Stock image.

Sol Glatstein, a 79-year-old resident of Manhattan’s Upper East Side, took a bus downtown one day last month to sell a mint-condition American Silver Eagle dollar coin inherited from his parents for $100.

Until this year, Glatstein had planned to pass the coin on to his one-year-old grandson. But the recent record-breaking rally in silver prices prompted him to cash in.

Across North America, many others are doing the same. Coin and jewelry shops are seeing a rush of customers seeking to sell their collectibles, silverware and family treasures after a historic surge in silver prices.

Despite its status as a precious metal, silver has lacked the allure of gold — a more popular investment for those seeking a store of wealth. But the extreme rally in silver prices over the past few months has spurred a reappraisal of the silver items sitting in drawers and cupboards at home.

Some customers are coming in with “stuff that they’d completely forgotten that they had, and it was just sitting in a safety deposit box or in a closet somewhere,” said Greg Cohen, a senior numismatist at Stack’s Bowers Galleries, a rare coin shop on Park Avenue in Midtown Manhattan. “They never thought about it until now. And then they realize, wow, this actually added up to quite a bit.”

Glatstein had worried his silver coin might eventually be lost. After selling it at Stack’s Bowers, he said cash in hand gives him more options to treat his grandson. “I have $100. I can go to Ralph Lauren and buy him an outfit.”

It’s been a busy year at Stack’s Bowers, which has locations worldwide and is owned by Gold.com Inc. At its Manhattan store, the average number of daily visitors has grown to 50 from 30 over the last year, Cohen said. Most are there to sell, he said.

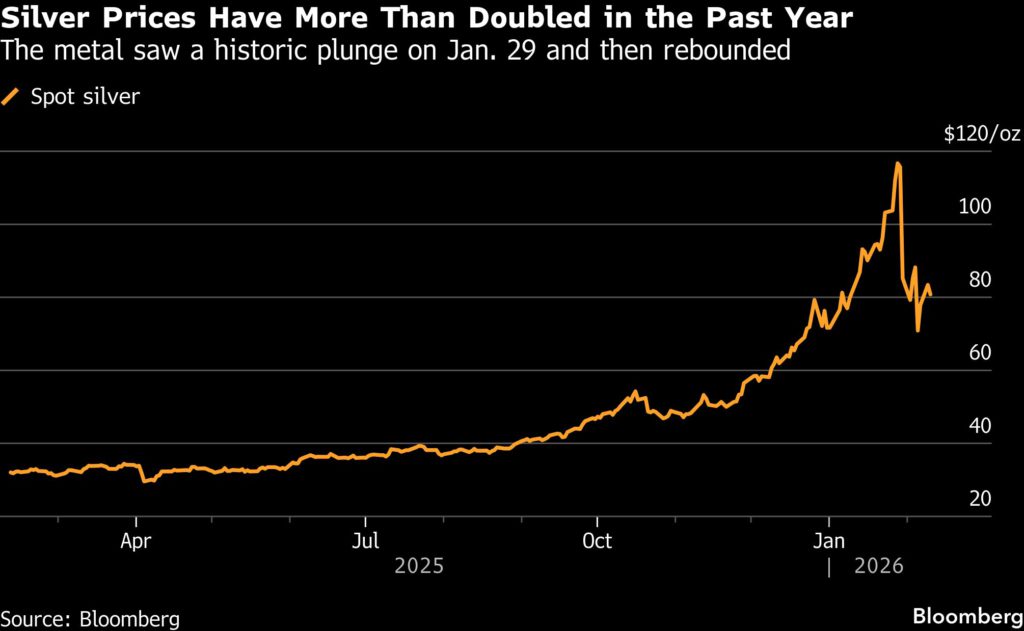

Silver prices have swung sharply in recent weeks, but remain more than double their level a year ago. That’s lifting the melt value of silverware, jewelry and coins above what many collectors once prized them for.

“Everyone’s grandma is selling their chandelier, forks and knives — anything that’s made of sterling silver to utilize the silver prices,” said Gene Furman, owner of King Gold & Pawn and Empire Gold Buyers, which has locations around the New York City area.

