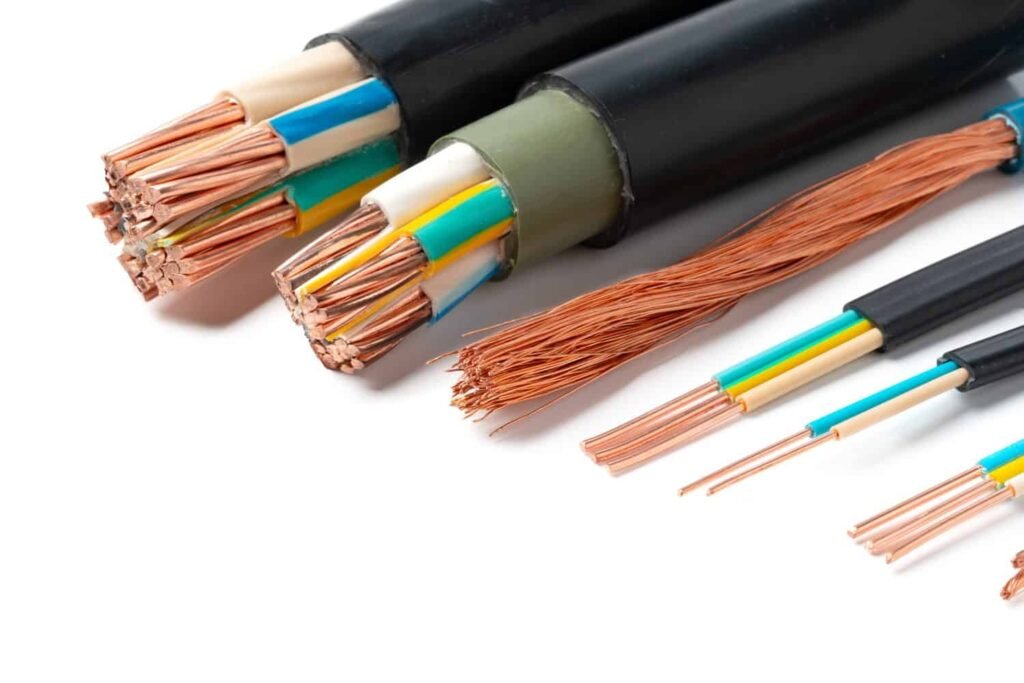

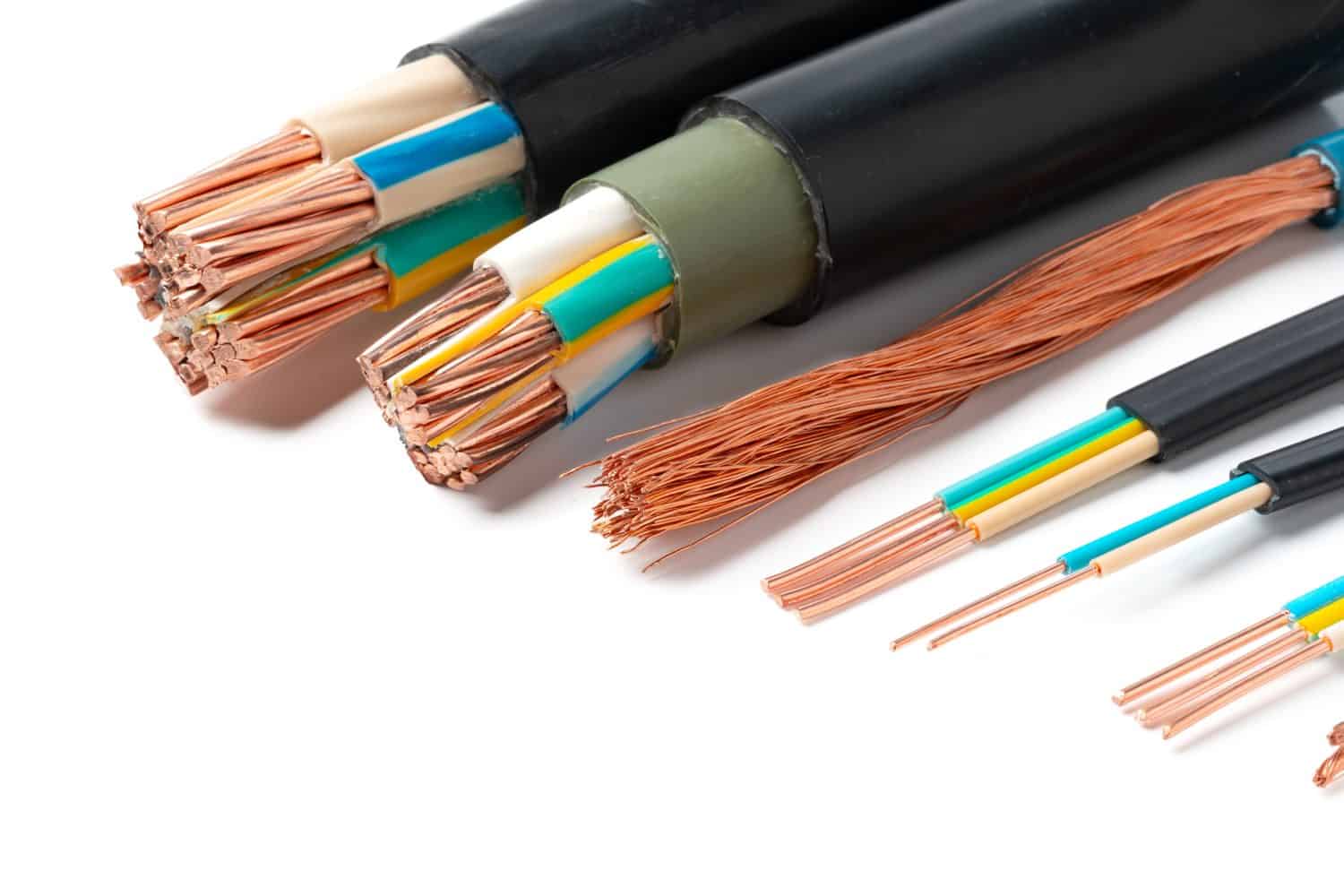

© FabrikaSimf / Shutterstock.com

Billionaire mining executive Robert Friedland addressed the USC Marshall Energy Business Summit back in September to outline the severe global copper supply crisis. Driven by rising demand from electrification, renewable energy infrastructure, data centers, artificial intelligence (AI) development, and grid upgrades, Friedland contrasted the vast oil market with the smaller, thinly traded metals markets, including copper. He noted that shifting away from crude oil requires these metals for electric vehicles, windmills, solar panels, and military technology. He also highlighted copper’s essential role in underwater power cables and offshore wind farms.

Over the past 10,000 years, humanity has mined about 700 million metric tons of copper, with 80% still in use today. Global annual consumption stands at 30 million tons, with only 4 million tons coming from recycling. To maintain 3% GDP growth — without additional electrification demands — the world would need to mine the equivalent of the past 10,000 years’ production in the next 18 years. When factoring in green technology and AI, the shortfall grows even larger. This is why copper prices are continuously breaking records today.

However, ore grades are declining, demanding 16 times more energy and double the water to produce copper compared to 1900. Chile, which produces 24% of the world’s copper, is powered by a mix of energy sources, including coal and an increasing share of renewables, though energy costs and storage challenges persist.

Friedland warned of a “train wreck” unless six new tier-one mines come online every year from now until 2050, representing 40% of future production. He called much of the AI and green energy hype “fantasy” without adequate metals and energy, noting even nuclear plants require these resources. That means the following two copper miners stand to reap a massive windfall from the coming copper boom that will make the current situation seem quaint.

Southern Copper (SCCO)

