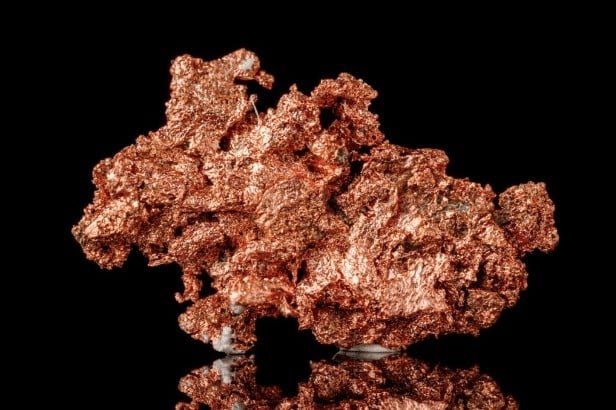

Copper. Image: Minakryn Ruslan/stock.adobe.com

The proposed merger between Rio Tinto and Glencore may not have eventuated, but the strategic logic that underpinned the talks – consolidating and strengthening copper exposure – is very much alive across the sector.

In the lead-up to last week’s February 5 deadline, speculation centred on how Rio could accelerate its copper growth by acquiring Glencore, leveraging the latter’s balance sheet, operational expertise and project development capability to extract greater value from a combined portfolio.

The deal ultimately faltered amid fundamental differences between the two companies, with leadership structure, governance and valuation cited as key sticking points.

While this particular transaction failed to proceed, it has not altered the broader reality shaping global mining strategies: copper is increasingly driving mergers and acquisitions activity across the sector.

Rapid expansion of large-scale data infrastructure and telecommunications projects is intensifying demand for critical minerals, particularly copper, which is essential for power transmission, cooling systems, cabling, electronics and grid infrastructure.

The World Economic Forum (WEF) has highlighted the growing copper intensity of data centre and power grid buildouts.

“Estimates suggest over 4.3 million tonnes of copper could be associated with data centres and adjacent power infrastructure by 2035,” the WEF said.

“Industry outlooks warn of a 25–30 per cent copper shortfall by 2035, underscoring long-term exposure as facility and grid demand rise together.”

This demand backdrop is feeding directly into the strategies of the world’s largest miners, with copper increasingly central to long-term growth plans and acquisitions being prioritised to expand copper footprints.

For Rio Tinto, Glencore’s copper assets – especially those in South America – were viewed as the most attractive element of the proposed deal. However, analysts questioned whether those assets would necessarily deliver optimal value when bundled with Glencore’s broader portfolio.

Rio exited the coal sector several years ago, and an acquisition of Glencore would have re-introduced exposure to coal assets in Queensland and elsewhere, commodities outside Rio’s strategic focus.

In simple terms, the Glencore deal would have delivered copper, but also a range of businesses for which Rio Tinto has shown limited appetite.

Since assuming the Rio Tinto chief executive role, Simon Trott has emphasised a disciplined approach to capital allocation, positioning the miner as a leaner, more focused company. Trott has repeatedly spoken about ensuring Rio has “the right assets in the right markets”, with a streamlined portfolio centred on iron ore, copper, aluminium and lithium.

Rio may be more inclined to pursue targeted bolt-on acquisitions rather than blockbuster mergers; standalone copper projects that can be integrated more cleanly into its operating model and governance framework.

Australia is not short of such opportunities.

Aeris Resources’ Constellation project in western New South Wales recently secured development consent, marking a key step toward establishing a new, high-quality domestic copper source. Located near the Tritton copper mine, Constellation is planned as a combined open-cut and underground operation targeting production of around 500,000 tonnes per annum of copper ore.

Austral Resources has also strengthened its position, agreeing to acquire the Lady Loretta mining leases and associated infrastructure from Glencore. The tenure sits adjacent to Austral’s Lady Annie copper mine in north-west Queensland, enabling near-term ore feed through a pit wall cutback and access to additional mineralisation. The transaction supports processing at the Mt Kelly plant and advances Austral’s ambition to build a larger, multi-asset copper business in the region.

Meanwhile, True North Copper’s Mt Oxide project, also in north-west Queensland, is emerging as a potential multi-kilometre copper-cobalt-silver system. Recent drilling at the Aquila discovery has extended mineralisation over more than 1km, with the system remaining open along strike and at depth. Multiple high-quality targets across the broader corridor point to strong growth potential within a well-endowed base metals province.

There is no indication Rio is actively pursuing acquisitions involving these specific projects; however, they illustrate the type of focused, scalable copper opportunities that align with the company’s stated ambition to consolidate and enhance its position as a leading global copper producer – without the complexity and compromise of a mega-merger.

Read more: Copper power plays reshape the landscape for BHP

Subscribe to Australian Mining and receive the latest news on product announcements, industry developments, commodities and more.