Tankers markets remain unaffected by the rising tension in the Middle East, with freight prices showing little changes. Meanwhile, top executives in the US chemicals industry saw an increase in median pay in 2023, reversing a decline from 2022. Additionally, the South Korean government is working toward formalizing a free trade agreement, European LNG price surges and sulfuric acid market price correction amid global economic uncertainty are in focus this week.

1. Tanker markets shrug off rising Middle East tensions

What’s happening? Bearish sentiment across freight markets has proved largely unshaken by escalating tensions in the Middle East, as expectations of an Iranian retaliation against Israel have done little to lift prices. Platts, part of S&P Global Commodity Insights, assessed the rate to carry a 140,000 metric ton cargo from the Persian Gulf to UKC at $20.81/t Aug. 13, down from $21.07/t July 31 after the back-to-back assassination of top Hamas and Hezbollah officials, while clean tanker rates have stayed broadly stable as traders have pointed to steady tanker flows around the Cape of Good Hope and limited movement in war risk premiums.

What’s next? Markets remain watchful for signals of any retaliation that could tip the region closer to an all-out conflict with broader implications for energy infrastructure and trade flows. Yet as tense relations and tit-for-tat attacks between Israel and Iran drag on, traders have proved less responsive to isolated incidents and pointed to mutual interests in keeping oil flowing. “Iran would have little to no strategic gain by purposefully attacking oil infrastructure in the region,” said Jim Burkhard, Commodity Insights’ vice president of oil markets, energy and mobility. “That is not to say it won’t happen, perhaps by accident or on purpose. But such attacks would spur responses against Iran.”

