Ready, steady, go signals for real assets

Real assets could be considered as an alternative diversifier to bonds. The advantages of real assets to a 60/40 portfolio can be inflation protection, equity risk diversification, as well as more stable returns. However, these features are balanced with other key factors, such as higher transaction costs and sporadic liquidity for many real assets. Based on the asset characteristics listed in the table in exhibit 1 using a traffic lights system (positive, neutral, negative), we see that commodities score the highest across its real asset peers offering a high degree of flexibility on holding periods.

Commodities can be accessed via broad-based indices, such as the Bloomberg Commodities Index (BCOM) or Bloomberg Enhanced Roll Yield (BERY), which offer a rolling exposure to a basket of futures contracts.

BERY closely tracks the BCOM with additional features of allocating to multiple futures contracts to mitigate negative roll yields in static nearby contracts and dynamically tilt weights based on the shape of the forward curve to capture backwardation or carry returns. A long-only investment in commodities, across energy, industrial metals, precious metals, agriculture, and livestock sectors, has delivered inflation protection in both macro and shock regimes, as well as portfolio diversification.

Real assets are bond diversifiers offering inflation protection

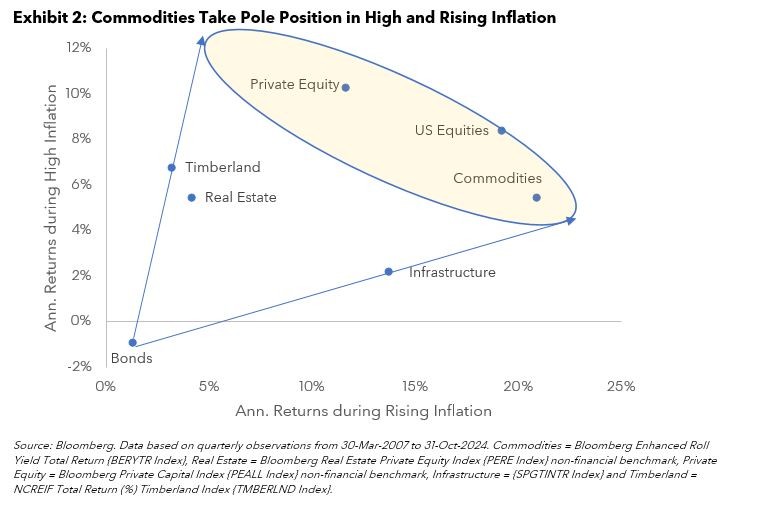

Bonds are deemed risk diversifiers to equities amongst traditional assets. However, it is during inflationary periods that bonds have failed to deliver their risk mitigation profile for many portfolios. It is in these environments of high and rising inflation, as shown in exhibit 2, that commodities, private equity and US equities are optimal candidates. Commodities have historically delivered the highest annual returns during rising inflation measured by quarterly changes in 10y US breakeven and performed strongly when inflation has been high based on US CPI YOY levels.

Real assets can help offset negative bonds performances during rising and high inflation. US equities usually already feature in asset portfolio hence the most efficient real assets candidates for inflation protection are private equity and commodities. However, there are differences to note when looking at times of inflation surprises.

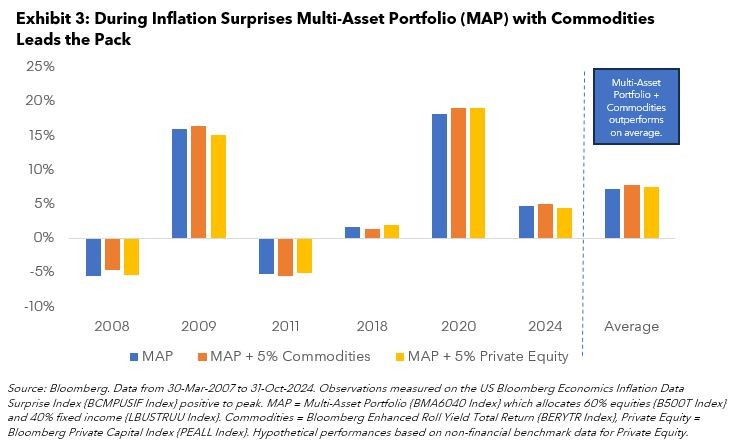

Don’t stall in unexpected inflation surprises

Using US Bloomberg Economics Inflation Data Surprise data {BCMPUSIF Index}, we can identify six historical periods when inflation has been unexpectedly high. In exhibit 3, we show the performances of the multi-asset portfolios (blue bars) including a 5% allocation to commodities (orange bars) and private equity (yellow bars) during these surprisingly high inflationary episodes. On average, the portfolio including commodities boosted the multi-asset portfolio returns by 7%. It is in these scenarios where commodities indices offering daily, tradeable prices can allow portfolio managers to capture gains and potentially redeploy capital to cheap, distressed assets. Whereas the private equity performance will be mark to market based on quarterly valuations. This highlights the benefit of accessing daily liquidity in commodity indices over the inflexibility of quarterly valuations in private equity.

Get real with commodities to get ahead

Real asset investors have a choice including commodities, real estate, private equity, infrastructure, and timberland. When we compare the key characteristics, we find that commodities take pole position relative to its real asset peers. Further, in its role as a diversifier to bonds, commodities alongside private equity have historically delivered strong returns in periods of high and rising inflation. Although, when it comes to scenarios of unexpected inflation periods, commodities indices have the further advantage of daily liquidity with manageable bid offer spreads and lower transaction costs which allows investors to harvest gains and put those profits back to work. A commodities investment alleviates the rigidity of lengthy lock-up periods with quarterly marks inherent with investing in other real assets. Finally, there is transparency on what has been driving returns and attribution analysis in the commodities market. Real assets require substantial capital for investment while commodities indices are available in fully funded (total return) and unfunded (excess return) formats.

Don’t be caught in a cloud of smoke when other asset classes stall – consider commodities for your real asset allocation.