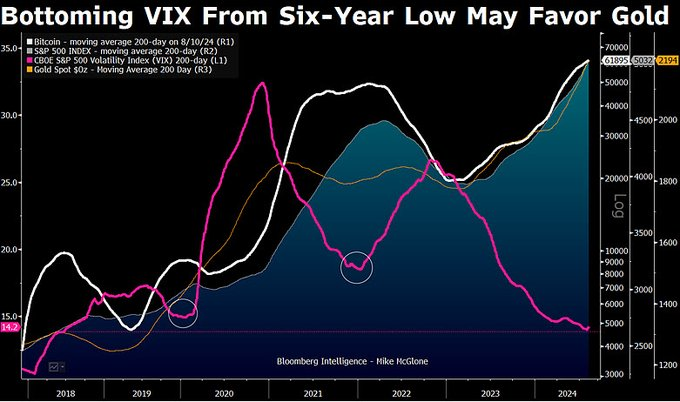

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, has shared the potential implications of Bitcoin’s (BTC) recent performance on the broader United States stock market.

Particularly, in an August 10 X post, McGlone suggested that Bitcoin—a key indicator in the realm of risk assets—might be maturing rapidly, particularly in the context of US exchange-traded funds (ETFs). However, this maturation could be placing considerable pressure on the stock market.

He pointed out that Bitcoin has experienced a notable decline from its previous highs, a trend McGlone believes is exposing vulnerabilities within the stock market. As of August 10, 2024, Bitcoin was trading at around $60,000, a level last seen in March 2021.

During that same period in 2021, the expert observed that the S&P 500 was trading at approximately 3,900. By August 9, 2024, it had risen to 5,344.

McGlone’s analysis suggested that Bitcoin’s recent slump—which briefly saw the leading cryptocurrency drop below $50,000—might be placing an “inordinate burden” on the stock market, which has remained elevated despite challenges in the cryptocurrency sector.

This comparison underscores a potential disconnect between Bitcoin’s performance and traditional risk assets like the S&P 500.

“Slumping Bitcoin may be showing an inordinate burden on the US stock market to stay elevated,” the expert noted.

Bitcoin’s role in the broader market

According to the strategist, Bitcoin trades 24/7 and is increasingly serving as a leading indicator for broader market sentiment. As Bitcoin continues to mature, particularly with the growing presence of ETFs, its movements may carry more weight in influencing other markets.

However, this also means that when Bitcoin struggles, it could have wider repercussions for the stock market.

Overall, McGlone’s insights suggest that the fate of the US stock market may be more closely tied to Bitcoin than previously thought, especially as the cryptocurrency market evolves and integrates further into the mainstream financial system.

It’s worth noting that Bitcoin and the general stock market recently recorded an outflow of capital in the wake of fears of a recession hitting the US.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.