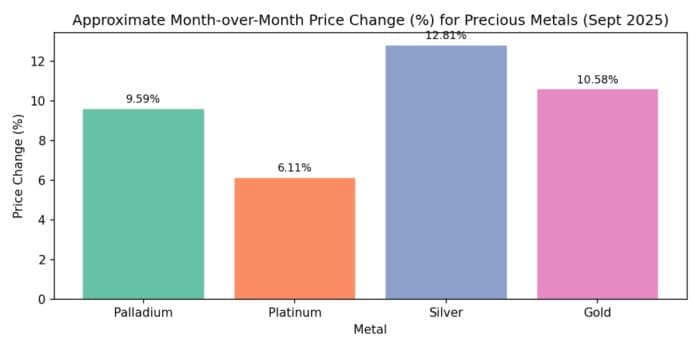

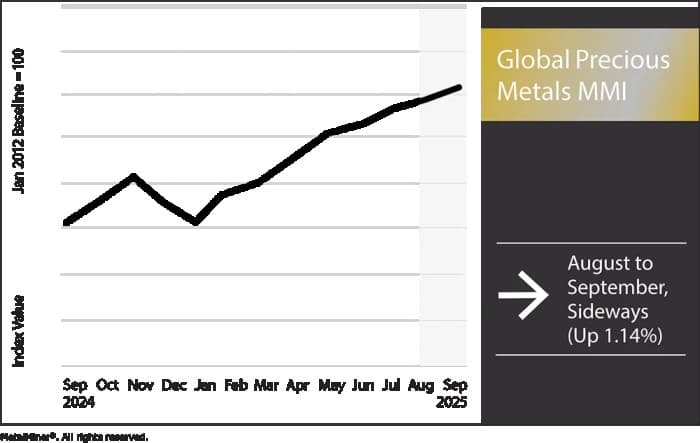

The Global Precious Metals MMI (Monthly Metals Index) moved sideways, trending up by a slight 1.14%. Despite the sideways movement, precious metals prices have been anything but stale.

The past two weeks have been dramatic for the precious metals market, as gold set new records, silver touched levels not seen since 2011 and palladium and platinum moved higher on supply concerns.

Meanwhile, the U.S. Federal Reserve’s 25-basis-point rate cut at its September meeting, along with the prospect of additional easing, weakened the dollar and revived safe-haven demand across the precious metals complex. This underscores why it is so important that procurement professionals stay nimble when managing contracts.

What is Happening With Palladium Prices?

Palladium prices have seen a significant rally over the last two weeks. Analysts at XTB say the metal gained more than 3% on September 10 alone as investors grew worried about potential sanctions on Russia, which produces nearly half of global palladium. Recently, Montana senator Tim Sheehy led a delegation asking President Trump for a 50% tariff on Russian palladium to counter “predatory trade practices” that have depressed U.S. prices and jeopardized domestic mining jobs.

Palladium supply is also tightening. Trading Economics notes that primary supply is falling faster than demand due to disruptions in South Africa and North America. Simultaneously, recycling supply has risen thanks to China’s vehicle trade-in program. Despite these headwinds, Trading Economics expects palladium to trade around $1,189 by the end of the quarter and $1,303 within a year. Therefore, procurement teams should hedge against volatility and closely monitor how tariffs and substitution trends impact their supplies.

Precious Metals Prices: What is Happening With Platinum Prices?

Platinum has followed a similar trajectory to palladium. The WPIC’s Platinum Quarterly projects an 850,000-ounce deficit for 2025 due to weak refined output. Although recycling is increasing, it remains insufficient to meet demand, which places further bullish pressure on prices. Along with this, NASDAQ reports that heavy rainfall has reduced South Africa’s production by 8% year-on-year in the second quarter, and mine output is expected to continue declining.