2. US chemical industry executives expect mixed compensation trends in 2024

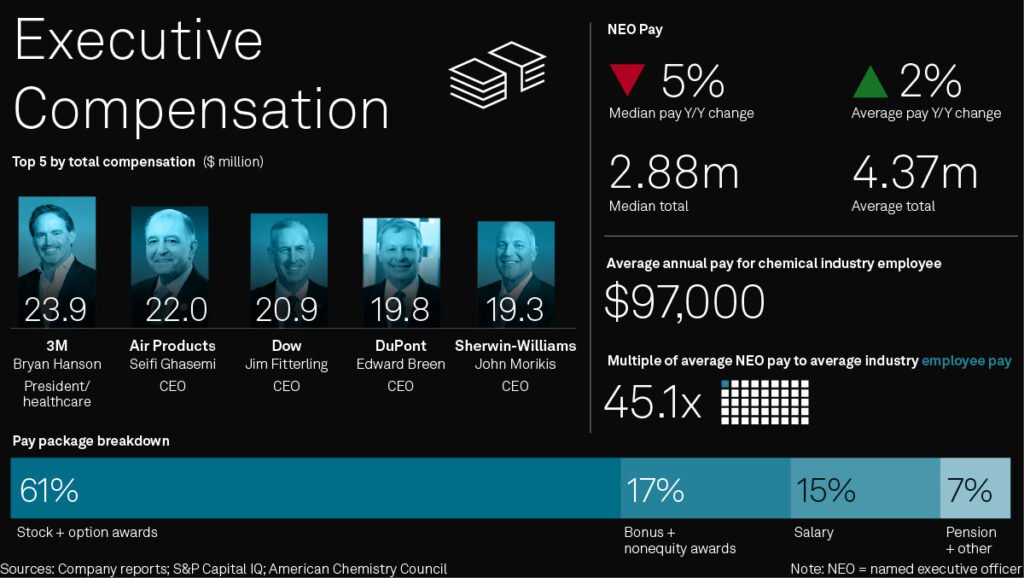

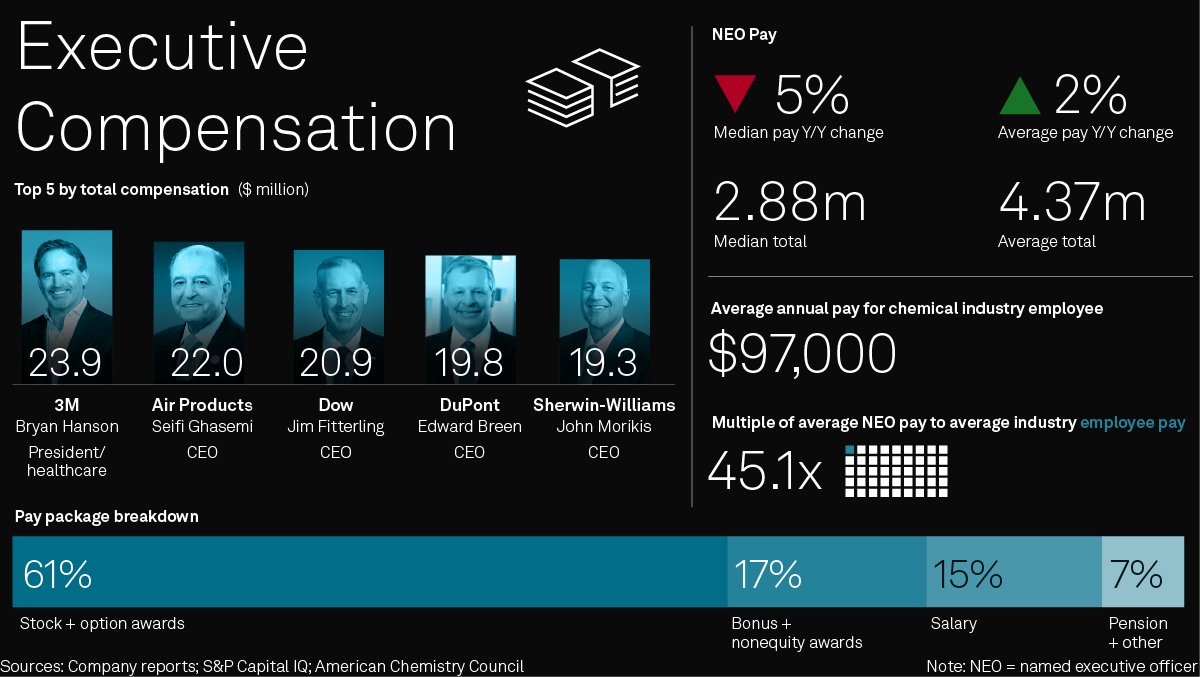

What’s happening? Median pay for the US chemical industry’s top executives increased in 2023, reversing a decline from 2022, according to a survey by Chemical Week by S&P Global. Median total compensation for named executive officers at US publicly traded chemical companies increased by 5% to about $2.73 million from 2022 to 2023. This compares with a 2% drop in median pay from 2021 to 2022. Among the 197 NEOs included in the survey, some 110 saw an increase in total pay in 2023, while 84 experienced a decline and three executives had flat pay.

What’s next? Executive compensation is generally closely tied to equity markets. Broader equity market indices generally fared better than the CW75 — and index of chemical stocks compiled by Chemical Week – in 2023. The S&P 500 index, for example, increased by 24.3% in 2023. But the rising tide of equities lifted executive pay, at least at the median. As of 2024, minimal fluctuations have been observed in the CW75 index, suggesting another mixed year for compensation. However, market sentiment can shift rapidly, as recent gyrations in global equities have demonstrated.

3. South Korea refiners hope for cheaper sour crude as Seoul aims to fully implement FTA with GCC nations

What’s happening? The South Korean government aims to complete the necessary procedures to fully implement a free trade agreement with Gulf Cooperation Council members by September. The government plans to finalize an economic impact evaluation, seek ratification from the National Assembly and complete other administrative procedures for the FTA’s entry into force. The goal is to formally implement the FTA before the end of 2024.

What’s next? This FTA could enable South Korean refiners to procure Middle Eastern sour crude at a cheaper price, thereby improving their margins. The formal implementation of the FTA with major Middle Eastern crude producers would give South Korean refiners an advantage in purchasing Persian Gulf sour crude at a lower cost. Currently, Seoul levies a 3% tariff on imported crude oil, but this is either abolished or reduced for countries with FTAs. For instance, the South Korea-US FTA allows cost cuts by up to $2/b for WTI Midland crude purchases.

4. European price surge threatens LNG flows to Asia as winter approaches

What’s happening? Arbitrage opportunities for LNG between Europe and Asia are shrinking as European prices surge while demand remains low. Despite the challenging market, Asia still received 43% of US LNG exports in July, up from 32% in July 2023. Meanwhile, Europe’s share has steadily declined, hitting its lowest level since September 2021.

What’s next? European LNG demand may rise as winter approaches, potentially attracting more shipments from September onward. However, geopolitical risks, unplanned maintenance, and possible heat waves in Asia could disrupt this shift. Traders might continue to favor Asia due to stronger demand and better price hedging, even as Europe’s winter needs loom.

5. Sulfuric acid market on edge amid global economic uncertainty

What’s happening? Sulfuric acid average spot prices have hit recent highs of $152.50/mt CFR Brazil and $85.50/mt FOB West Europe. These price increases can be attributed to constrained supply due in part to a shortage of liquid sulfur in Europe and persistent demand from major consumers in North Africa. Excluding the jolts from the pandemic and Russia’s invasion of Ukraine, when average prices soared above $280/t CFR Brazil and $230/t FOB West Europe, average prices last peaked at $132.50/t CFR Brazil and $85/t FOB West Europe in late 2018 and early 2019, respectively.

What’s next? Following the volatility in global financial markets, participants in the European sulfuric acid market have reported little immediate impact but many say they are staying vigilant. The participants anticipate the potential for a price correction following the steady price increases observed throughout much of 2024.

Reporting and analysis by Kelly Norways, Thomas Washington, Vincent Valk, Philip Vahn, Sakshi Jalan, Matt Hoisch