Ibrahim Akcengiz

By Brian Luke

Following one of the more politically volatile months of this election year, commodity performance has delivered mixed results. The S&P GSCI Gold rallied 4.3%, while the S&P GSCI Crude Oil fell by the same amount. However, both gold and oil remained firmly up on the year, registering gains of 17.3% and 16.5%, respectively. Overall, they pared year-to-date gains back by 3.5%, finishing up 7.2%. With three months until the general election, we take a look at commodity performance during this crucial period in U.S. politics.

During the Republican National Convention, participants cheered at the prospect of the economic policies touted by the GOP nominee, Donald Trump. Chief among them are tariffs on foreign goods and the desire to ramp up production of U.S. oil. Both policies, if enacted, could have direct, albeit long-term, effects on the commodity markets. The likelihood of a Republican executive branch could help explain the steep moves during July in the S&P GSCI Crude and the S&P GSCI Gold. The potential increase in the supply of oil could help explain the fall in the S&P GCI Crude in the month; though countermeasures by OPEC+ and geopolitical events have contributed to volatility, according to S&P Commodity Insights. You can read more on what is driving the oil market as well as the outlook here and here. The prospect of increased tariffs and budget deficits could have contributed to inflationary worries, helping propel the S&P GSCI Gold up for the month.

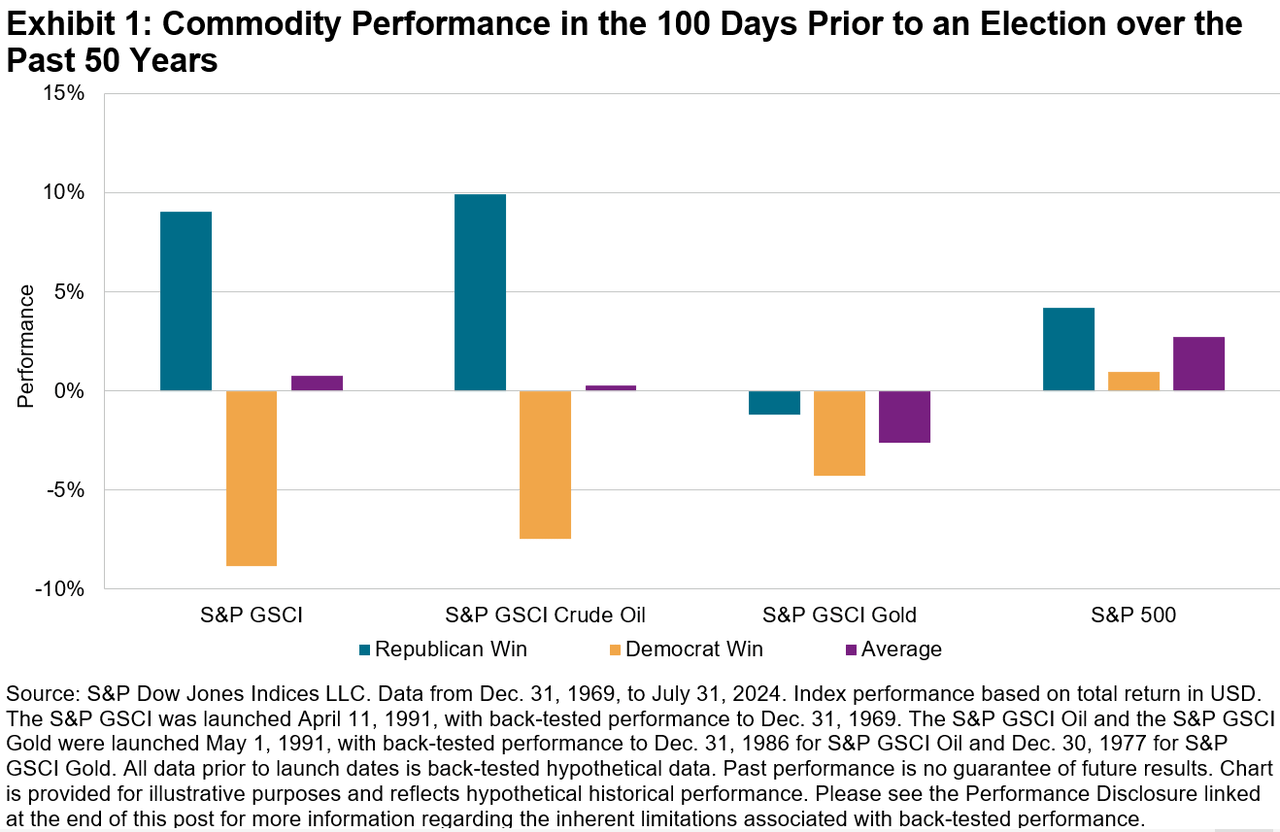

Looking back over the past 50 years of commodity performance during the run-up to presidential elections and the one-year following them highlights stark differences based on which party goes on to take office. We measure both the 100 days leading up to an election as well as the one-year performance following election day. On average, the S&P GSCI has historically trended positive leading up to an election, and it has rallied 9% prior to a GOP win but retreated 8.8% before a Democrat has gone on to win (see Exhibit 1).

Regardless of winner, commodities have historically performed well, averaging 11.2% in the year following an election. Expanding across asset classes, commodities have outperformed stocks in the year following a GOP win, with oil contributing the largest average return of 26.7%, dating back to the 1988 election when oil futures first entered the S&P GSCI (see Exhibit 2). Historically speaking, the pursuit of expanding oil production by Republicans, or pursuing a policy to “drill baby drill,” has led to substantial outperformance in the S&P GSCI Crude Oil, running contrary to what potential supply increases would do to dampen prices.

Balancing geopolitical and inflationary risks through a diversified commodity index like the S&P GSCI has historically led to less volatility than single commodities, while achieving positive correlation to inflation. The S&P GSCI has historically achieved returns in excess of 11% one year following an election, outperforming the S&P GSCI Gold with nearly half the volatility of the S&P GSCI Crude Oil over a three- and five-year period. Looking at the three-year annualized risk-adjusted returns, the S&P GSCI has outperformed the S&P 500 (see Exhibit 3).

Disclosure: Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures, please visit www.spdji.com/terms-of-use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.