The demand for metals, especially steel, is currently high in India.

India’s steel demand is projected to grow by 8-10% in 2025, driven by strong growth in construction, infrastructure projects, and manufacturing.

Government initiatives such as the Pradhan Mantri Awas Yojana, Gati Shakti, and Make in India are key drivers for most metal companies.

Here are a list of 3 metal stocks that can be added to your 2026 watchlist. We have chosen well-known companies with a proven track record.

Some of the data is taken from the Equitymaster Stock Screener.

#1 Maithan Alloys

First on our list is Maithan Alloys.

Maithan Alloys is one of India’s leading manufacturers and exporters of ferro alloys, particularly niche value-added manganese alloys.

The company has established itself as a pioneer in manufacturing multiple manganese alloy variants used in automobile grade steel. It operates manufacturing facilities across 3 Indian states and exports to over 35 countries.

Currently, the stock’s PE is 4.4 and PB is 0.7.

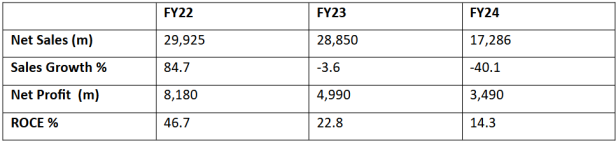

Maithan Alloys Financial Snapshot (FY22-24)

The company reported revenues of Rs 6,323 m in Q1 FY26, against Rs 3,751 m in the corresponding period last year. The net profits were Rs 5,379 m in Q1 FY26, from Rs 4,561 m on a YoY basis.

The prospects for the company are good. The global manganese alloy market shows potential with a projected growth rate of around 6% CAGR from 2025 to 2034. The market size was valued at about US$ 28.5 billion (bn) in 2024 and is expected to reach US$ 53.5 bn by 2034.

Key growth drivers include sustained demand from the steel production industry, EV battery manufacturing, and global infrastructure development.

#2 Jindal Saw

Second on our list is Jindal Saw.

The company is a leading Indian manufacturer and global supplier of iron and steel pipes, fittings, and pellets.

It specialises in large-diameter submerged arc welded (SAW) pipes used mainly for oil, gas, slurry, and water transportation.

Currently, the stock’s PE is 9.3 and PB is 1.1.

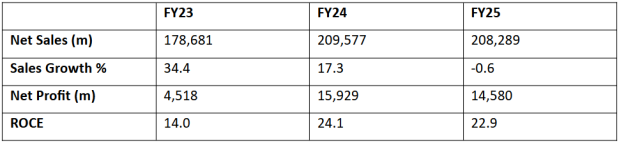

Jindal Saw Financial Snapshot (FY23-25)

The company reported consolidated sales of Rs 40,847 m in Q1 FY26, against Rs 49,391 m in the corresponding period last year. The company reported a net profit of Rs 4,051 m in Q1 FY26, against net profit of Rs 4,112 m in Q1 FY25.

Moving forward, the company has approved a US$ 118 m capital investment plan to expand its presence in the Middle East.

This includes a new pipe manufacturing plant in Abu Dhabi, UAE, with an annual capacity of 300,000 tonnes, primarily serving the oil and gas sector in the MENA (Middle East and North Africa) region. This project is expected to be completed within 12 to 36 months and will cost around US$ 105 m.

Jindal Saw aims to maintain and grow its leadership in the steel pipe sector through capacity expansion, operational excellence, sustainability, and strategic global partnerships.

#3 Kalyani Steels

Third on our list is Kalyani Steels.

Kalyani Steels serves primarily the forging industry in India and is a preferred steel supplier for manufacturers of commercial vehicles, two-wheelers, diesel engines, bearings, tractors, turbines, and rail components.

It has continuously upgraded its technology and infrastructure to maintain a competitive edge and meet market demands.

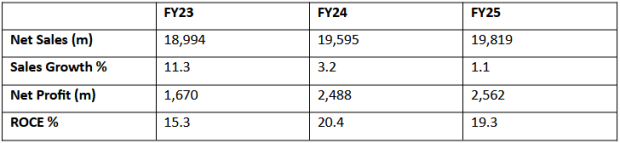

Kalyani Steels Financial Snapshot (FY23-25)

The company reported a drop in revenues to Rs 4,428 m in the latest quarter from Rs 4,615 m in the corresponding quarter last year. The net profits were Rs 617 m, up from Rs 522 m in the corresponding period last year.

Kalyani Steels has ambitious expansion plans aimed at increasing its steel production capacity significantly by FY29.

It aims to reach a capacity of 1 m tonnes per annum by FY29.

Kalyani Steels acquired the assets of Kamineni Steel and Power India located in Telangana, which includes a melt shop with a capacity of around 0.36 million tonnes. The acquisitions and expansions should benefit the company going forward.

Conclusion

The metal industry in India is a fast growing area, especially the steel industry, which is the largest globally.

In addition to steel, the broad metal fields including iron ore, aluminum, manganese and copper are also growing significantly and contributing to India’s GDP, employment and exports.

The region benefits from government policies that promote self -reliance and investment, which pays attention to modernization for green technologies and permanent growth.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.