Most cautious investors would not consider it prudent to have 40% of their portfolio represented by a single asset, but that’s the point reached by the world’s central banks with their holdings of gold.

The 40% calculation is contained in the latest analysis of central bank reserves by Citi, a leading investment bank.

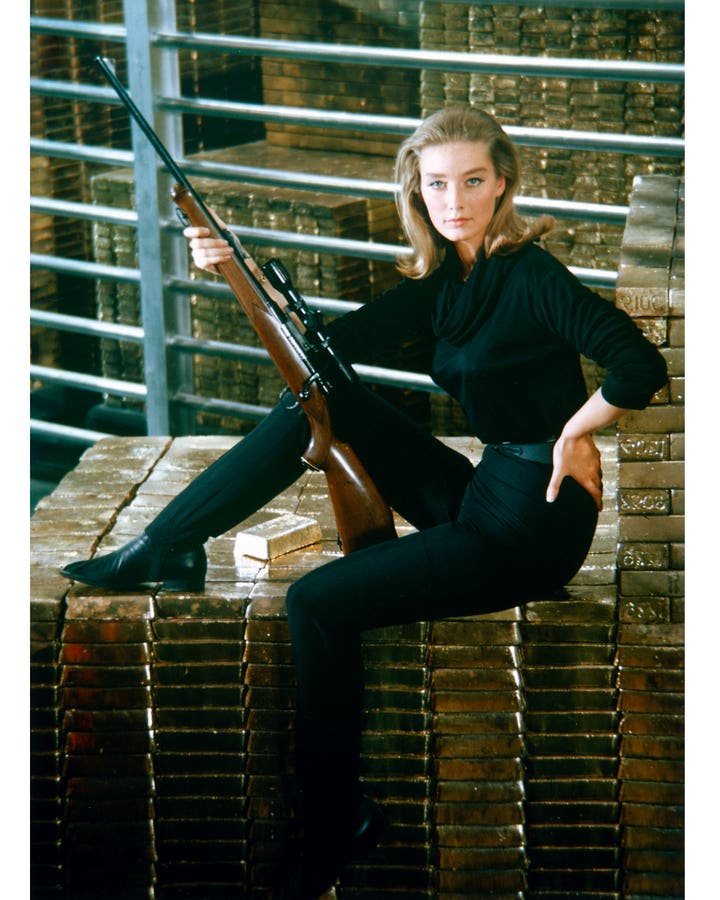

English actress Tania Mallet sits on a pile of gold bullion in Fort Knox, for her role as Tilly Masterson in the 1964 movie ‘Goldfinger’, 1964. Photo by Silver Screen Collection/Hulton Archive/Getty Images)

Getty Images

As recently as three years ago gold held by central banks represented closer to 20% of their reserves.

The rapid increase in the gold price to its latest $3685 an ounce, coupled with a record pace of gold buying by emerging market central banks, are the key factors in gold reaching its highest share of central bank reserves in 30 years.

Citi is not confident that the gold rush can continue with a price decline to $3000/oz expected over the next six-to-12 months, before dipping down to $2700/oz by this time next year.

Those future price tips will be tested later this week when the U.S. central bank, the Federal Reserve, considers whether to cut official interest rates.

Lower rates tend to favour exposure to gold as does economic and political uncertainty, two factors which could overpower Citi’s caution.

Also underpinning a view that the gold price could remain elevated, or even rise further, is the development of new ways to invest in gold, which is a relatively scarce commodity.

Digital Gold

Digital gold, a concept being pioneered by the World Gold Council, an industry lobby group, could increase the market for gold as an investment, while cryptocurrency promoters are considering expanding gold’s role as an asset underpinning stablecoins.

In both cases, gold must first be purchased and stored to enable it to be offered (and traded) as a digital product, effectively creating a new form of demand.

Citi said in the latest edition of its Commodity Market Outlook that gold investment demand had increased this year alongside a weaking U.S. dollar for which the main catalysts were larger than expected tariffs imposed by President Trump, together with increasing medium-term concerns about Federal Reserve independence.

