Austin-based Lucky Energy, the better-for-you energy drink brand, has closed an oversubscribed $11.75 million Series A funding round led by Brand Foundry Ventures.

Other investors include Imaginary Ventures, Sapphire Sport, and Sugar Capital. This latest round brings the company’s total funding to $26.5 million.

Launched in late 2023, Lucky Energy is already making waves in the energy drink market, defying expectations with rapid growth. The newly secured funds will accelerate its expansion into major retailers by 2025.

Founded by beverage entrepreneur Richard Laver, Lucky Energy has positioned itself as a category disruptor. The company takes a “less is more” approach, using simple ingredients and aiming to inspire consumers to persevere and take risks. “I saw a white space in the market to create a product that entertains today’s consumers and motivates our community to relentlessly chase their dreams,” Laver said.

Lucky Energy’s leadership team includes industry veterans like Hamid Saify, the new Chief Marketing Officer formerly with Liquid Death, and Aaron Sorelle, the Chief Growth Officer, who joins from C4 Energy. The team also includes Tyler Larkin as SVP of Sales and Distribution, who brings key expertise from Liquid Death. The brand plans to use the Series A funding to grow awareness, support strategic partnerships, and scale its retail presence to reach over 8,000 retail locations by the end of the year.

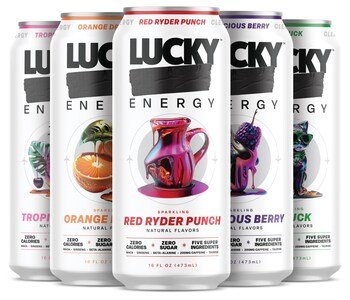

With five flavors featuring super ingredients like maca, taurine, ginseng, and caffeine, Lucky Energy offers a cleaner alternative to traditional energy drinks. As demand grows for healthier options, investors see tremendous potential. Rico Mallozzi, Principal at Sapphire Sport, noted, “With the top three energy brands over 20 years old, the market is ripe for an anti-brand like Lucky Energy. Its rebellious approach and unique brand identity have broad consumer appeal.”

In addition to expanding its retail footprint, Lucky Energy is focused on creating out-of-the-box content, consumer rewards, and innovative product launches that empower its loyal customer base to live boldly and fully embrace life’s challenges. Laver’s vision for Lucky Energy isn’t just about selling a drink—it’s about building a lifestyle brand that connects with consumers on a deeper level.

Andrew Mitchell, Founder of Brand Foundry Ventures, expressed excitement about Lucky Energy’s future, stating, “We believe Lucky Energy is poised to become a major player in the $100 Billion plus energy drink category. Its clean energy focus and talented team set it apart as a brand to watch.”

With its disruptive mindset, experienced team, and growing consumer base, Lucky Energy is well on its way to becoming a leader in the energy drink market, inspiring its customers to “keep going” with each sip.