but would still be enough to help prices.

Panmure Liberum put lithium in its top three gainers for 2026, just behind natural gas and thermal coal. Looking further ahead, the broker’s top three for the next five years are Brent crude, cobalt and lithium, with gains of around 50 per cent for the battery metals and 30 per cent for oil.

Bernstein thinks it will take a while for lithium to really get going. “An inflection is coming [a year faster than we previously thought] and our 2028 and 2029 estimates are much higher than consensus as we see potential deficit due to potentially higher demand for [energy storage] battery, and medium- and heavy-duty vehicle battery,” the US bank’s analysts said.

That translates to a price forecast of $20,000 a tonne in 2028, although Bernstein also thinks prices for the next two years will be flat.

London lithium names should ultimately benefit, although given most are developers, not producers, this will be sentiment rather than profit-driven.

What else?

Top of the tree for Panmure Liberum for 2026 is thermal coal, because it thinks China will curb local production and raise imports. Thermal coal, used in power stations, has largely traded around $100 a tonne on flat demand in recent years.

Bullish observers see a shift in pricing coming from supply: investors are unwilling to put up cash for new projects, and so it will get more and more difficult to feed coal power plants.

But there is a race between utilities switching to lower-emission technologies such as gas and renewables and supply dropping off. In the short term, UBS painted the opposite picture to Panmure.

“Thermal coal is trading at [around] $110 a tonne and remains above support levels; we expect seaborne prices to be rangebound in 2026 with China domestic supply to recover and Brent/gas prices expected to remain soft,” they said.

Another common pick for 2026 is cobalt. “We have revised our cobalt forecast upwards due to delays in DR Congo exports under the new quota regime, which combined with a three-month transit time to China, is expected to keep the Chinese market tight and prices elevated in the first half of 2026,” said analysts at BMO.

They also backed copper and gold for further gains, and said volatility in artificial intelligence (AI)-linked equities could be good for metals buyers: “We think an AI bubble pop could represent a strong buying opportunity for some commodities, assuming no major wider economic turmoil.” These would be copper, aluminium and uranium.