Southern Copper (NYSE:SCCO) is positioned to benefit from projected copper market deficits and higher prices, with analysts forecasting 2026 revenues of $16 billion, a 17% increase from 2025 levels, and earnings per share of $7.31. The company reported record 2025 sales of $13.42 billion and net income of $4.33 billion, driven by supportive metals prices and by-product output. For 2026, Southern Copper expects to produce 911,400 tons of copper, a 4.7% decline from 2025 due to lower ore grades at Peruvian operations.

However, management anticipates a global copper deficit of 320,000 tons in 2026, with inventories at just 14 days of demand, supporting elevated prices. Operating cash costs per pound are expected to remain flat in 2026. Capital expenditures reached $1.3 billion in 2025, up 29% year-over-year, as part of a $20.5 billion long-term program. Key to growth is the Tia Maria project in Peru — 24% complete with $800 million committed and $508 million planned for 2026 — targeting first production in 2027 and 120,000 tons annually by 2028.

Analysts see Southern Copper’s revenue growth outpacing the industry’s 9.3% annual rate, driven by these expansions amid surging demand from AI data centers and electrification.

Freeport-McMoRan (FCX)

Freeport-McMoRan (NYSE:FCX), the world’s largest publicly traded copper producer, is set to capitalize on AI-driven copper demand through operational recovery and expansions. Fourth-quarter earnings of $0.47 per share easily beat analyst estimates with revenues of $5.63 billion up 9% over expectations. For 2026, the company forecasts copper sales of 3.4 billion pounds, slightly below 2025 due to a Grasberg mine incident, but expects an 8% rise in U.S. production from leach assets.

Grasberg operations are slated for phased restart in Q2, reaching 85% capacity by the second half of the year. Capital expenditures are projected at $4.3 billion to $4.5 billion for 2026, including $150 million for its Bagdad, Ariz. mine for engineering and early works. Management highlights copper’s role in renewable power, electric vehicles, data centers, and global connectivity, with strong growth anticipated into 2027-2028 as projects advance.

Consensus estimates project 2026 earnings of $2.66 per share on $28.6 billion in revenues, reflecting leverage to rising prices amid supply constraints and demand from data centers expected to reach 475,000 tons in 2026.