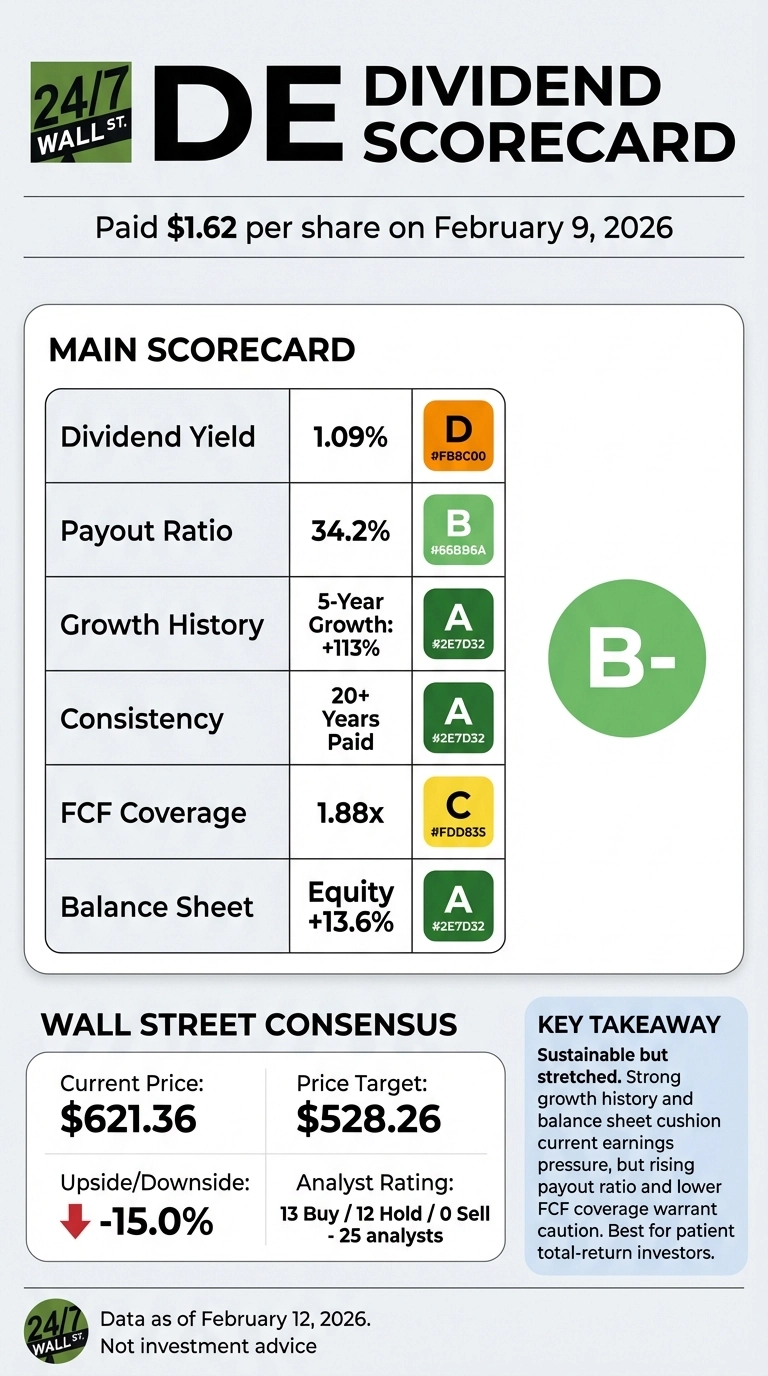

Deere & Company just delivered its latest quarterly dividend of $1.62 per share to shareholders on February 9, 2026, marking the fourth consecutive quarter at this elevated payout level. With shares trading at $621.36, the dividend yields a modest 1.09%. But beneath this steady payment lies a more complex story about dividend sustainability during one of the harshest agricultural downturns in recent memory.

The Dividend Growth Trajectory

Deere has assembled an impressive dividend growth record, with annual payouts climbing from $3.04 in 2020 to $6.48 in 2025—a 113% increase over five years. The company maintained its $1.62 quarterly dividend throughout all of 2025, representing a 5% increase from the prior year’s annual total of $6.18.

