The European Union has drawn a line in the sand. By 2027, the bloc intends to phase out Russian natural gas imports completely.

But as the policy ink dries in Brussels, a new challenge is emerging in the real economy…

We might not have enough hands to build the infrastructure that replaces it.

International Energy Agency (IEA) Executive Director Fatih Birol stood alongside European Commission President Ursula von der Leyen last week and called it the “end of an era.”

But he also delivered a warning.

The transition away from Russian energy is only as strong as the workforce available to execute it. And right now… that workforce is stretched to the breaking point.

The Golden Rule: Diversification

Following the invasion of Ukraine, the IEA responded with a 10-Point Plan to reduce reliance on Russian fuel. The results have been swift. Europe has moved toward firmer footing, diversifying suppliers and accelerating renewables.

Dr. Birol, speaking at the European Commission, laid out the new philosophy simply:

“In the energy world, overreliance can quickly turn into major geopolitical vulnerabilities. My number one golden rule for energy security is diversification.”

The deal is done. The timeline is set. But policy is just paper until it is built.

A Boom with a Bottleneck

The energy sector is growing. Fast.

According to the IEA’s newly released World Energy Employment 2025 report, the sector is a job-creation machine.

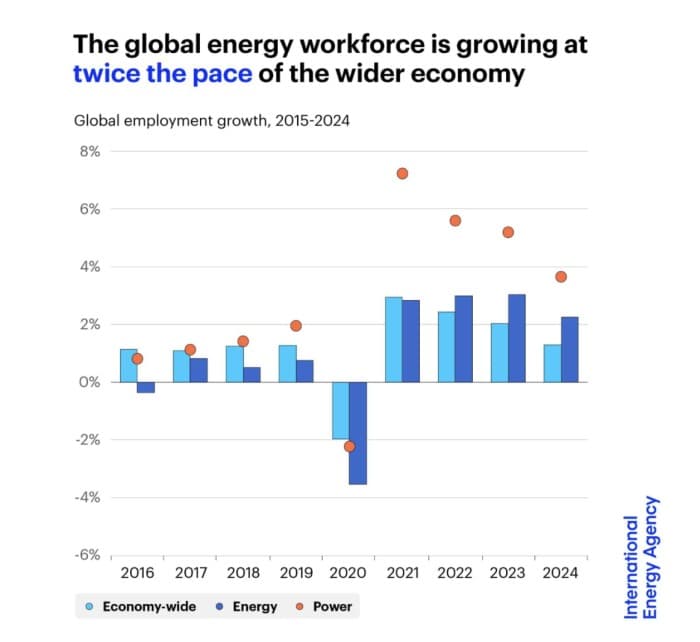

Global energy employment hit 76 million people in 2024. It is up by more than 5 million since 2019. Last year alone, energy jobs grew by 2.2%, a rate growing at twice the pace of the wider global economy.

The center of gravity is shifting, too.

- The power sector has overtaken fuel supply as the industry’s top employer.

- Solar PV is the primary driver of growth.

- Jobs in EV manufacturing and battery production surged by nearly 800,000.

At first glance, all seems well, but the report highlights a deepening shortage of skilled labor. Of the 700 energy-related companies surveyed, more than half reported critical hiring bottlenecks.

Europe is facing a paradox. It has the capital. It has the policy mandates. But it lacks the electricians, the engineers, and the grid technicians to deploy them on schedule.

These shortages threaten to slow the building of infrastructure, delay projects, and raise system costs exactly when Europe needs to move fastest.

Rewiring the Market’s Operating System

As the grid transforms to accommodate wind, solar, and batteries, the market design—the economic logic that governs the grid—is struggling to keep up.

The IEA’s concurrent report, Electricity Market Design, finds a disconnect.

Short-term markets are working well; they are efficiently dispatching power hour-by-hour. But long-term markets? They are failing to send the right investment signals.

The old models weren’t built for a system dominated by renewables. The report argues that we need to redesign these markets to value flexibility and attract long-term capital.

If we don’t fix the market signals, the investment won’t flow… no matter what the policymakers in Brussels say.

The Global Context

The pivot isn’t happening in a vacuum. While Europe finalizes its divorce from Russian gas, the rest of the world is moving, too.

- In Norway: Dr. Birol met with Prime Minister Jonas Gahr Støre to discuss Norway’s role as a guarantor of energy security and a partner in clean cooking initiatives for Africa.

- In Southeast Asia: 150 policymakers gathered in Vietnam for the IEA’s 22nd Energy Efficiency Policy Training Week, addressing rapidly growing demand in the region.

The Bottom Line

The 2027 phase-out deal is a massive geopolitical win for Europe. It signals resilience. But the hard work is just starting.

We have traded a geopolitical crisis for an industrial one. The race is no longer just about securing gas contracts; it is about securing the talent and the market structures to keep the lights on.

Europe has cut the cord. Now, it has to build the battery.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com