Spencer Dale is bp’s Chief Economist. Introducing bp’s latest Energy Outlook 2025, Dale said: “This year’s Outlook examines a range of issues including the changing structure of oil demand, the continuing electrification of the energy system, and the possible impacts of Artificial Intelligence on the energy system of the future.” Basically, bp say global carbon emissions peak before 2030, then follow a slow decline in scenario 1: the Current business Trajectory (business as usual), and a faster decline in scenario 2: Below 2℃ (when decarbonization is accelerated).

Dale said energy security will affect countries in different ways. Some called Electrostates may reduce imported fossil energies and push forward on domestic renewables and electrification. Other countries will focus on their own fossil energies and steer away from international supply chains that boost low carbon sources.

Global primary energy increased by 2% in 2024, which surprisingly lies above the average for the past 10 years. GDP correlates with energy usage and all countries want to boost their industrial economies. He added that in the U.S., growth of data centers and AI is a big new demand on energy (electricity).

Other highlights of the report are as follows:

Renewables Rising.

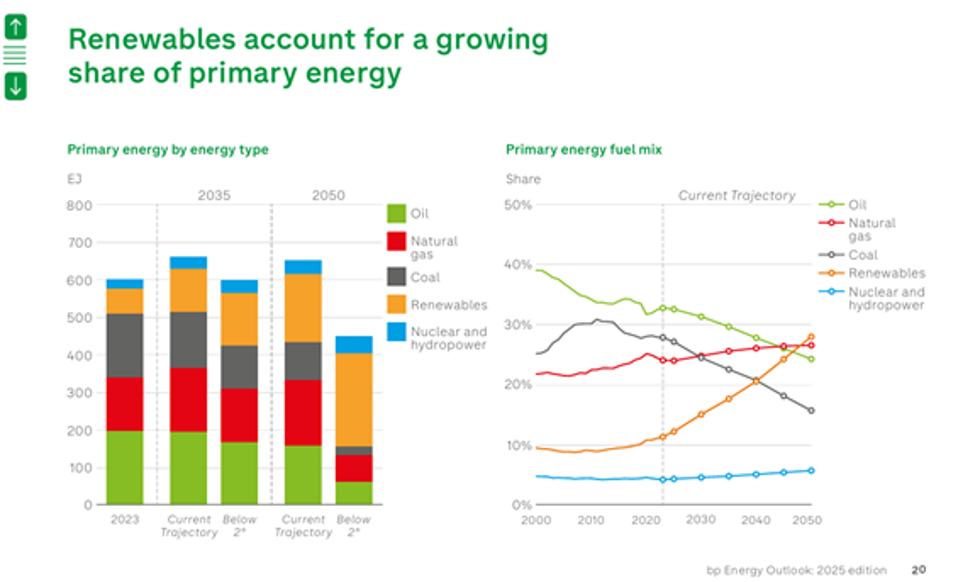

Figure 1 predicts rapid growth of renewables, meaning wind and solar, from now until 2050. During this time, oil and coal fall, but natural gas creeps upwards. By 2050, oil, gas, and renewables are each about 27%. Coal is 16% and nuclear-hydro is 5%. Coal is on its last legs, while nuclear remains at the starting gate. Reminder: the administration of President Trump is trying to resuscitate coal and nuclear, which both go against the world trends.

Figure 1. Primary energy fuel type through 2050.

bp Energy Outlook 2025

Bp raise the issue of fossil substitution, and insist the world is still in the addition phase, where new renewable energies are not replacing enough fossil energies. But in some countries, low carbon energy is rising while fossil energy is falling—in both the EU and the U.S. for example. By 2005, 35% of world’s primary energy had moved into substitution, primarily EU, UK, and US. By 2030, 60% will have moved into substitution, primarily reflecting China’s movement.

AI Power Needs.

Growth in electricity needs is predicted to be a giant 40% of overall U.S. demand over the next 10 years. But globally, this figure is only 10% in the Current Trajectory scenario. It turns out that AI can supply energy too, as its already being used in the oil and gas industry. Better analysis of geology can speed up exploration. AI can be used to design new wells and improve production operations and efficiency of related facilities.

Figure 2. Oil declines after 2030. Green line is Current Trajectory, blue line is Below 2℃.

bp Energy Outlook 2025

Outlook For Oil.

In Current Trajectory, oil consumption peaks around 2030, at 100 Mb/d (million barrels of oil per day). As developing markets decline, India and emerging countries in Asia boost demand to support their growing economies. Oil falls to 85 Mb/d by 2050, and this fall is focused in developed countries plus China. In most other countries, oil is sustained at 2035 levels.

In Below 2℃, oil plummets to 85 Mb/d as soon as 2035, which would scarify U.S. crude oil producers. The falling curves are dominated by reduced oil usage in transport (gasoline or diesel), but this is offset by first, increasing demand for road transportation across the world, and second, growing oil use as feedstock for petrochemicals, including plastic manufacturing.

The outlook for natural gas

This depends on two factors. First, emerging economies require more natural gas to grow their industries. Second, many countries are preferring to electrify their economies. Growth is dominant in the Current Trajectory where gas demand rises by about 20% in 2035 (Figure 3). This is mainly due to growth in the industrial sector of China, India and emerging Asian economies, as well as the Middle East.

Figure 3. Two outlooks for gas demand.

bp Energy Outlook 2025

Natural Gas In Developed Markets.

Gas demand in the developed world is flat or falling in the next 10-15 years in Current Trajectory. Except in the U.S. where domestic gas usage will rise by 15% by 2035 to support power needs in AI data centers. In emerging countries, other than China, demand for natural gas goes up.

In contrast, natural gas peaks by 2030 in the fast transition scenario and then declines rapidly (Figure 3). In developed countries, electrification of buildings and industry dominates as well as power sources switching away from gas-fired power plants. By 2050, bp estimates 60% of remaining natural gas will be tied to carbon capture and storage.

Figure 4. Trade in LNG dominated by emerging countries in Asia.

bp Energy Outlook 2025

Liquified Natural Gas.

Through 2030, in both scenarios, trade in LNG remains a golden age for the U.S. as well as Australia and Qatar, the three leaders in selling LNG. LNG exports rise by at least 60% by 2035. But after 2030, LNG trade depends on the pace of the energy transition (Figure 4, left panel). In Current Trajectory, LNG trade increases even more after this but at a slower pace. The U.S. can account for all LNG trades after 2045 due to its continuing natural gas resources (think shale gas). The Asian countries, so hungry for LNG, buy most of the LNG exports, and account for the total growth in LNG demand.

In the Below 2℃ scenario, LNG trade is strong up to 2030, but then falls rapidly (Figure 4) as the energy transition unfolds and global demand drops.

Russian exports of LNG are muted by international sanctions, but as effect of sanctions decline, the growth in global demand for LNG will enable Russia to expand its exports, perhaps doubling them by 2050.