The runaway energy demands of the artificial intelligence boom are pushing a new wave of innovative next-gen energy ambitions. Big Tech is pouring money into fast-tracking the development of futuristic energy alternatives like enhanced geothermal and nuclear fusion in an attempt to stay one step ahead of the energy monster the sector is creating.

Large language models are already consuming about 1.5 percent of the world’s energy, according to figures from the International Energy Agency. And as AI models become more advanced, they will only become more energy intensive. The sector is expected to double its energy needs by the end of this decade, at which point AI alone will rival the energy use of the entire nation of Japan.

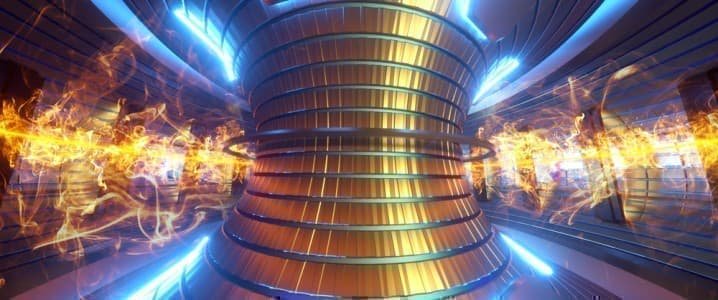

Nuclear fusion has become a sort of tech industry darling, as it has the potential to provide a ‘silver bullet’ solution to the energy security and sustainability threats posed by AI. In theory, commercial nuclear fusion could provide an essentially limitless source of totally clean energy, leaving behind none of the hazardous nuclear waste associated with nuclear fission.

Some of the tech sector’s biggest names, including Bill Gates and OpenAI’s Sam Altman, are major advocates of nuclear fusion as an answer to AI’s ballooning energy problem. In fact, Altman has said that the world simply doesn’t have enough energy to support the tech sector’s growth trajectory unless we develop new energy sources in the immediate future.

“There’s no way to get there without a breakthrough,” he said at the 2024 World Economic Forum in Davos, Switzerland. “It motivates us to go invest more in fusion.”

Achieving useful levels of nuclear fusion has remained out of reach for over a century, but the science is now advancing at a rapid pace. The increasing privatization of the sector and recent flood of fusion startups has injected huge amounts of cash and competition into the burgeoning field. While Big Tech has been supporting fusion unicorns for years, now even Wall Street is getting in on the action, signalling a critical shift in confidence and a major reconfiguring of the industry.

Until recently, only rich governments could afford to conduct fusion experiments, which are often massive in scale, enormously expensive, and slow-moving. ITER, the world’s biggest fusion experiment, is years delayed and about €5 billion over budget. But with the increasing diversification of the field, more and more agile approaches to fusion energy are being tested. Most of them are much smaller than the leading public projects, but still showing huge promise.

According to recent reporting from Utility Dive, the future of nuclear fusion may very well trend toward compact and local models as a critical complement to major projects. Advances in the ultra-powerful magnets that fusion projects rely on to control and contain superheated plasma have allowed for the development of much smaller reactors. Moreover, the demand for fusion energy is coming from the local level, as data centers increasingly decentralize energy needs and generate major hotspots in rural areas with little energy infrastructure.

The rapid growth and spread of AI integration and its associated resource needs is placing unprecedented strain on electric grids around the world. Regions that have borne the brunt of data center scaling are already crumbling under the weight and cost of the AI revolution. The scale of the problem bridges public and private spheres. As Silicon Valley employs its deep pockets to catalyze the development of new energy sources, policymakers are rushing to keep up with necessary supportive infrastructure like transmission lines.

“These are no longer just engineering problems. They’re political, economic and even military issues,” Utility Drive writes. “A single outage can silence AI services, industrial zones or defense systems.”

By Haley Zaremba for Oilprice.com