This consistency matters. The equipment manufacturer has paid dividends every quarter for over two decades, with particularly aggressive growth since 2021. The current $1.62 quarterly rate stands 7.4 times higher than the $0.22 quarterly payment from 2003, demonstrating long-term commitment to shareholder returns even through agricultural cycles.

The Earnings Reality Check

Here’s where the picture gets concerning. Deere’s net income collapsed 29% year-over-year in fiscal 2025, falling to $5.027 billion from $7.1 billion in fiscal 2024. That’s a 50.5% contraction from the fiscal 2023 peak of $10.166 billion.

Revenue followed a similar trajectory, declining to $44.665 billion in fiscal 2025 from $50.518 billion the prior year. The company’s operating margin compressed from 22.6% to 18.8% as pricing power weakened and costs remained elevated.

The dividend payout ratio tells the real story. Deere paid $1.72 billion in dividends against $5.027 billion in net income during fiscal 2025, pushing the payout ratio to 34.2%. That’s up sharply from 22.6% in fiscal 2024 and 14% in fiscal 2023.

Cash Flow: The Critical Metric

Operating cash flow provides a more complete view of dividend sustainability than net income alone. Deere generated $7.459 billion in operating cash flow during fiscal 2025, down 19% from the prior year’s $9.231 billion.

After subtracting $4.228 billion in capital expenditures, free cash flow came to $3.231 billion—barely 1.88 times the $1.72 billion dividend payment. That coverage ratio has deteriorated significantly from 2.75x in fiscal 2024 and 2.88x in fiscal 2023.

The first quarter of fiscal 2025 highlighted the pressure. Deere posted negative operating cash flow of $1.132 billion while still paying $403 million in dividends. The company relied on working capital releases and balance sheet strength to maintain the payment during this seasonal trough.

Balance Sheet Strength Provides Cushion

Deere’s financial position remains solid despite earnings pressure. Total shareholder equity increased 13.6% to $25.95 billion in fiscal 2025, while retained earnings grew to $59.676 billion. Cash and equivalents stood at $8.276 billion, up 13% year-over-year.

The debt-to-equity ratio improved from 2.87x to 2.47x, with total debt declining to $63.936 billion. This deleveraging provides flexibility, though the company still carries substantial debt relative to many industrial peers.

Interest expense of $3.17 billion consumed 7.1% of revenue in fiscal 2025, up from 4.1% in fiscal 2023. This rising debt service burden directly impacts the earnings available for dividends.

Historical Context and Cycle Considerations

Deere has navigated dividend challenges before. During fiscal 2022, free cash flow coverage dropped to just 0.69x, well below the current 1.88x level. The company maintained its dividend through that period and subsequently increased it.

In fiscal 2019, Deere actually generated negative free cash flow while paying $943 million in dividends, relying entirely on balance sheet strength. The current situation, while challenging, remains far from those crisis levels.

Valuation and Total Return Perspective

At $621.36, Deere trades at a trailing P/E of 33x and forward P/E of 37x. The stock has surged 33.5% year-to-date and 32.2% over the past year, suggesting investors are pricing in eventual agricultural recovery rather than current earnings reality.

The 1.09% dividend yield ranks below the industrial sector average and well below what income-focused investors typically seek. However, the five-year total return story incorporates substantial capital appreciation alongside modest dividend income.

The Verdict on Dividend Quality

Deere’s dividend deserves a B- grade—sustainable but stretched. The company has demonstrated multi-decade commitment to dividend growth and possesses the balance sheet strength to maintain payments through this downturn. The 1.88x free cash flow coverage provides an adequate cushion, particularly given the company’s $59.7 billion in retained earnings.

However, the rapidly expanding payout ratio and compressed cash flow coverage signal caution. If the agricultural downturn extends or deepens further, dividend growth will likely pause. The current $1.62 quarterly rate appears secure barring a severe deterioration, but investors seeking reliable dividend growth should monitor fiscal 2026 cash flow trends closely.

For income investors, the 1.09% yield offers minimal current income. The dividend’s value lies primarily in its growth potential once agricultural markets stabilize, making this more appropriate for patient total-return investors than those requiring immediate income.

If You’ve Been Thinking About Retirement, Pay Attention (sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance, and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor. Here’s how:

- Answer a Few Simple Questions.

- Get Matched with Vetted Advisors

- Choose Your Fit

Why wait? Start building the retirement you’ve always dreamed of. Get started today! (sponsor)