Every year, the Jackson Hole Symposium is one of the most closely watched events on the financial markets.

This year was no exception, as Federal Reserve (Fed) Chair Jerome Powell’s speech marked a turning point in monetary expectations, with immediate repercussions for Commodities, particularly Gold.

A more conciliatory Fed, relieved markets

By confirming that the US central bank was considering a first interest rate cut as early as September, Jerome Powell gave investors the signal they had been waiting for.

The Fed Chair’s comments highlighted the fact that inflation is now better contained, but also a worrying slowdown in employment.

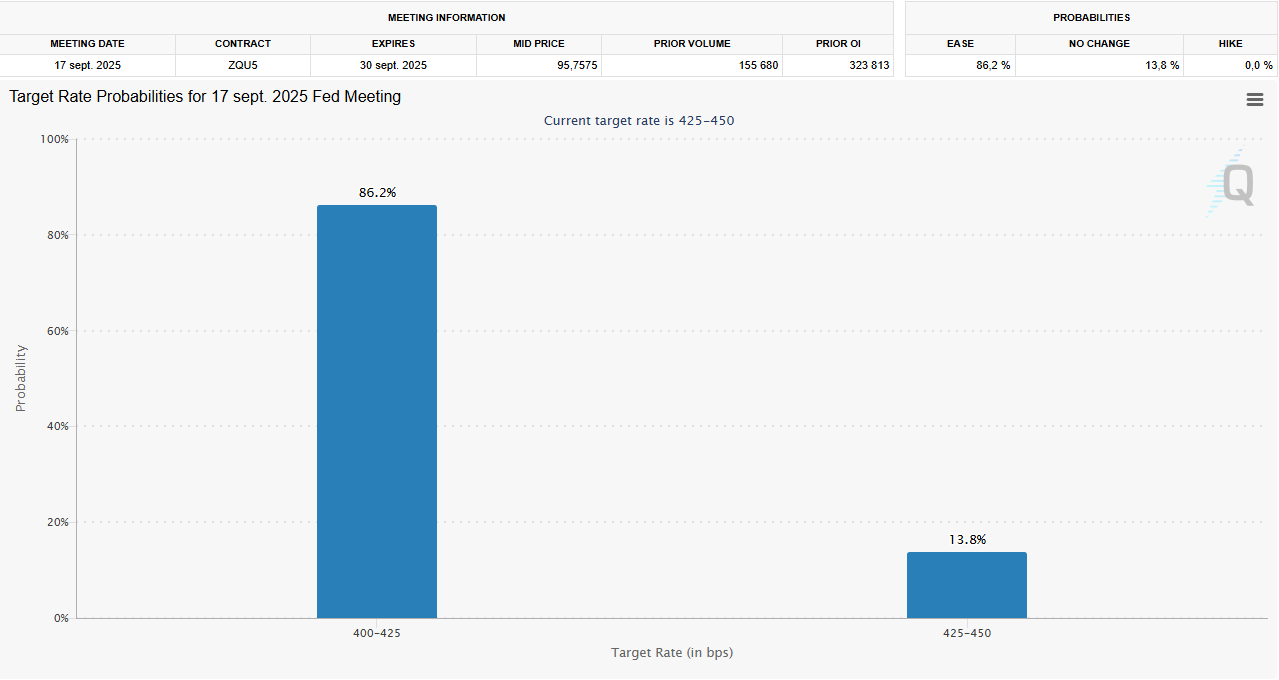

As a result, markets are now betting massively on rapid monetary easing, with over 86% probability of a 25 basis points (bps) cut as early as September, according to the CME FedWatch tool.

Fed Watch Tool. Source: CME Group.

