If your investment does not deliver returns above inflation, you’re effectively losing money.

In today’s environment, that bar is set high.

With Nigeria’s benchmark interest rate at 27.5% and inflation hovering around 22.22%, investors face a complex landscape—where risk-free assets now offer relatively high yields and even positive real returns, while riskier assets continue to deliver soaring, but more volatile, returns

While money market and government-backed fixed-income instruments remain strongholds for conservative investors, dollar funds offer currency hedge advantages, and equities and cryptocurrencies carry higher return potential—with higher volatility. Commodities, too, offer a buffer in inflationary cycles.

So, where should you be putting your money in this elevated yield environment?

According to analysts and portfolio managers, the answer lies in building a diversified portfolio tailored to individual circumstances.

One that doesn’t just chase returns but seeks to maximize the Sharpe ratio, which measures how much return you’re earning for each unit of risk you take.

In other words, it’s not just about how much you make but how smartly you earn it. By blending different asset classes—like equities, fixed income, foreign currency funds, and commodities investors can manage volatility, align with their risk appetite, and improve long-term outcomes.

Let’s explore how different asset classes are performing, their prospects, risks, and how they might fit into your portfolio.

Equities remain a compelling option for long-term investors seeking to beat inflation

In 2024, the Nigerian Exchange (NGX) showed impressive resilience, with the All-Share Index (ASI) posting a 37.65% year-to-date gain, outperforming inflation.

About 35 stocks recorded triple-digit YtD gains, and 70 stocks delivered returns exceeding the year’s inflation figures.

Coming into 2025—a year shaped by economic recalibration—the Nigerian stock market has pulled off an unlikely feat: creating the largest pool of billion-dollar stocks.

As of July 31, 2025, at least 17 companies listed on the NGX now boast market capitalizations exceeding $1 billion, collectively worth over $45.15 billion (N69.978 trillion), up by $11.7 billion (N18.2 trillion) in just seven months.

Many of these stocks began the year deeply undervalued. Currency devaluation made them even more attractive to dollar-based investors, rendering them “cheap” in real terms. Improved corporate earnings further reinforced the market’s appeal.

Arnold A. Dublin-Green, CIO of Cordros Asset Management, noted during the Nairametrics Drinks and Mics program: “This isn’t just a rally. It’s a massive opportunity—one of the most compelling contrarian bets in global markets today.”

Similarly, Samson Esemuede, of Zrosk Capital, said: “What we’re seeing in the equities market isn’t just a rally — it’s a recalibration.” He added:

This surge is occurring even without significant participation from institutional investors. “Just reallocate 5% of the N3.1 trillion in money market funds into equities—and see the difference,” he quipped.

Institutional participation remains thin. Pension funds allocate just 11.4% of their N24.10 trillion in assets to domestic equities, while mutual funds commit under 2% to equity and balanced funds.

Recommendation: Equities should make up 20% to 30% of a growth-oriented portfolio, especially for investors with long-term horizons and tolerance for volatility.

Treasury Bills, Bonds, Fixed Income: The allure of “Safe” returns

For conservative investors, Nigerian Treasury Bills (T-Bills) and Federal Government Bonds remain go-to assets for capital preservation and predictable income.

While they may not match equities in capital growth, they offer stability and near-zero credit risk.

But for retail investors, accessing these instruments at attractive yields is becoming increasingly difficult—banks and large institutions often crowd them out at auctions.

According to CBN’s June 2025 auction data:

- T-Bills yield: 17.80% (91-day), 18.35% (182-day), 18.84% (364-day)

- 10-year FGN bonds: 13.90% – 14.70%

- 15-year bonds: 15.40%

- OMO Bills: 23.70% (204-day), 24.30% (102-day)

With the MPR held at 27.5%, analysts expect yields to stay elevated barring a major drop in inflation. Though real returns remain negative, many believe it’s better to stay safe.

