Commodities are often touted for their diversification benefits. Because their prices mainly depend on the balance of supply and demand, they often show very low correlations with other asset classes.

Commodities are traditionally defined as raw materials or other basic ingredients used in manufacturing and industrial processes. As basic materials, they’re essentially interchangeable with other commodities of the same type. In addition to their diversification benefits, commodities can also be a useful hedge against inflation. Commodities themselves are a major part of most inflation indexes, and it makes sense that their prices tend to rise when inflation is increasing. Some commodities also show seasonal price movements, which can affect returns over shorter periods.

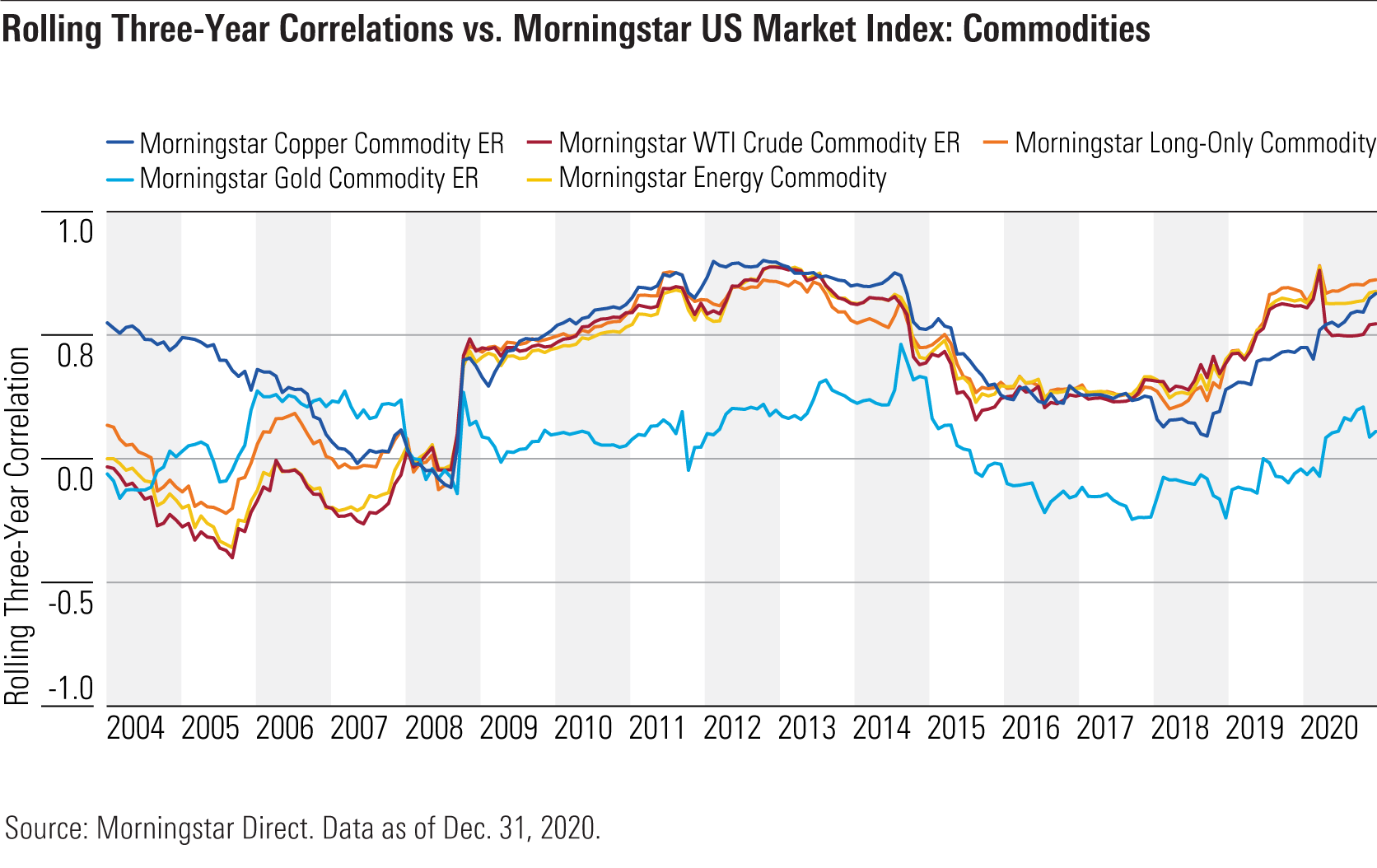

But in our recent examination of asset-class correlations, the “2021 Diversification Landscape,” we found that commodities have been moving more in tandem with other asset classes in recent years.

2020 Correlations for Commodities

Commodities provided a measure of protection during the COVID-19-driven bear market in early 2020, but anything energy-related suffered even sharper losses than the overall market as the price of oil collapsed. As a result, the Morningstar WTI Crude Commodity ER Index dropped 54.8% in the first quarter, and the Morningstar Energy Commodity TR Index shed 48.9%. Other commodities held up considerably better.

Diversified commodity indexes vary significantly, and the level of exposure to energy often drives their results. The Morningstar Long-Only Commodity Index has a 40% weighting in the energy sector but also measures the performance of futures contracts on other commodities, including agriculture, livestock, and metals. The index was down about 25.5% for the quarter. Copper also held up relatively well, but gold excelled with only a 2.3% loss.

