Jeremy Poland

I’ve continuously pounded the table on the long-term case for energy, and believe that we are about to see a relative momentum shift into the group. If you believe energy will remain a critical driver of GDP, and expect momentum to pick up, then you might want to take a look at the FT Energy Income Partners Enhanced Income ETF (NYSEARCA:EIPI). This is an actively managed exchange-traded fund that offers a compelling combination of high regular income distributions and long term capital appreciation.

EIPI is managed by the advisory firm Energy Income Partners, LLC, which has a 16-year track record of managing energy-related investments. Through its investment process, EIP seeks to balance yield, growth and valuation when considering investments. Companies are chosen based on their ability to sustain cashflows, their payout ratios, their ability to grow those dividends, and their valuation metrics.

EIP’s investment philosophy revolves around three key pillars. The first is yield analysis meant to Identify companies with either (A) predictable cash flows and high dividend payout ratios, or (B) cyclical cash flows capable of sustaining dividend payouts. The objective is to provide a reliable stream of income for investors. The second pillar is on growth, whereby: EIP focuses only on companies with rising earnings and cash flow per share. The third pillar is around the potential for improvable valuations, where unlocking value might result from business restructuring, a change in management, adjustments in the mix of asset ownership, or even from changes in government policy.

To further increase income generation, the fund employs a strategic covered call writing strategy which includes writing ‘covered’ calls on the equity securities of the fund, and writing ‘uncovered’ calls on the energy indexes and energy-correlated exchange-traded funds (ETFs). In addition to the income generated from buying dividend-paying stocks, the fund will receive a premium for the sale of those covered call options.

A Look At The Holdings

The Fund’s portfolio is fairly diversified. The largest position makes up 8.42% of the portfolio. This is generally a top-heavy fund, which normally I’m not a fan of. But given how badly Energy has lagged and the valuations of some of these holdings, I actually don’t mind the more concentrated approach here.

The combination of these positions alongside the covered call writing results in a 30-Day SEC yield of 4.93%. Quite competitive with upside potential on the equity side, especially given valuation metrics like Price to Earnings at a very reasonable 14.8x.

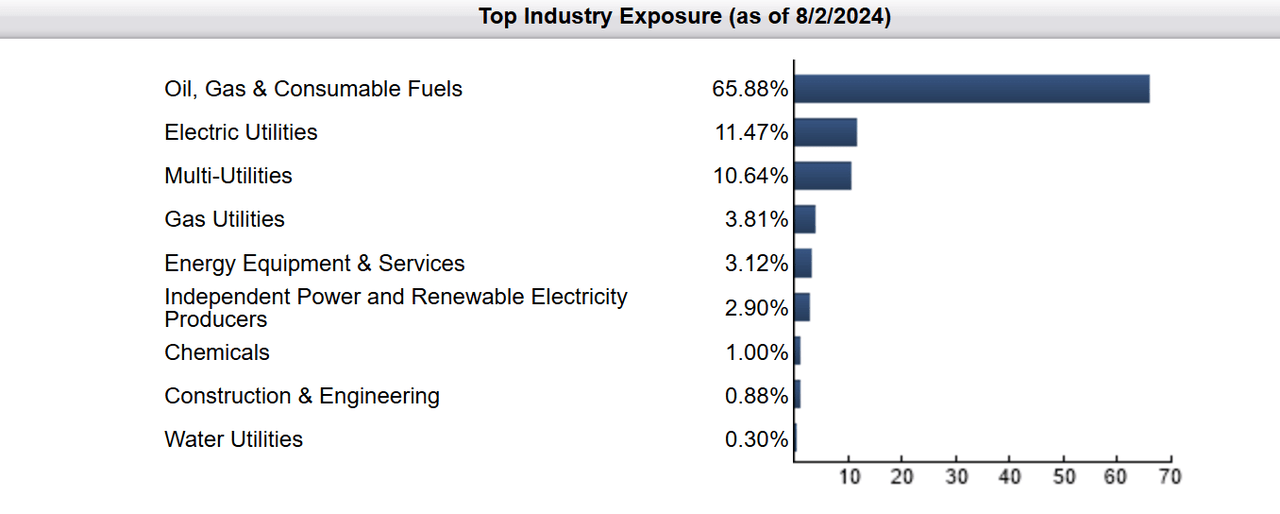

Sector Weightings

By industry exposure. Oil, Gas & Consumable Fuels make up the largest allocation at around 66% of the fund. Electric Utilities (which I’m particularly bullish on) makeup 11.47% followed by Multi-Utilities and Gas Utilities. Overall, it’s what you’d expect from a fund like this.

