Preference for gold persists as silver violently swings in 2026.

Most fund managers are keeping silver at arm’s length, warning that its sharp price swings make it too unstable to hold consistently in portfolios despite the growing pull from industrial demand.

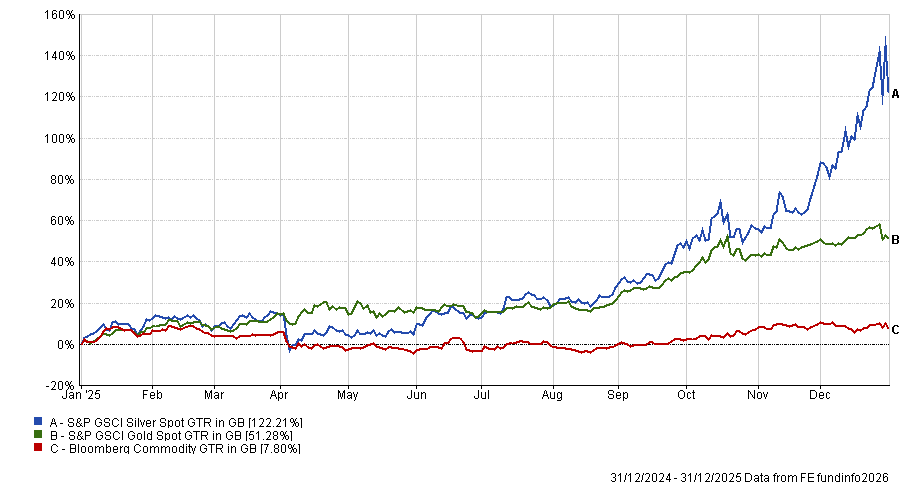

This caution comes despite silver’s extraordinary run in 2025, when the metal soared by almost 150% amid a rush to safe haven assets.

Performance of silver vs gold and commodities in 2025

Source: FE Analytics

However, fund managers argue that the dual role silver plays as a part currency hedge, part industrial metal used in sectors such as solar and electronics, can boost prices beyond what the fundamentals alone might justify, especially in more volatile markets.

They also stress that silver is typically more volatile than gold, and therefore less appealing, due to the silver market being much smaller and thinner, with less liquidity and dramatic swings. This is fuelled by supply constraints, given the precious metal is usually mined as a byproduct of other metals like copper.

David Coombs, head of multi-asset investments at Rathbones, said: “Historically, the price of silver has been more volatile than that of gold, especially in times of market stress, where gold typically sells within 2% of the spot price, while silver spreads can widen to 10% or more.”

Despite a strong 2025, Claudio Wewel, foreign exchange strategist at J. Safra Sarasin Sustainable Asset Management, added that the risk/return balance has become less favourable for silver in 2026.

“While the physical supply deficit should support a high silver price level in the near term, we caution that silver usually experiences much larger drawdowns after an extended rally than gold, owing to its higher price volatility,” he said.

“Given the momentum is fading, the risk/return balance has become less favourable for silver. This also means that it will be more difficult for silver to outperform gold from here.”

Indeed, the first weeks of 2026 have underscored that risk, with silver lurching through dramatic price swings in the face of a stronger US dollar and a sharp global equity pullback which triggered widespread unwinding of commodity positions.

While gold fell, silver collapsed, with exchange-traded funds tracking gold and silver losing nearly £150bn in value.

Silver stabilised to around $78 per ounce on Friday 6 February after rebounding from a brief plunge to $67, but it remains about 9% down for February and well below the near‑$120 level reached in January.

So does silver have a place in a diversified portfolio?

Against this backdrop, fund managers are reassessing where, if at all, silver fits within their portfolios.

Trevor Greetham, head of multi-asset at Royal London Asset Management, said he invests in silver as part of a diversified commodity basket but noted “we don’t trade it in its own right”.

“Silver is like gold on steroids,” he said. “It responds to the same geopolitical drivers as gold but silver also has industrial uses linked to the energy transition and artificial intelligence (AI) and it is a less liquid market prone to eye-watering swings, as we have seen in recent days.”

Will McIntosh-Whyte, co-manager of the Rathbone multi-asset portfolios, said they continue to favour gold over silver, “with the former providing a more liquid and stable safe haven asset versus silver”.

Coombs added that Rathbones also doesn’t see silver as a traditional diversifier to other asset classes.

“It is not a precious metal in our view and therefore it can be argued that it is not a compelling alternative store of value – it is not something we would hold in our portfolios,” he said.

Meanwhile, Alastair Laing, chief executive and co-manager of the Capital Gearing Trust, cited the fact that gold does not degrade, it is aesthetically appealing in jewellery and is held by numerous central banks and prized across multiple human cultures for millennia.

“Silver does not share this same depth of cultural and historical significance and therefore trades much more explicitly as an industrial commodity,” he said.

In contrast, Evy Hambro, co-manager of the BlackRock World Mining Trust, said he remains bullish on both gold and silver over the long term.

“Our headline silver exposure is modest but understates our true positioning, given our significant weighting in gold producers, many of whom also produce silver as a secondary output,” he said.

“In terms of portfolio exposure, there are few high-quality, pure play silver producer stocks in our view, which contributes to our modest exposure.”

Hambro acknowledged that silver looks more vulnerable to a near‑term pullback but said he remains positive on the longer‑term outlook.

More broadly, some analysts expect silver to average around $45 to $50 per ounce in 2026, with year-end targets reaching a $47 to $51 range. More bullish analysts are predicting prices closer to $100 per ounce, based on a continuing bull market and sustained industry demand due to electrification, renewable energy expansion and advanced manufacturing.

Solar PV manufacturers consumed over 25% of annual global silver supply in 2024 alone. Silver demand from this industry alone is expected to nearly double between 2020 and 2030.

In addition, electric vehicle-related silver demand jumped 20% in 2025. Silver is needed for parts like sensors, high voltage wiring, advanced connectors and power management systems.

AI and data centres are also emerging as a new demand vector, needing silver for things such as thermal management systems that are needed to handle extreme power loads.