Grain loads at CBH’s Geraldton terminal in WA, a major exporter of iron and grain in Australia’s commodity-focused economy. Photo: CBH Group

THE WORLD still has a long way to go in breaking commodity dependence, a situation where a country makes more than 60 percent of its merchandise export earnings from commodities.

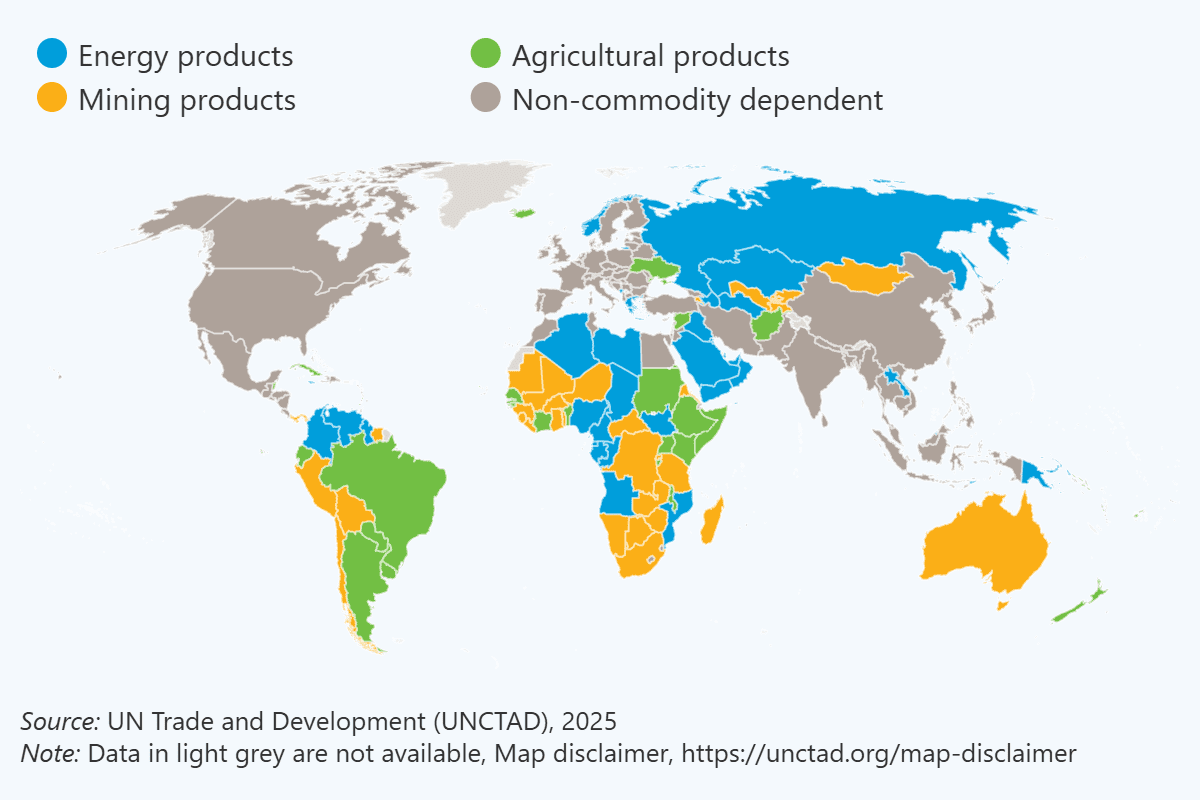

Such goods can be broadly categorised into three categories: energy, mining and agriculture, be it the wheat or coffee that we consume, or metals like copper and lithium that help power our daily lives.

But entrenched reliance on these primary products, long been of global concern, hinders industrial development and threatens countries’ fiscal stability when global prices go volatile.

Alarmingly, commodity dependence is prevalent across structurally weak and vulnerable economies, affecting more than 80pc of least developed countries and landlocked developing countries, and roughly 60pc of small island developing states.

More broadly across developing countries, two thirds of them, or 95 out of 143, remained commodity dependent during 2021 and 2023, according to the latest edition of The State of Commodity Dependence report released July 21 by UN Trade and Development.

The dependence is particularly heightened in Middle and Western Africa countries, most of which earned over a staggering 80pc of their export revenues from primary commodities.

Similar patterns also showed up in Central Asia and South America, where resource wealth plays a central role in trade.

The report warns that without more efforts to diversify economies and add value, countries risk squandering opportunities to translate their raw material wealth into engines of sustainable and resilient growth.