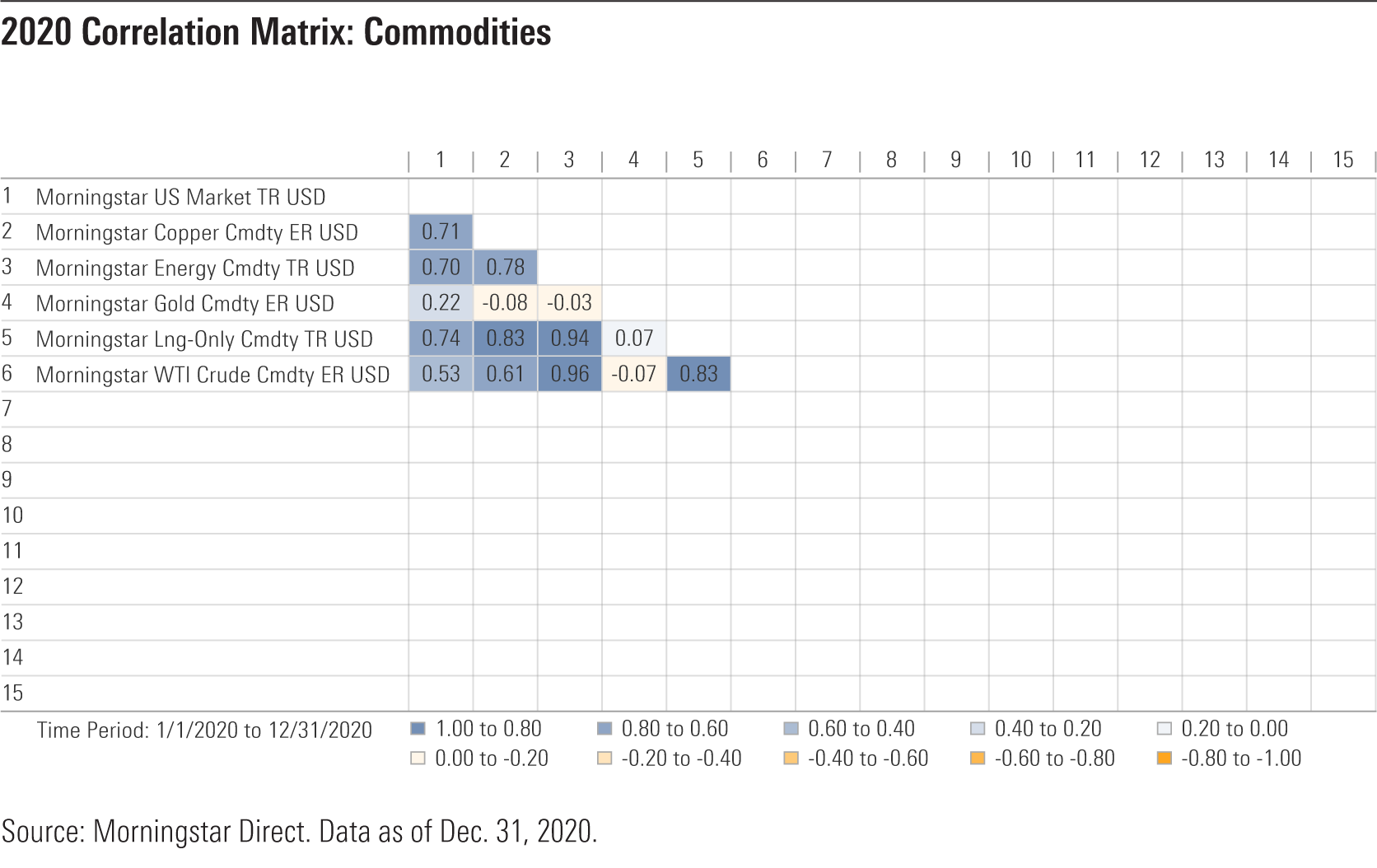

For 2020 overall, returns (and correlations) showed a similar pattern. Energy-related benchmarks showed the highest correlations with the broader equity market, and correlations for copper also increased relative to previous levels. Gold’s correlation with the overall equity market edged up from levels shown in previous years but remained quite low, at 0.22.

Longer-Term Trends for Commodities

Over time, correlations for most commodities have generally increased versus the Morningstar US Market Index. The Morningstar Long-Only Commodity TR Index, for example, showed a correlation of 0.74 when compared against domestic stocks in 2020, up from 0.43 over the trailing 20-year period. This partly reflects lower collateral yields (which are based on short-term Treasuries) over the years and the growing contribution of the spot and roll-yield components in these benchmarks’ overall returns–with the latter two being more equitylike.

Another possible explanation is increasing asset flows from institutional investors. Paradoxically, investors seeking out diversification may have caused commodities to behave more like traditional financial assets. As mentioned above, gold has also been moving slightly more in tandem with the equity market, but its correlation coefficient has remained relatively low.

Historically, commodities have generally been a strong hedge against inflation, but it’s not clear if this will hold true in the future. Over the past several years, major commodity indexes have actually had a slight negative correlation with inflation. However, commodities have continued to show negative correlations versus market volatility (as measured by the CBOE VIX Index). Other commodities (except for gold) have also had negative correlations with bond market indexes, making them a potentially useful hedge during periods of rising interest rates.

Portfolio Implications

As investors increasingly treat commodities as financial assets, their value as portfolio diversifiers has diminished. Gold is a notable exception and should continue to fill a valuable role as a buffer against equity market volatility. Other commodities, meanwhile, can still provide some diversification benefits for bond-heavy portfolios. It’s also worth noting that the way investors access commodities plays a major role in the potential outcomes. Roll yield, seasonality, and implementation decisions can all have a significant impact on results.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.