There should be few surer bets than India’s energy transition. Electricity demand is forecast to grow faster than any other major market next year, and the nation is racing to meet Prime Minister Narendra Modi’s 2030 deadline to add vast volumes of renewables — roughly double the current total.

Yet the impacts of climate change are making investors and project developers wary. Rising temperatures are fueling increasingly unpredictable global weather patterns, which in turn risk upending assumptions on power generation and profitability for giant wind farms and solar arrays.

Eversource Capital, one of India’s largest climate-focused asset managers, is prioritizing solar energy after selling its holding in a power producer with wind parks because of the potential negative impact of weaker speeds.

“Wind projects have underperformed,” said Chief Operating Officer Prasanna Desai. Advances in technology haven’t made up the shortfall, and upgrades to larger turbines “aren’t having the desired outcomes,” he said.

Similar concerns are being shared globally, and particularly as renewables account for an increasing share of the world’s electricity generation — up to almost 32% last year from roughly 22% a decade earlier, according to Ember, a UK-based energy-focused think tank.

Unpredictable weather is frequently making it harder to accurately calculate electricity demand or potential power generation from turbines and solar panels. The risk exacerbates existing challenges in the industry like higher borrowing costs, souring investor sentiment on climate action and policy pushback, most notably in the US.

Weaker wind speeds can directly impact the electricity generation of turbines, while drier conditions limit the effective operations of hydropower facilities, according to the International Energy Agency, which has warned that climate change is putting energy security at risk. Higher temperatures mean lower output from solar farms and usual regional patterns of solar irradiation intensity are forecast to shift, the agency says.

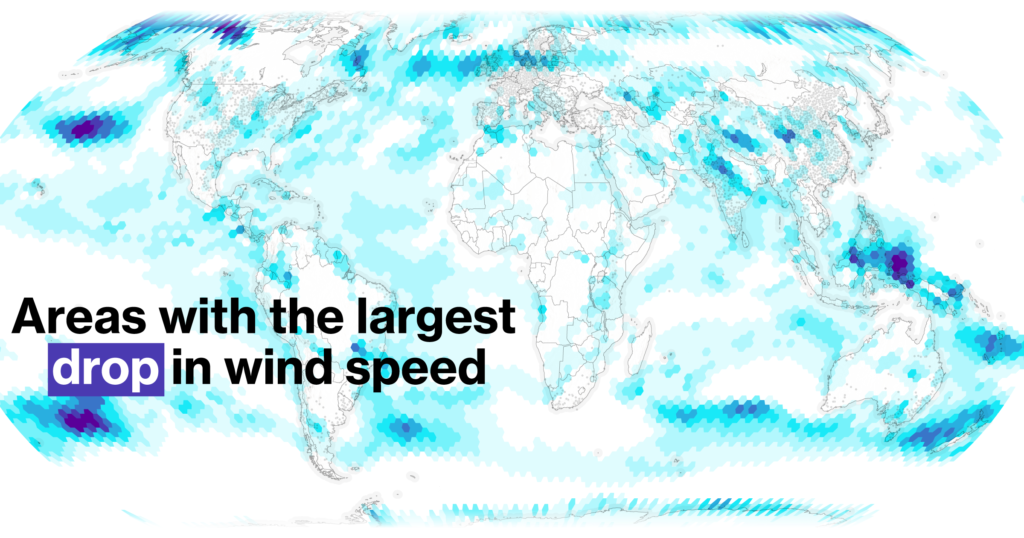

To understand the changing conditions for renewables, a Bloomberg Green analysis examined average wind speeds and solar irradiation in five-year periods between 2001 and September this year using Copernicus Climate Change Service data. Comparing those findings to 30-year averages shows wind speeds have dropped most significantly since 2021 in India, western China and parts of Southeast Asia, including Indonesia, the Philippines and Malaysia. Solar irradiation has been in decline in the same period across the Southern Hemisphere.

Variations in Wind Speeds

Parts of India, China and Southeast Asia have witnessed lower speeds since 2021

Source: Copernicus Climate Change Service

Note: Drop in average wind speed is the mean for 2021-25 compared to that of 1990-2020.