The decision to sell silver heirlooms over gold reflects retail investors’ price expectations, said Philip Newman, managing director at research consultancy Metals Focus. As gold hit successive record highs, many holders chose to sit tight, expecting further gains and seeing little reason to sell amid broadly healthy financial markets, he said. People are less certain about whether silver will keep climbing so they’re opting to cash in while gains are still impressive.

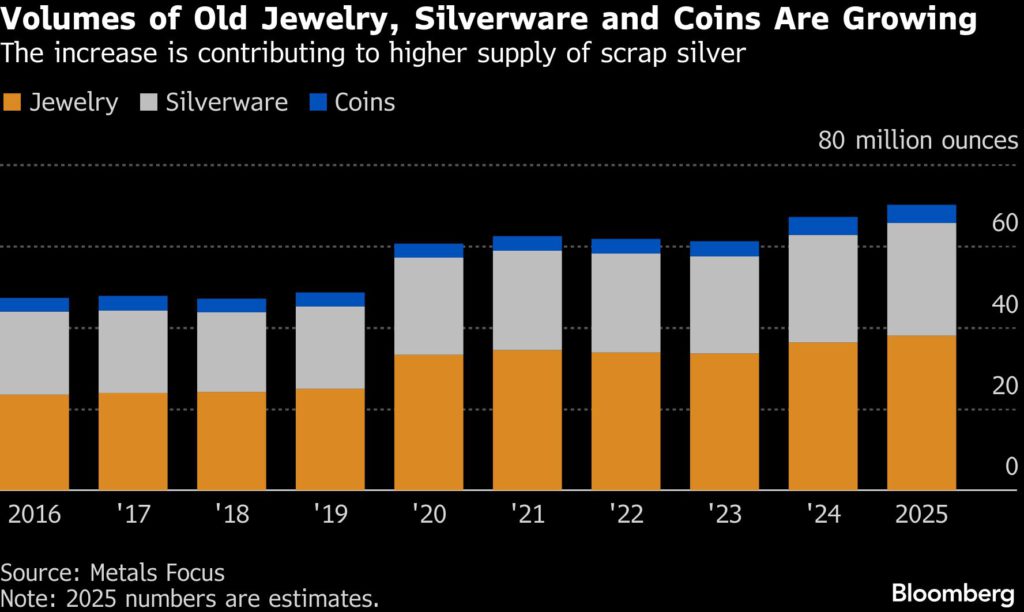

Recycled or scrap silver accounted for about 19% of total supply in 2025, and volumes from jewelry, silverware and coins have been significantly higher than analysts expected during the past year, Newman said. “We were surprised by it.”

Dealers are reporting that January was their strongest-ever month, driven by a surge in trading volumes for silver and bullion products. Silver transactions have climbed as the pre-1965 US silver dollar coins almost tripled in value since the beginning of last year.

“It’s coming in droves and droves,” Gary Tancer, owner of Coin & Jewelry Gallery of Boca Raton, said in an interview. Tancer said he bought 10 times more than he usually does in a year in January. “The average check I’m writing is probably in the eight to $10,000 range.”

Canada Gold, one of North America’s top precious-metals dealers, refined a record 2 metric tons of scrap silver in December alone, according to Chris Pollock, founder and managing partner.

“A lot of these are coins that previously people would’ve proudly kept in their coin collections,” he said. “Now we’re seeing these get melted down.”

The huge influx of silver flowing into the market is straining refiners, which take scrap and other metal-bearing materials and process them into high-purity products such as bullion bars. Heraeus Precious Metals, one of the world’s largest precious-metals refiners, is facing a backlog, said Dominik Sperzel, head of trading for the German firm.

“When you place the silver order today, it cannot just take a few weeks,” he said. “We’re already talking about months.”

Some shops have stopped buying as refiners struggle to keep up, which retired English teacher Jim Castaldo learned when he inquired about selling some mismatched silver forks to a dealer in Manhattan’s Diamond District.

“I heard that silver is going up, and I’ve had these for years,” the 82-year-old Connecticut resident said. “I had to go to a doctor’s appointment, so I figured, let me stop by and find out what’s happening.”

Meanwhile, Glatstein — whose collectible coin sale made him $100 richer — plans to keep an eye on the market because he’s still sitting on a collection of old, low-purity silver quarters and dollar coins.

“I plan to sell it all,” he said.

(By Yvonne Yue Li and Ella Feldman)