History suggests 2026 could be a challenging year for silver investors.

Silver is a precious metal, but unlike its close sibling, gold, it is used extensively in industrial applications, which absorb almost half of all available supply each year.

Silver surged by a whopping 144% during 2025, partly because investors piled into precious metals to hedge against rising political and economic uncertainty. However, silver’s gains were also fueled by fears of a supply shortage after China revealed plans to restrict its exports of the shiny metal starting Jan. 1, 2026.

Silver recently hit a peak of around $120 per ounce, marking the first time in history that it crossed the $100 milestone. However, it has since declined by 36% and is trading at $77 as I write this. Could this be the ultimate buying opportunity ahead of another bullish run, potentially to the $200 milestone this year? The answer might surprise you.

Image source: Getty Images.

Silver is an industrial supply versus demand story

Silver and gold share many physical and chemical properties. They are both excellent conductors of electricity, they are resistant to rust, and they are very malleable, so they can be easily shaped to suit a variety of industrial applications. However, only silver is widely used for commercial purposes.

A mere 216,265 tons of gold have been pulled out of the ground throughout human history, and its scarcity is the reason a single ounce costs around $5,000. Therefore, despite its similarities to silver, it’s simply far too expensive and difficult to obtain for most industrial applications.

Silver is significantly more abundant. Around 8 times more of it is mined each year compared to gold, creating a very reliable supply chain. As a result, it’s far more affordable, which is why over half of its total annual supply is soaked up by manufacturers of electronics, alloys, solders, and other industrial products every single year.

Today’s Change

(2.94%) $1.99

Current Price

$69.72

Key Data Points

Day’s Range

$68.86 – $71.32

52wk Range

$26.57 – $109.83

Volume

70M

China is the world’s second-largest exporter of silver, and in December, it announced a new set of restrictions to limit how much of the metal its domestic producers can sell globally. This stoked immediate fears of a supply shortage and triggered an acceleration in silver’s rally. The restrictions officially went into effect on Jan. 1 and will remain in place until the end of 2027.

China is a top manufacturer of electronics, so it’s trying to protect its domestic supply chains by stockpiling raw materials like silver. But the restrictions also give the country additional leverage in trade negotiations with other economic powerhouses like the U.S. and Europe, which it can use to bring down other trade barriers in favor of its domestic companies.

History points to downside, not upside, from here

Since silver is far more abundant than gold, investors don’t really treat it as a store of value. In fact, prior to last year, silver hadn’t set a new record high in a whopping 14 years. If we zoom out and look at the big picture, silver has returned an average of 5.9% annually over the last 50 years, so it’s underperforming gold, which climbed by 7.5% annually over the same period.

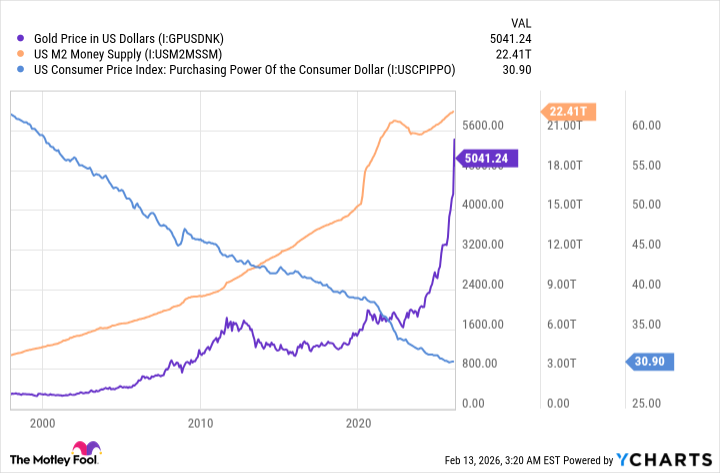

Gold typically trends higher steadily over the long term, mainly in line with increases in U.S. money supply and a depreciation of the U.S. dollar:

Gold Price in US Dollars data by YCharts.

Silver, on the other hand, is far more volatile. It lost more than 89% of its value after peaking in 1980, and it took a staggering 31 years to recover. After eventually setting a new record high in 2011, it suffered another sharp decline of 71% — and as I mentioned earlier, investors had to wait 14 years before it fully recovered on that occasion. Those who chose to invest either directly in the metal or through ETFs like iShares Silver Trust (SLV +2.94%) suffered.

Silver is already down 36% from its most recent all-time high, and it could slide even further. It’s impossible to predict what China will do from here, but if it were to loosen its export restrictions, for example, that would almost certainly trigger an aggressive sell-off as investors price in a more normal supply environment. We do know President Donald Trump plans to visit China in April, where he will meet with his counterpart, President Xi Jinping, and trade talks are expected to be on the agenda.

In summary, I don’t think silver will stage a further rally to $200 this year. In fact, history suggests further downside might be more likely instead.