“Climate change does really redistribute the sources of energy,” said Roberta Boscolo, climate and energy lead at the World Meteorological Organization. Wind is most susceptible to variable conditions, and parts of east Asia can be particularly impacted, she added. “A little change in the wind speed, it translates to a lot of lost power.”

Weather Disruptions

Changes in average wind speed and solar irradiation since 2001, compared to 30-year averages

Source: Copernicus Climate Change Service

Note: Data as of September 2025

Understanding the links between climate change, weather volatility and renewable energy production isn’t straightforward, particularly across a wider region rather than a specific, local site. Scientists are scrambling alongside traders, insurers and project owners to better interpret the relationship between shifting wind or solar patterns and electricity generation.

Wind and solar data are complex, and researchers say long-term trends are hard to calculate. Energy technologies keep evolving, too, meaning that larger turbines or more efficient panels could counteract changes in weather patterns.

Still, India stands out in the Bloomberg Green analysis as a major economy where wind speeds have consistently declined since the start of the century, compared to long-term averages.

In February, US-listed ReNew Energy Global Plc, which has more than 150 renewable energy projects across India, highlighted the impact of declining wind speeds as it revised down a forecast for a key annual profit metric by a range of as much as almost 10%.

The developer ultimately beat that earnings projection on factors like higher capacity and cost cutting. Yet last month, ReNew’s founder and Chairman Sumant Sinha pointed to a different issue now weighing on profitability: lower solar output.

“We also have seen an unusual trend in climatic conditions this year in India,” Sinha, also the firm’s chief executive officer, said on a November earnings call. An extended monsoon season resulted “in more muted power demand growth as well as lower solar PLF (plant load factor) compared to last year,” he added, referring to an industry term meaning a plant’s capacity utilization.

The task of accurately plotting power output is becoming trickier for the country’s operators, according to Debabrata Ghosh, head of India at Aurora Energy Research, a TPG Inc.-backed power market modeling firm. “Portfolios are being relooked at and efforts are being made to ramp down the wind components,” he said.

ReNew is among firms to have boosted weather forecasting capabilities, acquiring analytics firm Regent Climate Connect Knowledge Solutions Pvt. in 2020 and investing in a power diagnostics center in Gurugram, near New Delhi.

The inauguration of ReNew’s wind farm near Jasdan, Gujarat, India, in 2012. Photographer: Ajit Solanki/AP Photos

At that site, giant screens displaying metrics like wind speeds, solar irradiation and power generation are updated every 10 seconds, and flag problematic equipment to teams who liaise with on-the-ground colleagues. The technologies have significantly reduced weather-related damage and minimized downtime, according to Balram Mehta, ReNew’s chief operating officer.

Meanwhile, billionaire Gautam Adani’s clean power firm Adani Green Energy Ltd. has incorporated artificial intelligence tools into day-ahead forecasting to address weather risks. Other companies in India and elsewhere are investing in technologies such as wind turbines that automatically halt generation when gusts become dangerously strong.

India’s government is taking action too, adding hundreds more automated weather stations and at least 13 centers specifically aimed at monitoring regional renewable energy generation trends. Officials are promoting projects that include a mix of different energy sources.

Scientific research so far ties slower wind speeds in India’s wind farm-heavy states to warming of the Indian Ocean, which reduces the temperature and pressure differentials between land and sea, factors that are crucial in creating wind. Increasingly erratic monsoon winds, also seen as a result of rising global temperatures, are making power generation during the usually optimal May to September period more unpredictable.

Solar irradiation in India weakened in all five periods analyzed by Bloomberg Green, a factor that can have some, though minor, effects on electricity generation, according to the IEA. Higher temperatures also lead to a range of more serious impacts, and power generation efficiency can degrade as much as 0.5% for each degree above 25C (77F), the agency says. India experienced its hottest year on record in 2024.

Unpredictable Weather Patterns

As the world warms, tropical circulation is expanding poleward, potentially altering climate conditions

Sources: Intergovernmental Panel on Climate Change and National Oceanic and Atmospheric Administration

Note: Diagram is conceptual and not to scale.