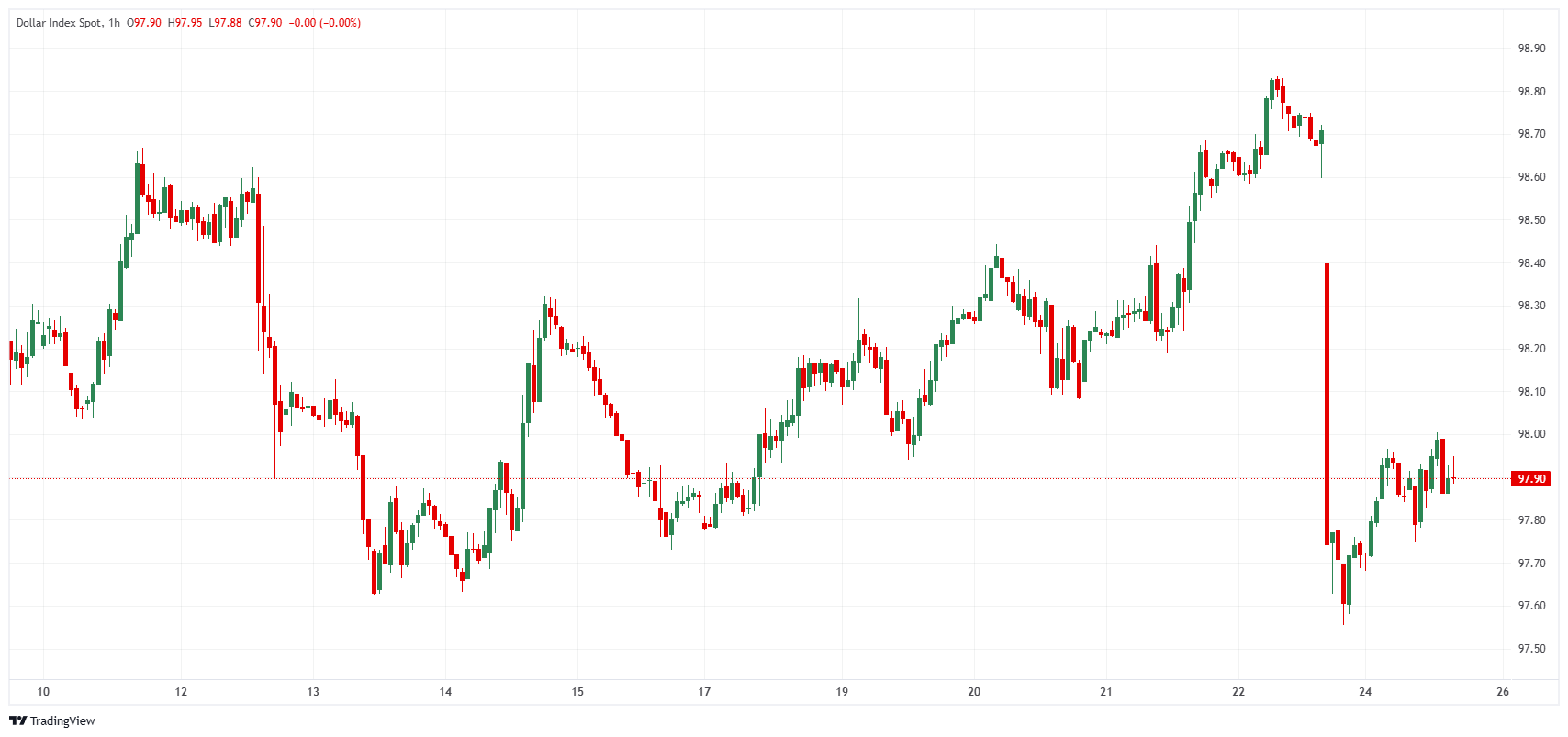

This more dovish tone immediately weakened the US Dollar (USD) as an immediate reaction, creating a favorable context for the entire Commodities complex, whose prices often move inversely to the US currency.

US Dollar Index (DXY) 1-hour chart. Source: FXStreet.