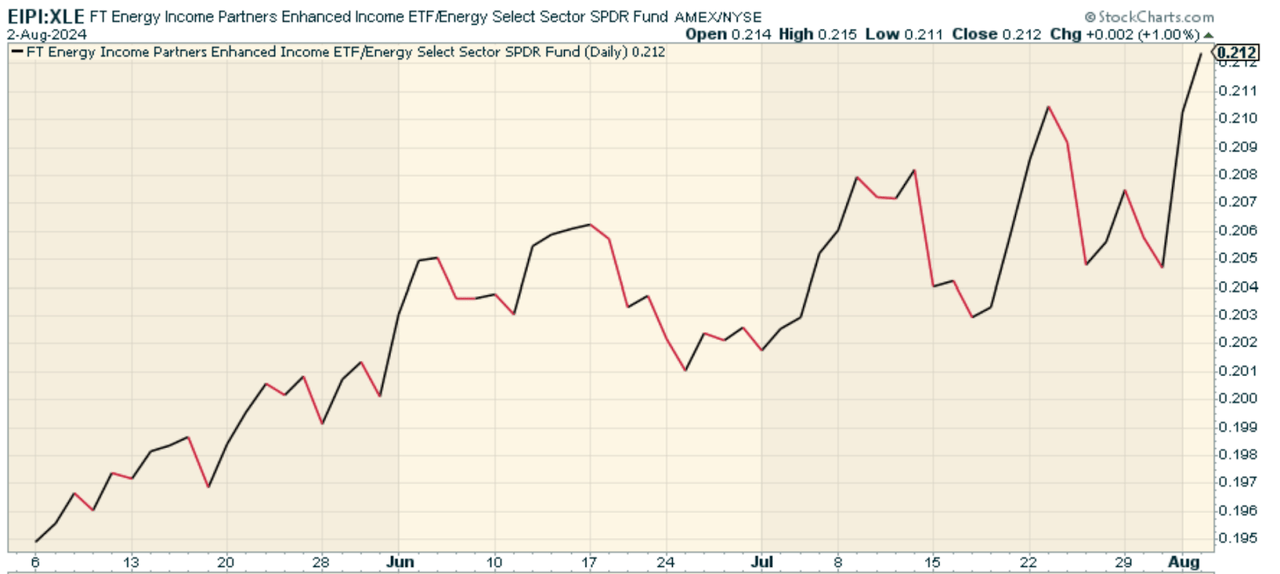

Peer Comparison

One fund this is worth comparing against is the Energy Select Sector SPDR Fund (XLE), which follows the Energy Select Sector Index and exposes you to a somewhat broader swath of energy companies, including exploration and production companies, integrated oil and gas companies, and energy equipment and services companies. When we look at the price ratio of EIPI to XLE, we find that EIPI has nicely outperformed. This may have more to do with the covered call approach though as it relates to total return. Good to see.

Pros and Cons

On the positive side, there’s some nice yield here, the portfolio appears to be attractively valued, and it’s outperformed broader energy. It’s a pure play on energy that is based on fundamentals with what appears to be a robust screening process overall. This should hopefully result at least in a chance for future outperformance, making the portfolio attractive for long-term investors.

The problem? Despite my own bullishness on the group, I recognize that the energy sector is prone to risks related to geopolitical tensions, regulatory changes, environmental challenges, and the shift to renewables. All of this is likely to disrupt the operations of traditional energy companies, pushing them to diversify their businesses and perhaps dilute core competencies.

Finally, investors should also look out for the volatility of energy prices themselves, which can strongly influence the returns and valuations of companies in the sector. Supply and demand imbalances, macroeconomic conditions, and technological developments can all play a role in driving fluctuations.

Conclusion

For those seeking income and capital appreciation from the energy sector with an ETF offering, the FT Energy Income Partners Enhanced Income ETF offers an attractive alternative. Unlike many of its competitors, EIPI has an active management strategy, and utilizes a covered-call writing strategy to juice yield. I think it’s a good fund from what I’ve seen overall, and if I’m right about the tailwind to come in energy stocks, this should continue to hold up well.