The metal’s safe?haven appeal has also attracted investors seeking an alternative to costly gold and volatile palladium. Trading Economics forecasts platinum at $1,451 by quarter’s end and $1,562 in 12 months. According to platinuminvestment.com, buyers should secure long-term contracts and watch for U.S. tariffs on platinum-containing products, which currently exempt sponge and ingot but tax some finished goods.

What is Happening With Silver Prices?

Silver stole the spotlight this month, jumping to a 14-year high. Fortune notes that silver was already $40.61 on September 2, about 42% higher than a year before and 10.7% above its August level. The rally has been largely fueled by expectations of further U.S. rate cuts and a weaker dollar.

This makes non-yielding assets more attractive. Sprott Asset Management emphasizes that silver has been in a structural deficit for seven consecutive years, with mine supply having fallen 7% since 2016. Meanwhile, demand for electrical and electronics has risen 51% during the same period.

Analysts at FXStreet describe a bullish technical picture in which the 20-day exponential moving average sits near $41.30 and the relative strength index remains elevated, suggesting momentum could carry prices toward $45. Given silver’s structural deficit and growing industrial applications, procurement teams should consider forward contracts and utilize MetalMiner’s forecasting tools for tailored buying strategies.

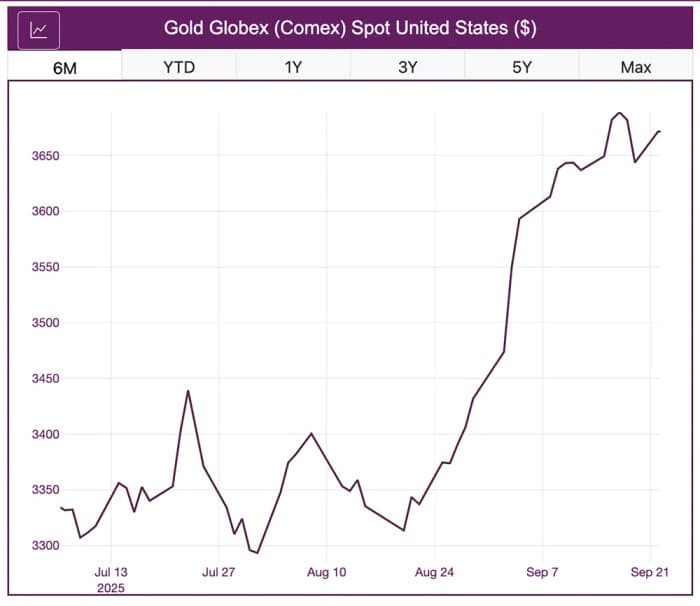

What is Happening With Gold Prices?

Finally, gold continued to extend its record-breaking rally. On September 17, prices hit $3,688.90 per troy ounce. Amid these new highs, Citigroup strategists told clients they expect the gold and silver bull market to broaden and potentially shift into copper and aluminum next year, citing dovish Fed policy, trade tensions, and concerns over U.S. debt. CBS News recently reminded investors that interest rate cuts, rising inflation, and market uncertainty have historically propelled gold higher and could potentially push it past $4,000 per ounce.

Meanwhile, gold demand remains robust. Trading Economics attributes the rally to safe-haven flows amid geopolitical risks and strong central bank buying, though the WPIC notes that some investors are rotating into platinum due to gold’s high cost. Nevertheless, the yellow metal’s role as a portfolio hedge keeps it in demand. For procurement professionals, that means jewelry and electronics components tied to gold could face higher costs

Trends for Precious Metals Prices: Noteworthy Shifts

- Palladium bar prices dropped by 7.26% to $1,111 per troy ounce.

- Platinum bar prices rose by 7.12%, leaving prices at $1,384 per troy ounce.

- Silver ingot prices rose by 10.71% to $40.53 per troy ounce.

- Lastly, gold bullion prices hit an all-time record high once again, rising month-over-month by 5.45% to $3,470.10 per troy ounce.

By Metal Miner

More Top Reads From Oilprice.com