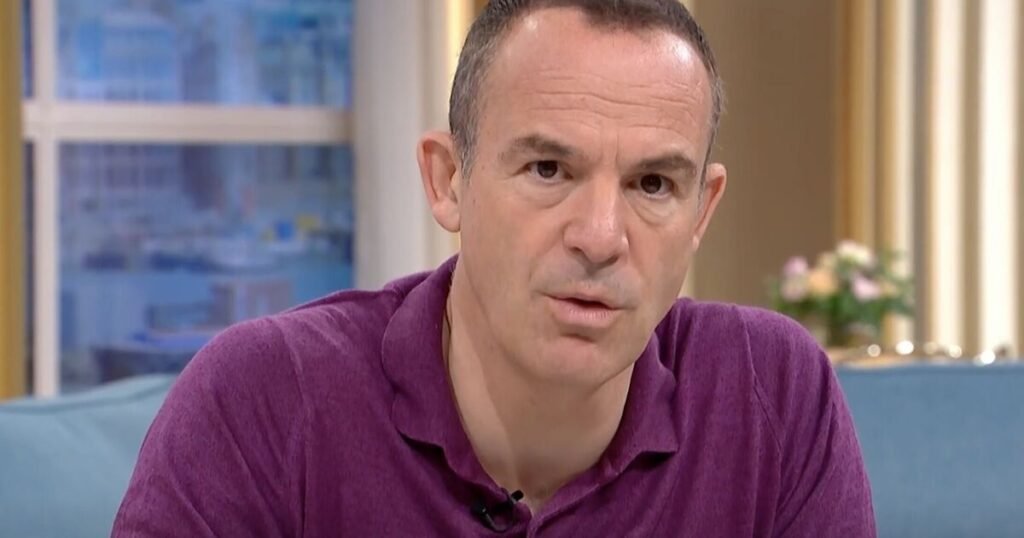

Martin Lewis has warned that the pockets of the one group will hit the hardest as the energy bills are set to rise from October. Ofgem recently announced that the annual household energy bills will rise from £1,720 to £1,755 from October 1. This means the household will pay an extra £35 on their energy bill from next month.

However, according to the money saving expert, the increase will leave a hole in the pockets of the lower energy users hardest due to the daily standing charges on gas and electricity. The expert also requested that the homeowners who are still on a standard tariff to lock in a fixed rate before the new price cap sets in.

Mr Lewis said: “Now we know the Cap will be at the current rate or higher until at least the end of the year, it’s easy to compare to the cheapest fixes.”

He also suggested trying to try and escape the price cap if feasible by securing a better deal.

He noted that current fixed rates are on average nearly 17% below the October price cap rate, equivalent to around £250 per year cheaper on a typical bill.

He added that fixed deals have “guaranteed rates, so you know they won’t rise for at least a year”, reports the Daily Record.

He continued: “That means for those on a capped tariff, switch to a fix and your energy use immediately costs less, and is guaranteed to do so until at the very least the 31 December, but almost certainly well beyond that too.”

If you pay for your electricity and gas using standard credit, Direct Debit, a prepayment meter, or an Economy 7 (E7) meter, you’re using one of the common billing methods available to UK energy customers. Standard credit means you settle your bill after receiving it, typically every quarter. Direct Debit allows for automatic monthly or quarterly payments, often at a fixed amount, which can help with budgeting. Prepayment meters require you to pay in advance by topping up a card or key, offering more control but often at a higher cost.

Mr Lewis explained: “The average Standing Charge is rising 4.5 per cent for electricity users and 14 per cent for gas. To put it in context if it stayed at this level over a year, you’d pay a horrific £320 a year (on average for Direct Debit) just for having the facility of gas or electricity even if you didn’t use it.

“That means lower users will be disproportionately hit, with some facing effective rises of 5 per cent or more. Yet perversely, higher users gain, as the rate for each unit of gas you use is being cut. So high users who use a lot of gas may see a rise of just 1 per cent-ish.”