Commodity trade still matters

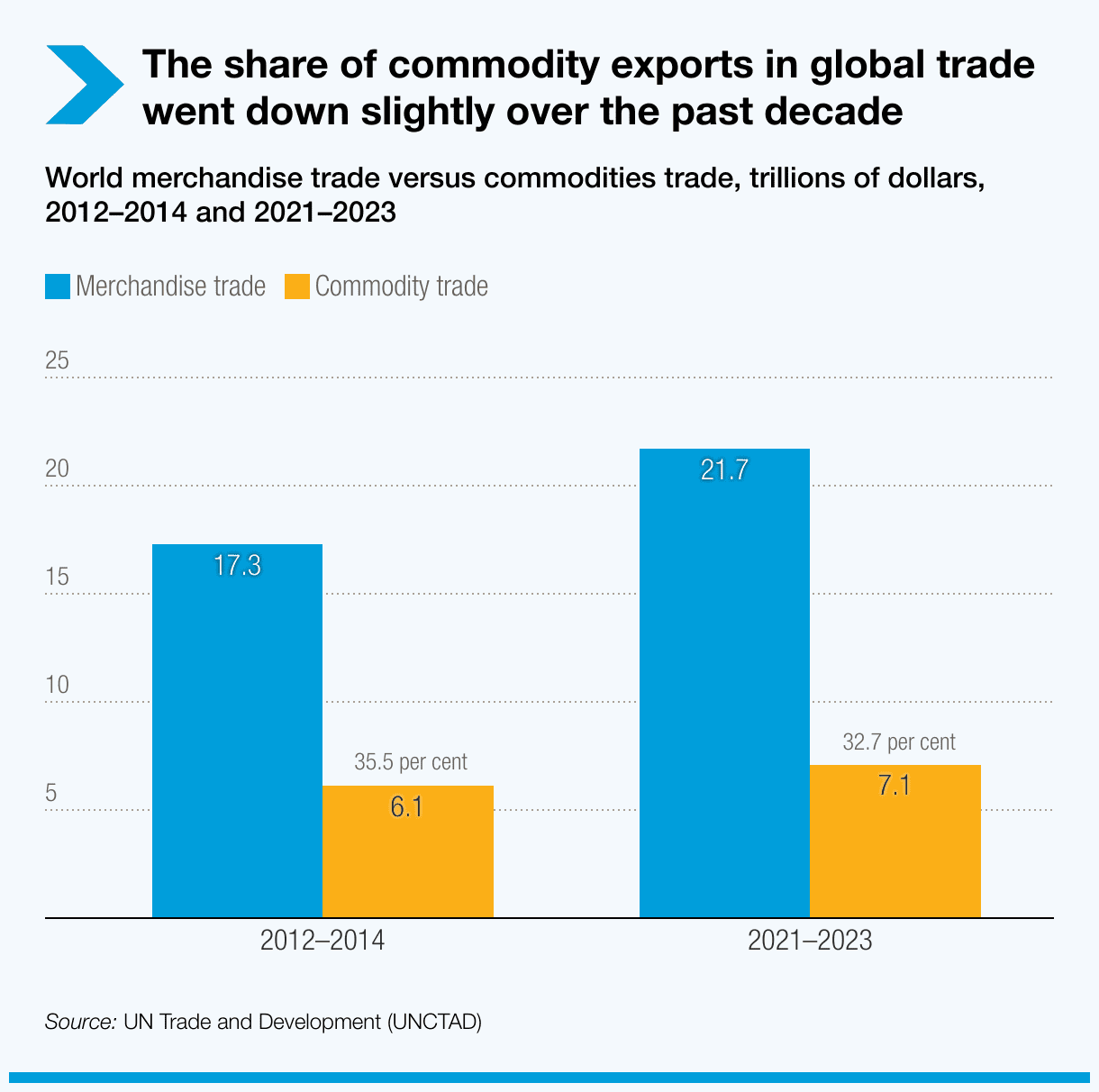

Commodity exports remain central to the global economy, accounting for 32.7pc of international trade in value terms between 2021 and 2023, down from 35.5pc a decade earlier.

Comparing the same periods, the value of world trade in goods went up 25.6pc, while that of commodity trade expanded relatively slowly at just 15.5pc.

The shift underscores that countries mainly exporting raw materials could miss out on the broader benefits of global trade, increasingly driven by diversification, innovation and value-added production.

Energy down, ag and mining up

Energy products continued to dominate global commodity trade, making up 44.5pc of the total value during 2021-2023.

But that share was significantly smaller than a decade before at 52.1pc, largely due to lower oil prices and shifting energy demand – including the transition to renewable sources – reshaping global trade flows.

Meanwhile, agricultural commodity exports grew by 34pc to reach $2.3 trillion, most of which came from food items.

Mining products, such as minerals, ores and metals, followed closely with a 33.4pc increase in export value averaging $1.65 trillion annually during 2021-2023.

Figure 2: Commodity dependence by dominant export product group. Source: UNCTAD

Asia leads on exports, Africa’s position weakens

Between 2021 and 2023, Asia and Oceania maintained their position as the world’s largest source of commodity exports, comprising 37.1pc of the global total.

Western Asian countries contributed a significant share, with the United Arab Emirates and Saudi Arabia responsible for more than half of the sub-regional total.

In contrast, Africa’s commodity exports were down 5.6pc, primarily due to a decrease in energy products from Nigeria, Angola, and Algeria, all leading oil exporters on the continent.

As a result, Africa’s total earnings from commodity exports fell by over $25 billion from a decade before, offsetting growth in the agricultural and mining sectors.

With the right policies, economic transformation is possible

The State of Commodity Dependence 2025 report provides updated statistical profiles of 195 UNCTAD member states, exploring how their commodity exports and imports have changed between 2021-2023 and 2012-2014.

While 99 countries remained commodity-dependent, the total number of countries in this category has declined slightly from 106 to 103 between the two periods studied.

Notably, countries such as Indonesia and Guatemala have successfully reduced their commodity dependence below the 60pc threshold, demonstrating that a combination of targeted policies, strategic investment and expanded market access are conducive to building more diversified and resilient economies.

The report series, available biennially, serves as a tool for change in this direction, helping countries identify the risks and opportunities linked to commodity wealth.

Armed with the much-needed data, policymakers, economists and development partners can better assess vulnerabilities, harness opportunities and design effective strategies for economic diversification, value addition and sustainable development.

Source: UNCTAD