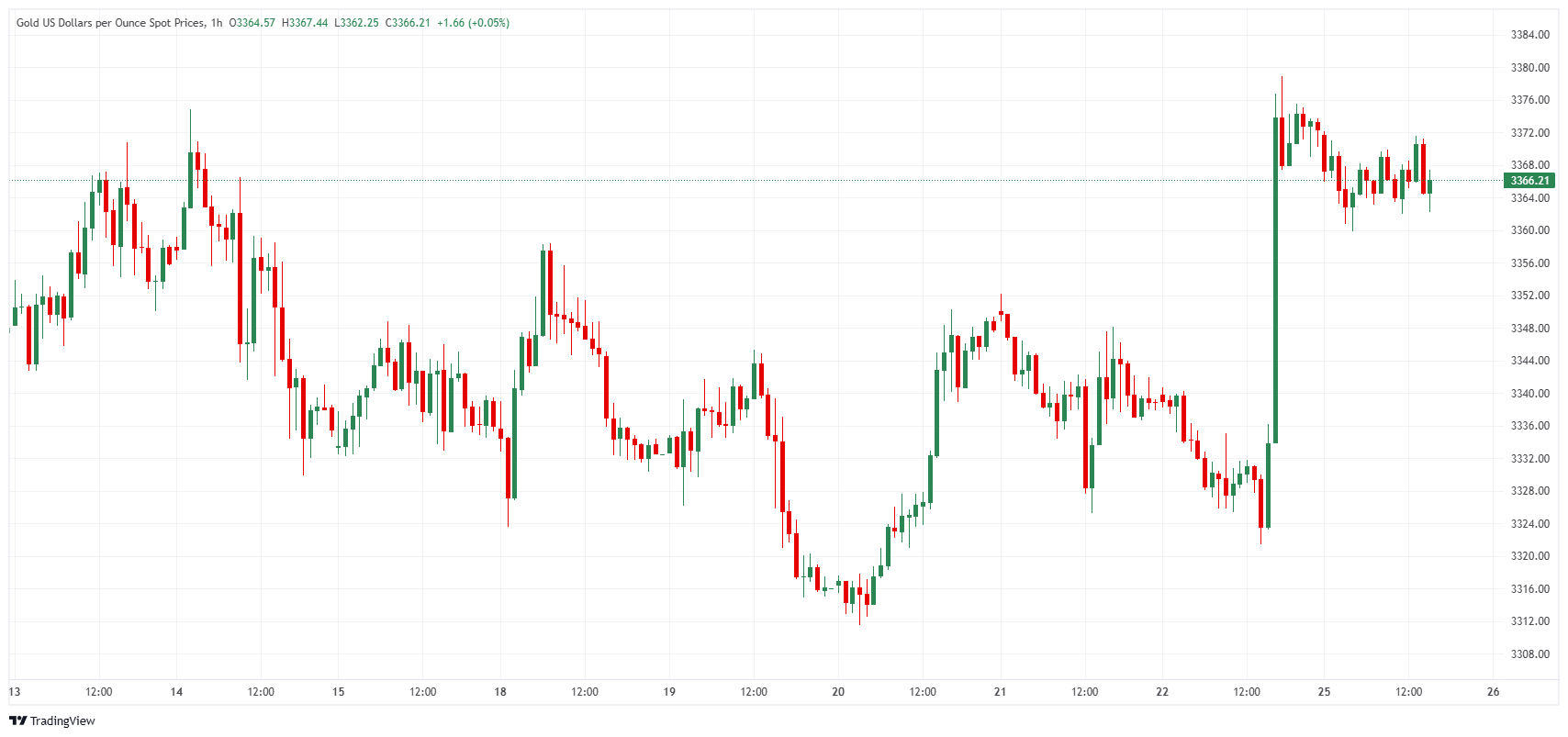

Gold in the spotlight, boosted by the prospect of lower interest rates

Gold, the safe-haven par excellence, was the first to benefit from this change in tone from Chair Powell. The yellow metal surged by almost 1% after the speech, breaking through new technical thresholds and resuming the upward momentum interrupted in recent weeks.

Gold price 1-hour chart. Source: FXStreet.

Investors see a double opportunity. On the one hand, Bond yields are set to fall with lower interest rates; on the other, a weaker US Dollar makes Gold more attractive to international buyers.

Physical demand also helped to sustain the movement: Swiss exports in July showed a notable increase to the United States and India, where the festive season traditionally stimulates jewelry buying, noted Kedia Advisory.

For its part, China maintained solid premiums on its imports, a sign that consumption remains robust despite economic uncertainties.