Bismarck Rewane, CEO of Financial Derivatives Company, summed it up:

“If you’re not chasing alpha, the best play is to earn 18%–24% with minimal risk and go to sleep.”

Recommendation: Risk-averse investors can allocate 30%–40% of their portfolio to T-Bills and Bonds for income and stability.

To navigate access constraints, consider FGN Savings Bonds, money market funds, or fixed-income mutual funds, which offer easier entry points and better execution for retail investors.

Mutual Funds: Diversification with professional oversight

Mutual funds offer a managed route into various markets—money market, equity, fixed-income, real estate, or dollar-based funds.

Money market mutual funds dominate, with a NAV of N2.77 trillion as of April 2025. These funds preserve capital while delivering attractive yields.

- As of January 2025, Stanbic IBTC Money Market Fund returned 21.22%, beating its benchmark (91-day T-Bill at 18%).

Dollar mutual funds offer FX protection:

According to Nairametrics Research, 34 dollar-denominated funds returned 6.73% YtD (June 2025), down from 7.63% in 2024.

Recommendation: Allocate 15% to 25% to mutual funds depending on your knowledge, liquidity needs, and risk appetite. Use money market funds for Naira income and dollar funds for FX protection.

ETFs: Sectoral exposure with built-in diversification

Exchange-Traded Funds (ETFs) provide exposure to baskets of securities, tracking sectors or indexes with reduced unsystematic risk.

Twelve ETFs are listed on NGX, including:

- Vetiva Banking ETF (NGX Banking Index)

- Vetiva Industrial ETF (NGX Industrial Index)

- NewGold ETF (physical gold exposure)

Performance varies:

- Vetiva Industrial ETF delivered 6.52% in June (MoM), 5.51% (QoQ), and 2.12% YtD.

However, Nigerian ETFs often lack standardized yield reporting.

Recommendation: Allocate 10% to 15% to ETFs, especially for moderate-risk investors seeking low-fee, diversified exposure.

Currencies and Commodities: Hedge, Not Yield

FX and commodities like gold offer protection rather than income.

- Holding dollars (via domiciliary accounts or USD mutual funds) yields little unless invested in dollar bonds.

- Gold ETFs or commodity equities (e.g., NewGold ETF) help hedge against inflation and naira depreciation.

- Gold trades near $2,400/oz YtD, while oil-linked investments remain cyclical and volatile.

Recommendation: Use commodities and FX as 5% to 10% “satellite” portfolio holdings for risk mitigation.

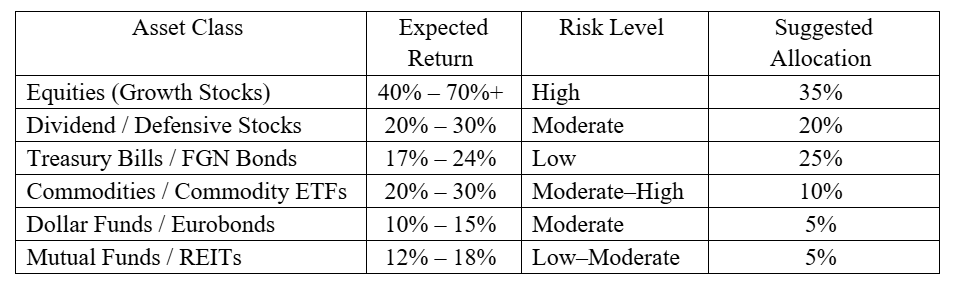

While the proposed allocations offer a blueprint, the ideal mix depends heavily on individual investor preferences particularly risk appetite, investment horizon, and income needs. Integrating these asset classes into a portfolio must also account for target return objectives, market conditions, and the risk-return trade-off of each instrument.

In essence, if an investor targets a 35% annual return, the portfolio should be tilted towards assets with higher return potential, but this comes with increased volatility.

Striking the right blend requires adjusting allocations dynamically, based on both expected market returns and individual tolerance for risk

Sample Portfolio allocation to target 35% return