Economists are warning that financial markets aren’t fully pricing in, or even pricing in at all, US President Donald Trump’s views and his attacks on the Federal Reserve.

These risks include high inflation, or more serious, a loss of confidence in US government debt.

It’s no secret that Trump isn’t happy with the central bank and has even called the chair of the Federal Reserve, Jay Powell, a “numbskull”, as he declined to cut rates earlier this year.

A poll of 94 economists based in the US and Europe by the Financial Times revealed many fear that the continued assaults will have a permanent effect on the Fed towards prioritising jobs and lowering government borrowing costs, rather than inflation. One economist said that “The Fed will become a puppet state of the government”.

Another said that the Fed would have to “fight for its survival or risk a US dollar crisis”. In fact, this is one thing that economists agree on: that the Fed should maintain its independence. But as we know, markets generally don’t move when things aren’t a surprise.

Would we be surprised if Trump took control of the Fed? This is a rhetorical question. I would not be surprised. But economists say the risks aren’t priced in.

Despite this, only one thing matters: price. Doomsayers sound smart, but in reality markets always tend to trend higher. Stocks go up, stocks go down. Our job is to generate a profit from these movements, and we don’t need to be Warren Buffett to do it (thankfully, as I’m not).

I am seeing lots of stocks start to point upwards. Small caps are on the move, which tells me we are in for a bullish run. That can, of course, change at any point, and we have to be mindful of the Autumn Budget, which is scheduled for the end of November. News stories are appearing regularly about what might happen, and my guess is that these stories are leaked to test public opinion. If there is a clear backlash, the government can just say “we were never planning this”.

However, my big hope is that Isas are left unchanged. Isas are one of the few ways hardworking ordinary individuals can still build wealth, and to see a limit put on them as the minister for pensions, Torsten Bell, would like to do would be a sad day indeed.

I would even be willing to accept a provision that Isa money can only go towards London-listed stocks. I wouldn’t like it, and I think investors would generally be worse off, as instead of buying passive global trackers they might buy the inferior FTSE 100 index. Or they might even buy speculative stocks, which would see them lose colossal amounts and help zombie and garbage companies to keep going just a bit longer. But I can see why the government might want something in return for the tax breaks.

One stock that I have been looking at has been going for more than a century. Wynnstay (WYN) is a UK agricultural business that supports livestock and crop farmers with products and expert advice. Its offerings include animal feed, seeds and fertilisers, grain trading and marketing, as well as depot merchanting. Wynnstay is essentially a one-stop shop for farmers for things they can buy and advice they need.

Wynnstay has done the ‘Grand Old Duke of York’ twice – marching to the top of the hill and marching back down again.

In Chart 1 we can see the trough (pun not intended) before the rise and fall, and the second rise and fall pre- and post-pandemic.

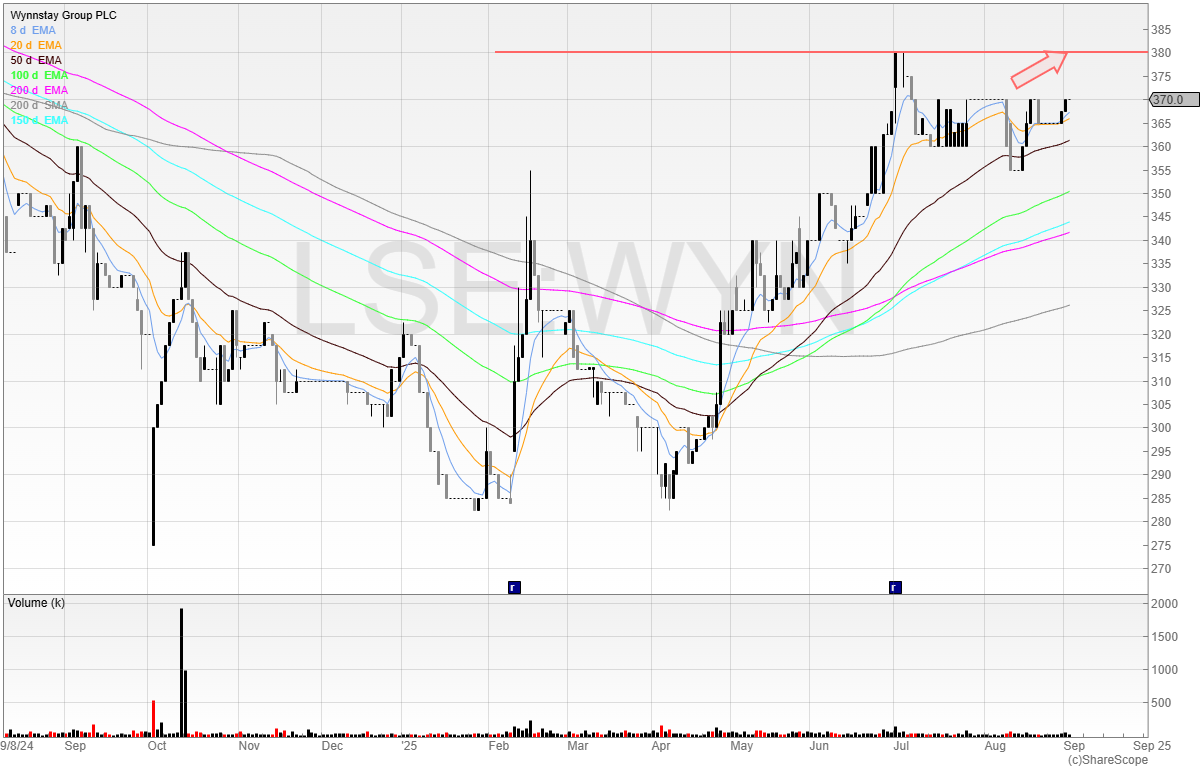

Moving to Chart 2, we can see that the hallmarks of a new stage two uptrend are clear. The moving averages are pointing upwards and the price is now above the majority of these.

We can also see a shallow base building with a potential breakout coming at 380p. I am long a quarter of a position as a cheat and intend to add the final lot should the price break 380p.

My stop is under the recent lows because if the trend breaks down, I have no interest in this.

The current forecasts are for £6.05mn post-tax profit this year, rising to £7mn in 2026.

This puts the company on a current price/earnings ratio of 14, which is probably fair for a business like this. I don’t believe this to be a hugely attractive operation in terms of quality, but in the recent interim results the board says the business is on track for full-year forecasts.

Remember, Wynnstay is on SETSqx and therefore can be illiquid. However, having pinged the RSP several times, the real spread is much tighter. Advertised spreads often make the stock appear more illiquid than it actually is. Even so, this is not a terribly liquid stock and so I must advise caution.