Silver, Oil and other Commodities follow suit

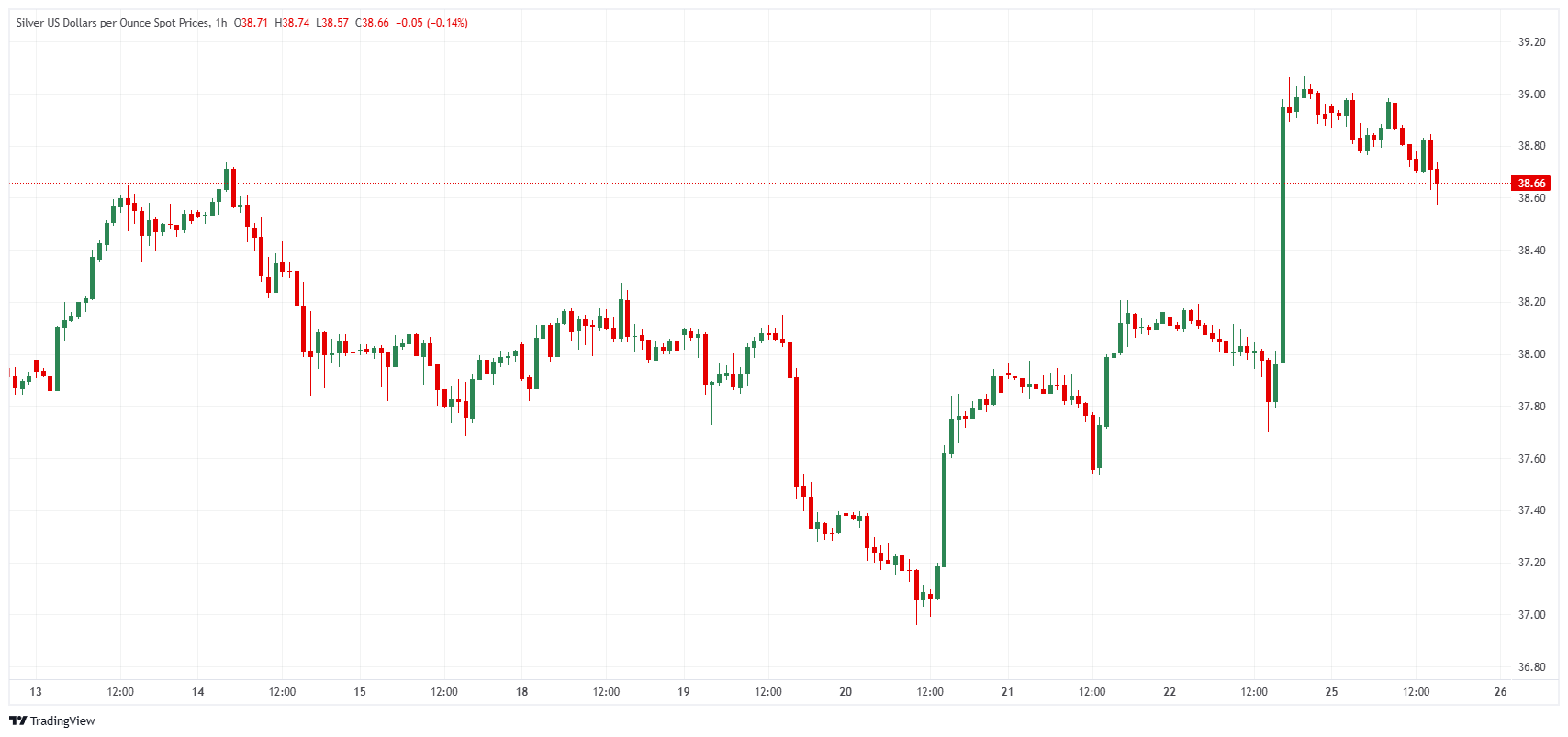

While Gold caught the eye, the Powell effect was also felt in Silver, which advanced even more strongly, benefiting from its hybrid role between safe-haven asset and industrial metal.

Silver price 1-hour chart. Source: FXStreet.

Analysts are puzzled by the performance gap between Silver and Gold, some seeing it as a sign of Silver’s own dynamic, often more volatile but capable of outperforming when precious metals recover.

On the Energy front, the Fed’s accommodating message offset a more complex context. Oil prices, already buoyed by uncertainties linked to the Russia-Ukraine conflict and US sanctions, found the prospect of lower interest rates an additional factor of short-term support.

Nevertheless, the fundamentals remain fragile. Supply remains abundant, and global demand could suffer if the economic slowdown worsens.

Fragile but revealing support

Jerome Powell’s speech at Jackson Hole confirms the extent to which US monetary policy remains a major catalyst for Commodities.

The expected cut in key interest rates acts as a powerful psychological and technical driver for dollar-denominated assets, starting with Gold.

But this impetus rests on a precarious balance. If inflation were to rise again, and the Fed needs to pause cutting interest rates, the dynamic could quickly reverse.

For the time being, Gold has emerged stronger from the Jackson Hole Symposium and remains in the spotlight. As a barometer of investor confidence in the Federal Reserve, it could soon test new all-time highs if the central bank confirms its accommodative stance.