Global temperatures also set a new benchmark in 2024, and conditions through 2025 suggest it’s likely to rank as the second or third-warmest year ever, Copernicus said this month. Among factors fueling the rise is the expansion of Hadley Cell atmospheric circulation patterns, which are changing weather in subtropical regions.

Wind droughts are also becoming more commonplace as a consequence of rising temperatures. That was the finding from a paper published in Nature in July, and it’s supported by IEA data that shows global mean wind speeds have declined over most land areas since the 1970s. Both China and the US — which account for more than half of global wind power generation, according to BloombergNEF — are projected to experience a decrease in mean wind speeds.

China, which has almost as much solar and wind capacity installed as the rest of the world combined, saw wind velocity decline in four of the five periods analyzed by Bloomberg Green. Over the past five years that’s been mostly in central and western China, an area that includes locations where vast new renewable energy parks are being constructed.

Weaker Sunlight

The Southern Hemisphere is seeing declines in solar irradiation

Source: Copernicus Climate Change Service

Note: Drop in average solar irradiation is the mean for 2021-25 compared to that of 1990-2020.

Spells of meager wind and solar generation have long been common in markets like Europe, where so-called Dunkelflaute periods, typically in winter, curtail clean energy output.

Weather fluctuations could become more important in places like Germany, because wind and solar account for more than 40% of electricity generation, and the UK, where wind is now the largest source of electricity. While some scientists contend that climate change is pushing ideal wind conditions away from Europe’s mid-latitudes, other research suggests future warming could have only a negligible effect on speeds in Germany and parts of central Europe.

European energy companies have also discussed the challenges. German utility RWE AG said last month that “unusually low wind speeds” in European markets in the first three quarters of 2025 had driven up generation from conventional power plants.

Denmark-based Orsted A/S has recently flagged multiple instances of weaker winds and in September issued a profit warning specifically tied to the impact of “lower-than-normal” offshore speeds. However, those declines were within an expected range of variability, and the company doesn’t see evidence of longer-term trends that will significantly limit generation at European operations.

Both firms have also previously discussed the so-called wake effect, a loss in electricity generation when turbine farms are built close together and cause wind speeds to drop.

Investors are seeking to improve their ability to predict the risks from wilder weather, and to refine holdings to minimize potential downside.

Energy Infrastructure Partners AG, which manages about €7.5 billion ($8.8 billion) in assets, has been working with a climate risk specialist on tools to assess “future variations in wind speed and temperature patterns for wind and solar assets,” it said in its most recent sustainability report.

Reduced “efficiency and reliability of energy assets” are among potential risks from chronic climate change, the report said. Zurich-based EIP aims to finalize a review of the impact of physical climate risks on its portfolio in the first quarter of 2026.

Concern over weather variability has helped propel a market in weather derivatives — in which a buyer is paid by reinsurers and other counterparties if conditions cross certain thresholds for factors like heat, wind or rainfall — to a value of more than $25 billion, according to some industry estimates. Demand for hedges against low wind is up about 25% this year from 2024, according to Tim Boyce, head of weather derivatives for the EMEA region at broker TP ICAP Group Plc.

Read More: Renewables Battling Climate Change Need to Insure Against It

Insurers too are seeing more activity as a result of freak weather. Zurich Resilience Solutions, a unit of Zurich Insurance Group AG, has grown its climate team from two in 2020 to more than 100, as clients seek site assessments, catastrophe modelling and help making assets more resilient to extreme conditions.

Wind turbines damaged by Super Typhoon Yagi in Hainan province, China, in 2024. Photographer: Luo Yunfei/China News Service/Getty Images

“Renewable energy is particularly exposed to climate change,” said Mark Fletcher, head of the firm’s Asia Pacific business. “You have a perfect storm where the climate’s getting worse, and the world is building more and more renewable energy assets in areas that are catastrophe exposed.”

For developers, co-locating different technologies — such as combined solar and wind parks — can help mitigate the impacts of weather volatility. Better geographical diversification of projects and portfolios with a wider spread of energy technologies are other potential defenses, the WMO, International Renewable Energy Agency and Copernicus said in a 2023 study.

“The industry has to look at where to put the assets,” the WMO’s Boscolo said. “Not only looking at the past, but also looking at the future.”