Going up, but surely not forever

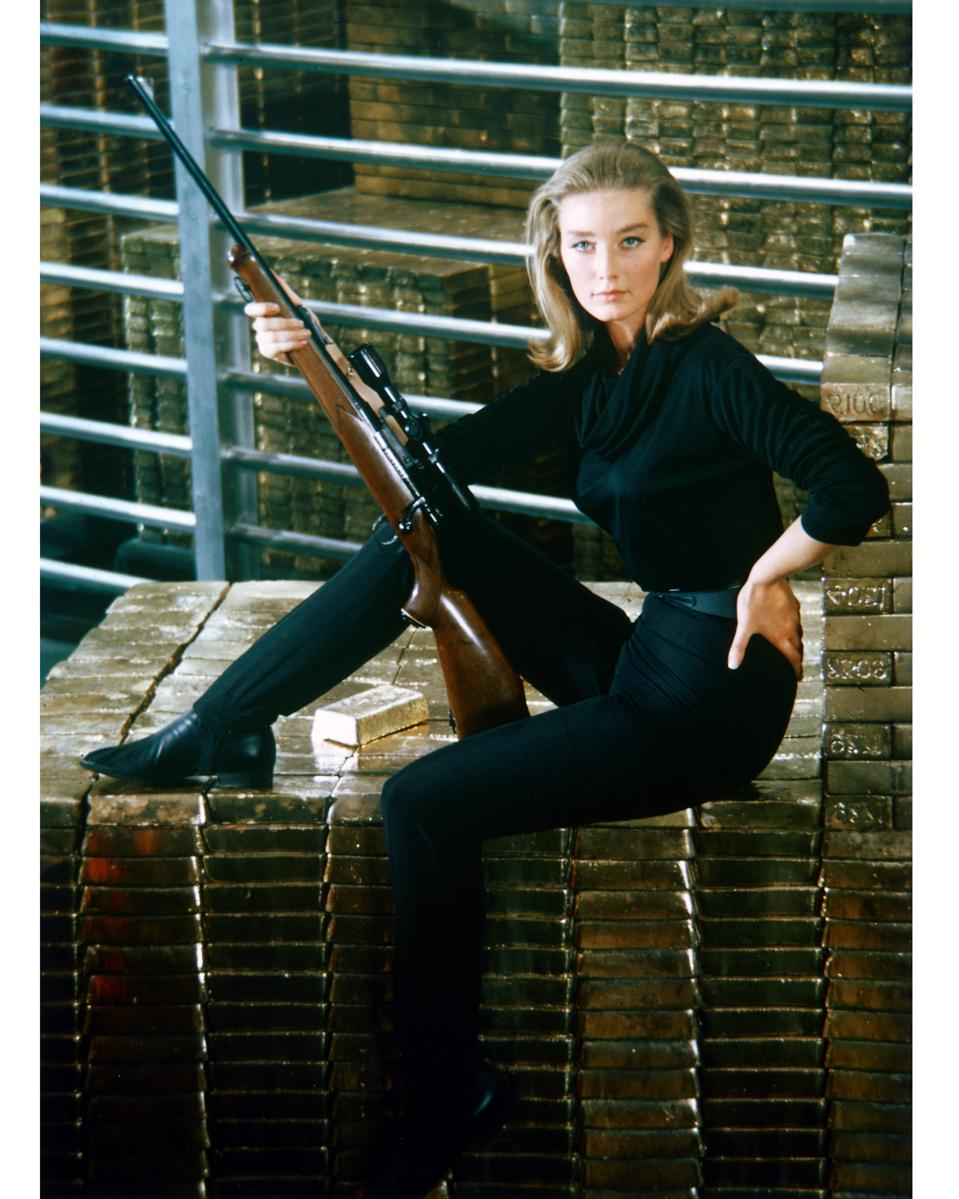

getty

According to Citi’s calculation gold today is trading at $4200/oz using five-forward prices which have led to 50-year high margins for miners of the metal who are generating a profit of $2200 on every ounce produced.

The high margins prompted a keynote speaker at a mining conference this week in Colorado Springs to predict that the next phase of the gold rush would be in the shares of gold miners.

Ronnie Stoferle from Liechtenstein-based Incrementum AG said gold has had a great run but was now at the point when gold and silver mining companies start outperforming.

Stoferle’s optimism is at odds with Citi’s view that gold is edging closer to an inflection point which would signal a steady fall.

This week’s Federal Reserve interest rate meeting will be a critical test for gold and its supporters.